I am bullish on Micron (MU). This American company’s stock has a forward P/E valuation of just 7.8x.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Micron is an American firm engaged in the $66.8-billion DRAM (Dynamic Random Access Memory) industry. It also competes in the $46.6-billion NAND flash storage products industry.

Micron’s stock is trading at a 26% discount to its 52-week high of $96.96. (See Micron stock charts on TipRanks)

Catalyst for DRAM

Microsoft (MSFT) has made it final: Windows 11 requires TPM 2.0 hardware security compliance. Most Windows computers in use today cannot comply with this TPM 2.0 requirement.

The most-likely scenario is people will just have to buy new laptops and desktop PCs if they want Windows 11. This can boost the PC DRAM and NAND flash storage segments of Micron.

Micron is the world’s No. 3 manufacturer of server/PC DRAM products, with 23% market share.

PC builders like Lenovo (LNVGY), Dell (DELL), and HP (HPQ) will bid high to get RAM, SSD drives, and processors for their upcoming Windows 11 computer products.

Growth Driver For Micron

This company also sells consumer and data center-grade solid-state drives (SSD). Many laptops and desktop computers now come equipped with Micron’s NVMe SSD hard drives.

Micron’s NVMe SSD products give it an 11% market share in the $46.6-billion NAND flash storage industry.

Micron Is Undervalued

Micron’s stock is more affordable than its semiconductor peers. MU has a trailing P/E ratio of 20.1x. This is lower than AMD (AMD) at 36x, and Nvidia (NVDA) at 73.8x. AMD does not pay any dividends. Micron pays greater dividends than Nvidia.

MU’s Piotroski F score is 8, signifying that it is very strong financially, and presents excellent value. The total cash position of Micron is $8.4 billion, and its net operating cash flow is $18.9 billion.

The short-term assets of $18.6 billion exceed Micron’s short-term liabilities of $5.5 billion, and long-term liabilities of $8.2 billion.

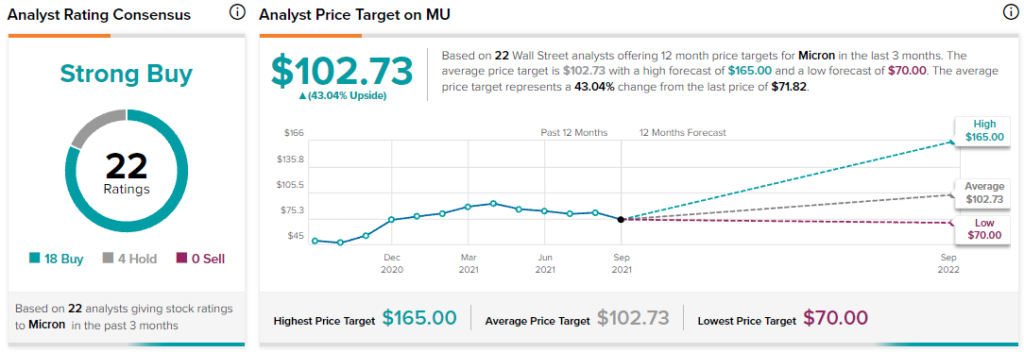

Wall Street’s Take

The consensus among Wall Street analysts is that Micron is a Strong Buy, based on 18 Buys, and four Holds. The average MU price target is $102.73, implying 43% upside potential.

Conclusion

The undervaluation of Micron makes it a very attractive investment.

Disclosure: At the time of publication, Motek Moyen did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates, and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices or performance.