Micron Technology (MU) still has great potential in the memory market, primarily due to the EBU market, which has grown by 51% year-over-year. This driver is determined by the growth of the electric car market, 5G networks, and the IoT market, which require advanced memory types.

We expect the company to improve profitability by increasing margins. In addition, a hidden opportunity for profitability growth is low financial leverage. According to our valuation, MU is trading at a slight discount to the fair price. The margin of safety is insufficient for purchase. We are neutral on the company.

Company Profile

Micron Technology specializes in the development and sales of memory (NAND and DRAM) for a variety of markets and consumers. The company consists of the following units:

- CNBU – Compute and Networking Business Unit (includes sales in -consumer markets, cloud server, enterprise, graphics and networking);

- MBU – Mobile Business Unit (sales memory for mobile phones);

- SBU – Storage Business Unit (sales SSDS for the cloud and enterprise market, client and consumer storage);

- EBU – Embedded Business Unit (sales of memory and data storage for the automotive industry, industry, and consumer market).

Industry Overview

According to SDKI, the Semiconductor Memory Market is estimated at $115 billion and will grow at a CAGR of 12.6% until 2025.

MU operates in the fastest-growing market segments. According to Bloomberg, automotive semiconductors will grow at a CAGR of 11.80%, and the IoT market will grow at a CAGR of 25.4%, according to Fortune Business Insights’ research.

In Q1 FY2022, Micron’s automotive and industrial segment grew by 25% year-over-year. According to the company’s forecasts, this segment’s revenue will grow at a CAGR of 40% in the next three years.

We expect solid growth in both of these markets. We expect the – overall, if you look at DRAM content CAGR in the automotive market, that’s approximately 40% over the course of next three years

CEO Sanjay Mehrotra during the last conference call

The IoT (Internet of Things, EBU) segment, Industrial IoT, grew by 80% year-over-year, also showing great growth. Consumer IoT grew by 40% year-over-year by increasing virtual reality headsets and smart home devices.

We expect IoT demand trends to accelerate further as 5G speeds the adoption of data-intensive applications powered by intelligent edge infrastructure.

CEO Sanjay Mehrotra during the last conference call

Thus, we see great potential in the markets that form the EBU segment. Currently, the demand in these markets significantly exceeds the supply. The companies will cover this imbalance only in 3-4 years. The segment now accounts for 15% of revenue ($4.2 billion) and is the third-largest. If growth aligns with management’s expectations (which looks realistic), the segment’s revenue will reach $9.6 billion by 2024.

Financial Performance

On average, Micron Technology’s revenue has grown by 17.4% per year over the past five years. Currently, the company receives 75% of revenue from long-term supply contracts; 4 years ago, this figure was 10%. This eliminates the probability of high volatility in Micron’s revenue.

At the moment, the Net Profit Margin is 21.1%, with a Gross Margin of 37.7% and an Operating Margin of 24.5%. Margin indicators increased during the pandemic due to the price increase for semiconductors.

The current MU asset turnover is significantly lower (0.5) than its maximum value (0.7), due to a drop in revenue in 2019 and 2020. However, in the current market environment, asset turnover may rise to 0.6, which will lead to an increase in ROA by 2 p.p.

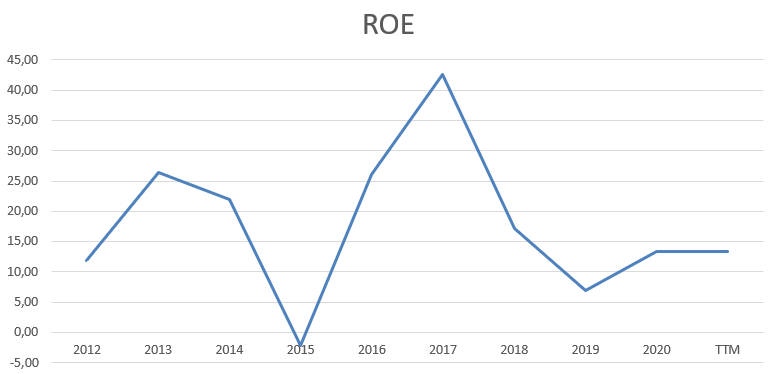

Since 2017, the assets-to-equity ratio has been 1.3. Low leverage is a hidden driver for profitability growth. If the company increases its financial leverage to 2, with the current net margin and asset turnover, it will increase the return on equity by 6.4 percentage points to 19.8%.

Given the current market environment, we expect the company to continue improving its profitability through improved margins and asset turnover. We already see that the balance of inventories in the last four quarters is lower than last year. Low leverage is also a hidden profitability driver. Only by increasing leverage can MU significantly improve the return on equity.

Valuation

Within our DCF model, we made several assumptions. We expect revenue growth in line with the Wall Street consensus. Margins and other relative indicators are predicted based on historical dynamics and the current trend. The terminal growth rate is 4%. Our assumptions are presented below:

Based on our assumptions, the expected dynamics of key indicators are presented below:

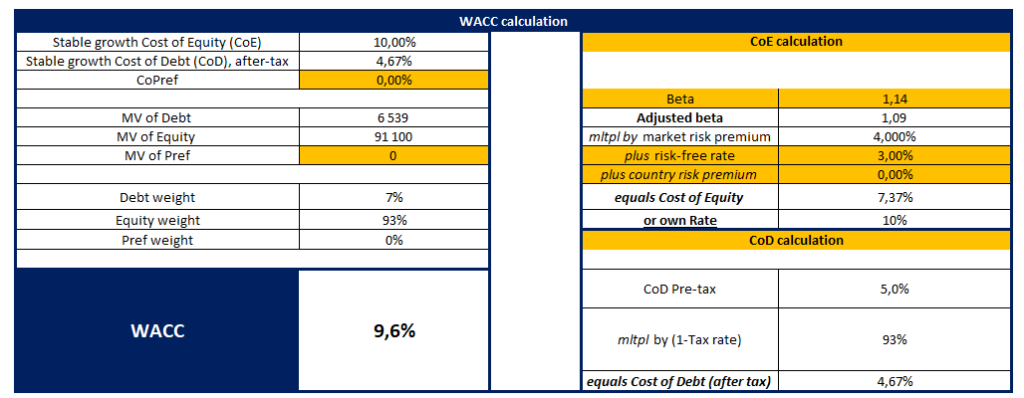

With the cost of equity equal to 10%, the Weighted Average Cost of Capital (WACC) is 9.6%.

With terminal EV/EBITDA equal to 6.8x, the fair value of the company is $160.1 billion or $106.47 per share. Thus, the company is trading at a 12% discount. The margin of safety is insufficient.

The P/E multiple is higher than the competitors’ and is equal to 14.4. The average P/E for the semiconductor industry is 22.2. On EV/EBITDA, Micron trades at a premium to peers.

| Micron | Kioxia | WD | SK Hynix | Intel | Industry Average | |

| P/E | 14.4x | 11.37x | 12.8x | 11x | 12.2x | 22.2x |

| EV/EBITDA | 6.8x | 9x | 8.35x | 6.1x | 6.7x | 18.5x |

Wall Street’s Take

From Wall Street analysts, Micron earns a Buy analyst consensus based on 18 Buy, 4 Hold, and 1 Sell ratings. At $108.18, the average MU price target implies 12.4% upside potential.

Conclusion

Micron Technology is the market leader in memory and can grow at double-digit rates through the EBU segment. MU can improve profitability by increasing all three components: net margin, asset turnover and financial leverage. However, it looks like all of the above drivers are already included in the stock price.

According to our valuation, the company is trading at a slight discount, but the margin of safety is insufficient. Notably, our price target is in line with the Wall Street consensus. Thus, we wait for a more attractive entry point.

Disclosure: At the time of publication, Vladislav Kolomeets did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates Read full disclaimer >