Investors are bracing for tougher times as the Federal Reserve’s interest rate hikes are expected to tip the U.S. economy into a recession. Technology stocks have already been crushed by macro challenges and could remain under pressure in the short term. However, Wall Street remains bullish about the future prospects of certain tech stocks, though near-term uncertainty prevails. Using the TipRanks Stock Comparison tool, we will compare three prominent tech stocks – Meta Platforms (NASDAQ:META), Zoom Video (NASDAQ:ZM), and Advanced Micro Devices (NASDAQ:AMD). Let us see which stock could offer higher upside as per Wall Street pros.

Meta Platforms (META)

Meta Platforms, formerly Facebook, has been under pressure this year due to lower advertising revenue reflecting a tough macro backdrop, the impact of Apple’s iOS privacy policy update, and growing competition from TikTok. Earlier this year, Meta cautioned that Apple’s privacy policy changes could cost it $10 billion in advertising revenue.

Moreover, legal issues alleging violation of users’ privacy and regulatory challenges are also weighing on Meta. Furthermore, the company is investing billions of dollars in Metaverse, which might fetch long-term results but is a drag on the near-term profitability.

In July, Meta reported a nearly 1% drop in its Q2 revenue, marking its first quarterly decline in top line since going public. Earnings per share fell 32%. The company’s Q3 guidance reflects another quarter of declining revenue. However, those optimistic about Meta believe that the company is poised to bounce back once macro headwinds fade given its huge customer base.

Is Meta a Good Stock to Buy?

As per a recent Wall Street Journal report, citing sources familiar with the matter, Meta is planning to slash its expenses by at least 10% over the coming months. Staff reductions will be a part of the company’s efforts to cut expenses.

Following the WSJ report, Morgan Stanley analyst Brian Nowak estimates that if the news of cost cuts is true, then Meta’s GAAP EPS could come in at almost $10.85 in 2023, up from the analyst’s previous estimate of $9.90.

Nowak believes that “Confirming these cuts, clarity on revenue, engagement [and] time spent, and reels monetization” could be key catalysts for META shares in Q3. Nowak has a Buy rating on META stock with a price target of $225.

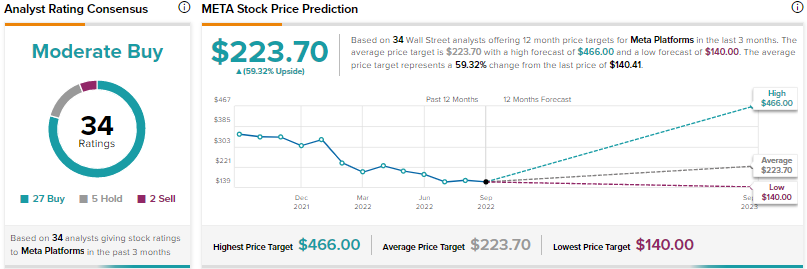

Meta scores a Moderate Buy consensus rating based on 27 Buys, five Holds, and two Sells. The average Meta Platforms stock price prediction of $223.70 implies 59.3% upside potential.

Zoom Video Communications (ZM) Stock

The video conferencing platform’s growth rates have slowed down after witnessing robust business during COVID-19 lockdowns and stay-at-home restrictions. Last month, Zoom reported revenue of $1.1 billion for the second quarter of FY23 (ended July 31, 2022), reflecting an 8% year-over-year growth. The Q2 growth rate marked a deceleration compared to the 54% growth seen in Q2 FY22 and 12% in Q1 FY23.

Zoom’s Q2 adjusted EPS exceeded expectations but declined 23% to $1.05. Zoom blamed currency headwinds and weakness in the online business (which comprises customers other than Enterprise customers). Additionally, the company issued weak guidance for fiscal Q3 and lowered its FY23 outlook.

While Zoom acknowledges the impact of macro challenges, it is confident about the long-term growth based on the strength of its Enterprise business. The number of Enterprise customers increased 18% year-over-year to 204,100 in Q2. The company is seeing strong traction for tools like Zoom Phone and Zoom Meetings, and is also optimistic about the newly launched solutions, like Zoom Contact Center and Zoom IQ.

What Is the Target Price for Zoom Stock?

Recently, Credit Suisse analyst Fred Lee initiated coverage on Zoom stock with a price target of $83. Lee pointed out that Zoom is the company that most people think of when it comes to work-related and personal video calls. That said, the analyst believes that Zoom faces “significant risk” due to rivalry from companies like Microsoft (MSFT) and Cisco (CSCO). Lee also noted that there is a potential for a drop in Zoom’s annual revenue run rate.

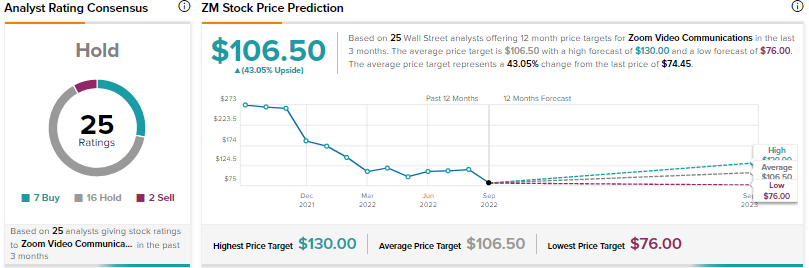

Consensus among analysts is a Hold based on seven Buys, 16 Holds, and two Sells. The average ZM price target of $106.50 implies 43% upside potential.

Advanced Micro Devices (AMD)

Leading chipmaker Advanced Micro Devices’ strong execution and innovation have helped it grab market share from Intel (INTC) over the past few years. While the weakness in the personal computer market has been a drag on the company’s recent performance, AMD continues to enjoy robust demand for its data center and embedded products. The second-quarter sales of AMD’s embedded segment gained from the Xilinx acquisition.

AMD’s Q2 revenue surged 70% year-over-year to $6.6 billion, while adjusted EPS jumped 67% to $1.05. Despite the market-beating results, investors were disappointed with the light Q3 guidance that reflected a continued drop in demand in the PC market.

Meanwhile, the company is optimistic about continued growth in the second half of the year, backed by its new 5-nanometer product shipments.

Is AMD a Good Stock to Invest In?

Last week, Morgan Stanley analyst Joseph Moore slashed his price target for AMD stock to $95 from $102 but maintained a Buy rating.

The analyst commented, “AMD continues to execute on its product roadmap while Intel attempts to regain its footing and deliver a long-awaited server product. We see further share gains for AMD in notebook and server processors in 2022 and 2023, offsetting industry-wide PC weakness and a likely gaming correction in 2023.”

Overall, the Street has a Moderate Buy consensus rating on AMD stock based on 19 Buys, seven Holds, and one Sell. The average AMD stock price target of $118.96 implies 75% upside potential from current levels.

Conclusion

Analysts remain cautious about tech stocks over the near term due to persistent macro headwinds. Currently, they are positive about the long-term prospects of Meta and Advanced Micro, while they are sidelined on Zoom Video. All three of these stocks have declined over 50% year-to-date. That said, analysts see higher upside potential in AMD stock from current levels.

Continued demand in the data center and cloud markets is expected to boost AMD’s business. As per TipRanks’ Smart Score System, AMD earns eight out of 10, implying it could outperform the market averages over the long term.