Mock Meta Platforms (META) for its name change and change of direction, if you will, but shares of the firm are becoming too cheap to ignore. The social-media family of apps could be cash cows for many years. Even if trendier platforms like TikTok disrupt, it’s a bad idea to underestimate the former FAANG front-runner’s ability to tilt the odds back in its favor.

Shares of Zuckerberg’s empire have never been this cheap, with the stock just north of 13 times trailing earnings. That’s indicative of a no-growth stock on the wrong side of secular trends, not a firm that could be leading the charge into the next big technological trend.

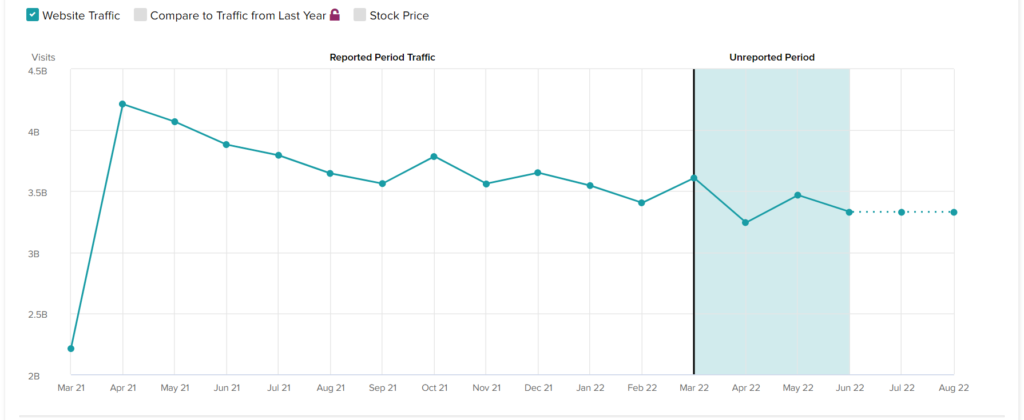

At these depressed levels, the metaverse and promises of digital good sales are nearly thrown in for free. Of course, investors will need to jump aboard the much-hated Facebook bandwagon as it looks to fight off declining DAU (Daily Active User) trends caused by changing consumer habits, privacy-centered operating system updates, and new rivals. In any case, I remain bullish.

Meta is Still Innovating Like It’s Nobody Else’s Business

Reels, Stories, and other video features have proven popular of late. Meta’s Reels product has been a hit among many of its users. As the federal government looks to view TikTok in a negative light, it’s Reels that could have the most room to run.

Still, it’s not just TikTok that Meta’s family of apps needs to contend with. Video, gaming, audio, and other forms of engaging entertainment are eating into time that could have been spent scrolling through Instagram or Facebook.

It’s clear that Meta needs to innovate or run the risk of losing ground to traditional forms of media.

The company needs to show investors that it can be the force that other firms strive to copy. As anti-trust roadblocks mount, it may be tougher for Meta to acquire its way around disruptive threats. Though Meta has done a great job of responding to threats like TikTok with similar offerings of its own, Meta really needs to focus on where the puck is headed next.

Right now, the company sees the metaverse as the new frontier. But could another tech trend come before the metaverse is ready to cater to billions of users?

Possibly. A metaverse where consumers spend billions of dollars on digital goods may be more than 10 years away. In the meantime, advanced AI and augmented reality (AR) seem like natural stepping stones.

Fortunately, Meta isn’t neglecting other areas of innovation amid its metaverse push. Sure, Meta is spending a considerable sum on the metaverse’s development, but it’s also innovating on the fronts of AI and AR.

Meta is leveraging AI to make its apps more engaging and to help fight misinformation. Such innovations will help the family of apps today and could enrich the digital worlds of the future.

Wall Street’s Take on Meta

Turning to Wall Street, Meta has a Moderate Buy consensus rating based on 29 Buys, seven Holds, and two Sells assigned in the past three months. The average Meta price target of $262.72 implies 54.8% upside potential. Analyst price targets range from a low of $180.00 per share to a high of $466.00 per share.

Layoffs May Come, but Innovative Pace Unlikely to Slow

There’s no question that the ad business will feel a bit of pressure once the economic slowdown arrives. Still, Meta will continue innovating on the fronts of AI and the metaverse, even as hiring slows and layoffs arise.

Zuckerberg recently noted to staff that Facebook would be “turning up the heat” to identify underperformers. Even as Facebook reduces its employee count, don’t count on the firm to pull the brakes on innovation. It’s still betting big on the metaverse and AI, two areas that warrant a much richer premium on shares.

The Bottom Line is that Meta Stock is too Cheap

Meta stock is too cheap to ignore, with a market cap that’s now under $500 billion. Many Wall Street analysts agree.

The future of virtual reality (VR) tech may be uncertain, but it’s the social-media business that could power the stock higher, even once the dreaded recession arrives.