Shares of the technology giant Microsoft (NASDAQ:MSFT) hit a new 52-week high of $378.87 on November 20 as investors cheered the appointment of OpenAI’s co-founder and former CEO Sam Altman and co-founder Greg Brockman. Including yesterday’s gains, MSFT stock is now up about 59% year-to-date. As MSFT stock has risen quite a lot, the analysts’ average price target suggests a limited upside potential from current levels.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Nevertheless, it wouldn’t be unexpected for analysts to adjust their price targets upward in the coming days, as Microsoft is well-positioned to deliver robust financials in the upcoming quarters. Let’s explore the factors that will drive its financials and support the rally in its share price.

Factors to Bolster Microsoft’s Financial Performance

Sam Altman’s appointment is viewed favorably as it is expected to enhance Microsoft’s AI (artificial intelligence) endeavors, thereby positively impacting its financial performance. In response to this latest development, Goldman Sachs analyst Kash Rangan expressed confidence that hiring OpenAI’s two founders has helped mitigate potential short-term disruptions to Microsoft’s Generative AI initiatives.

Rangan maintained a Buy rating on MSFT stock on November 20. Moreover, his price target of $450 suggests 19.22% upside potential from current levels. The analyst views MSFT as the “most compelling investment opportunity in the technology industry and across sectors.” Rangan anticipates the company will capitalize on its robust presence across all layers of the cloud stack. In addition, he expects Microsoft to continue to benefit from increased adoption of generative AI and digital transformation.

It’s worth highlighting that Microsoft introduced its first custom in-house CPU series, Azure Cobalt, and AI accelerator, Azure Maia, at the Ignite event. These new products will enhance Microsoft’s AI offerings and expand its market share in the cloud business.

To conclude, Microsoft is rapidly integrating AI across every layer of the tech stack, which will drive its future revenue and earnings.

Is Microsoft Stock a Buy or Sell?

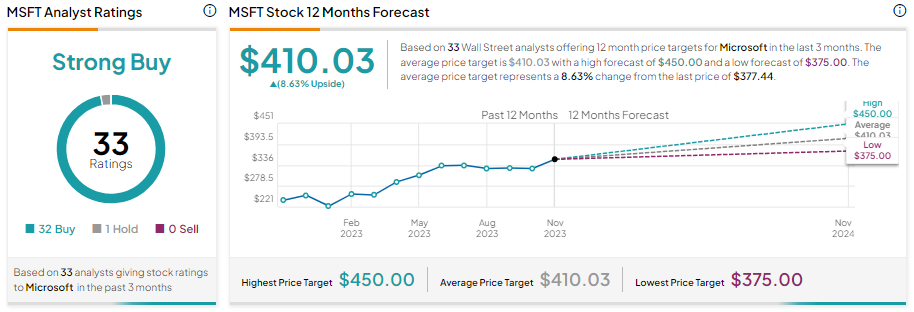

With 32 out of 33 analysts recommending a Buy on Microsoft stock, it sports a Strong Buy consensus rating. Further, the average MSFT stock price target of $410.03 implies an upside potential of 8.63% from current levels over the next 12 months.

Bottom Line

Microsoft’s diversified product portfolio, AI initiatives, and strength in the cloud business will enable it to generate solid financials in the coming quarters. This is reflected in analysts’ Strong Buy consensus rating on the stock.