Microsoft (MSFT), a giant in the computing, tech, and gaming fields, has run into of one of the biggest, and strangest, new developments in business of late.

There are jobs, but shockingly large proportions of them are going unfilled. Thus, in a bid to draw talent, Microsoft is putting big new money into its salary budgets. What, however, does this mean for investors?

While extra expenses of any sort have a drag on profitability, sometimes this drag is only temporary. In fact, it sometimes yields substantial gains. I look for this move to give Microsoft further boost, and thus stand bullish on its commitment to refresh its talent pool and continue innovating.

The last 12 months for Microsoft trading have been erratic, but on the whole, positive. The company is currently trading around $25 per share higher than it was this time last year. However, it’s well off its post-Christmas high of around $341 per share.

The latest news may concern some investors. Those more focused on the long term, however, may be encouraged. Microsoft plans to double its budget for salary raises, specifically those connected to merit.

Further, word from Satya Nadella says that the company also plans to up stock compensation by a full quarter, minimum. Microsoft representatives noted that this move would provide “a highly competitive experience,” and also come as a way to head off similar moves from its competitors in cloud computing.

Wall Street’s Take

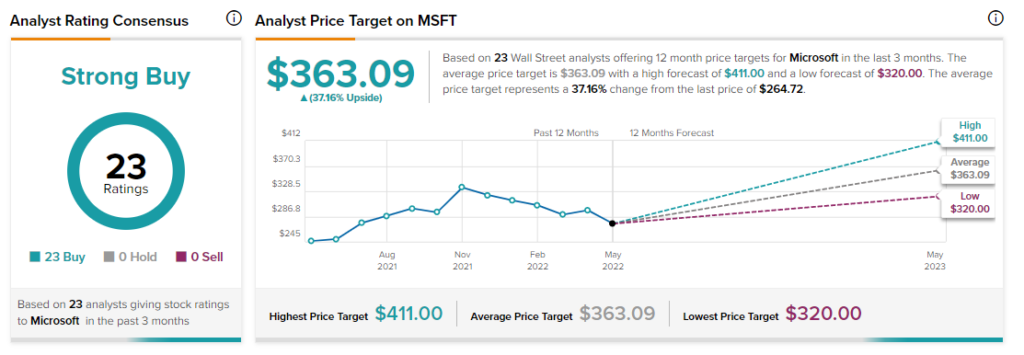

Turning to Wall Street, Microsoft has a Strong Buy consensus rating. That’s based on 23 Buys assigned in the past three months. The average Microsoft price target of $363.09 implies 37.2% upside potential.

Analyst price targets range from a low of $320 per share to a high of $411 per share.

Microsoft Draws Mixed Investor Sentiment

Microsoft has the confidence of many investors and analysts. In fact, Microsoft currently has a Smart Score of 9 out of 10 on TipRanks, which is the second-highest level of “outperform” there is. It implies a much better than average chance of outperforming the broader market. However, not every investor agrees, as we’ll see with investor sentiment.

First, there’s the matter of hedge fund involvement. Hedge funds, based on the results of the TipRanks 13-F Tracker, not only show another decline in hedge fund involvement, but a much steeper one that normal. Hedge funds have been gradually pulling back on Microsoft since March 2021, but the latest drop saw hedge funds pull back by around 40%.

There’s also the matter of insider trading at Microsoft, which is somewhat sell-weighted, particularly recently. In the last three months, sell transactions have swept buy transactions.

There were no transactions at all recorded for April, and February and March saw a combined total of 13 sell transactions with no buyers. Pulling back to the full year, we see 36 buy transactions and 47 sell transactions.

As for retail investors who hold portfolios on TipRanks, they represent an unalloyed bright spot for Microsoft. Portfolios holding Microsoft stock increased 0.3% in the last seven days, and 1.5% in the last 30 days.

Finally, there’s Microsoft’s dividend history to consider. It represents an ideal model for income investors. Microsoft has paid its dividend regularly since at least 2019, and has regularly increased the dividend, even during the pandemic.

The Seed Corn Isn’t Just Edible

There’s a phrase out there, a general maxim for prudent preparation: “Don’t eat your seed corn.” Essentially, it means that those who hear the maxim should refrain from simply consuming resources that can produce yield when invested. It’s not always applicable, or even useful — the starving must eat or will never live long enough to harvest — but it commonly makes sense.

It especially makes sense in a case like this. Microsoft is investing in its future, by putting more cash into merit raises. That holds on to its current stock of workers, and also draws potential new ones to work for the company. The increase in stock-related payouts helps too, as it provides some of that seed corn for the workers as well.

While Microsoft is a major presence in the industry, it’s far from the only one. A Grandview Research report notes that the cloud computing market in 2021 was worth $368.97 billion. Moreover, it’s expected to grow at a compound annual growth rate (CAGR) of 15.7% through 2030.

That’s a lot of growth, and it also means plenty of firms will be actively trying to seize a slice of this pie. That’s where Microsoft’s new commitment to merit raises comes in; with employees less likely to jump ship with better offers in hand, Microsoft can better work to pursue the market, secure in the knowledge it has the talent to back its play.

We’ve already seen Microsoft do something similar in the gaming space. It’s been on a tear in recent months, acquiring studios of all sorts to keep up the flow of games. One of the latest moves featured Microsoft picking up Activision Blizzard (ATVI). That’s given Microsoft a range of new console exclusive titles.

Such a strategy gives it an advantage over Sony (SONY) that it hasn’t seen in a decade. Though there are those who believe the deal will ultimately fall through, Microsoft’s acquisition frenzy is still going on at a brisk pace.

Concluding Views

It’s going to cost money to ramp up spending on employees. That’s money that could have gone almost anywhere else, including into paying investor dividends. However, Microsoft seems to want to secure its market position, and improve its potential for growth. That will take spending.

The company has excellent prospects in several growth markets, from cloud computing to video gaming. It’s also trading well off its highs and even below its lowest price targets. Take that together with a market that’s probably going to be fairly recession resistant, and you’ve got a great potential winner ahead.

That’s why I’m bullish on Microsoft, a company that’s not at all afraid to pass up a chance to eat the seed corn.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure