Another one bites the dust. A day after Microsoft and Alphabet delivered disappointing Q3 reports, Meta (META) announced another shocker.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Battered investors might be experiencing déjà vu, as like in the wake of its previous report (for Q2) the shares were taking a severe beating in the subsequent session adding further losses to a stock which had already shed 60% its value year-to-date.

The one big difference between the prior report and the latest was the top-line performance. While the company missed the revenue target in Q2 by some distance, the figure came in above the prognosticators’ expectations; revenue reached $27.71 billion, compared to the $27.38 billion expected on Wall Street. Nevertheless, that figure still represented a 4.5% decline from the same period a year ago.

If the top-line beat offered some kind of bright spot there wasn’t much else to sing about.

With the company splashing out on its metaverse initiative, costs and expenses increased by 19% year-over-year to $22.1 billion. At the same time, operating income dropped by 46% YoY to $5.66 billion. Operating margin shrunk from 36% a year ago to 20%, while net income fell 52% to $4.4 billion. It all resulted in EPS of $1.64 misses, some way below the Street’s $1.86 forecast.

Looking ahead, Meta also disappointed with the outlook; Q4 revenue is expected in the range between $30 billion to $32.5 billion, lower at the midpoint than consensus at $32.2 billion.

There were Downgrades aplenty on Wall Street following the print, but not all are recommending to jump ship. In fact, Baird’s Colin Sebastian pulls out the 3 magic words needed to boost sentiment: “Buy the dip,” says the analyst, who explains why it’s time to be “buyers on the pullback.”

“Meta’s Q3 report is further confirmation of the broader ad market slowdown, driving lower earnings/margins from deleverage and management’s commitment to certain investment priorities (AI, Messaging, Metaverse),” Sebastian explained. “Consistent with our preview, management spoke cautiously about Q4 – exacerbated by currency and macro pressures in Europe – and then guided expenses well above consensus – albeit fairly close to Baird’s estimate. Importantly, usage and engagement of Meta apps accelerated, Reels is making progress, and messaging is already a $9 billion run-rate business.”

To this end, Sebastian sticks with an Outperform (i.e., Buy) rating, although the price target does get a haircut and is reduced from $230 to $150. Nevertheless, there’s still upside of 53% from current levels. (To watch Sebastian’s track record, click here)

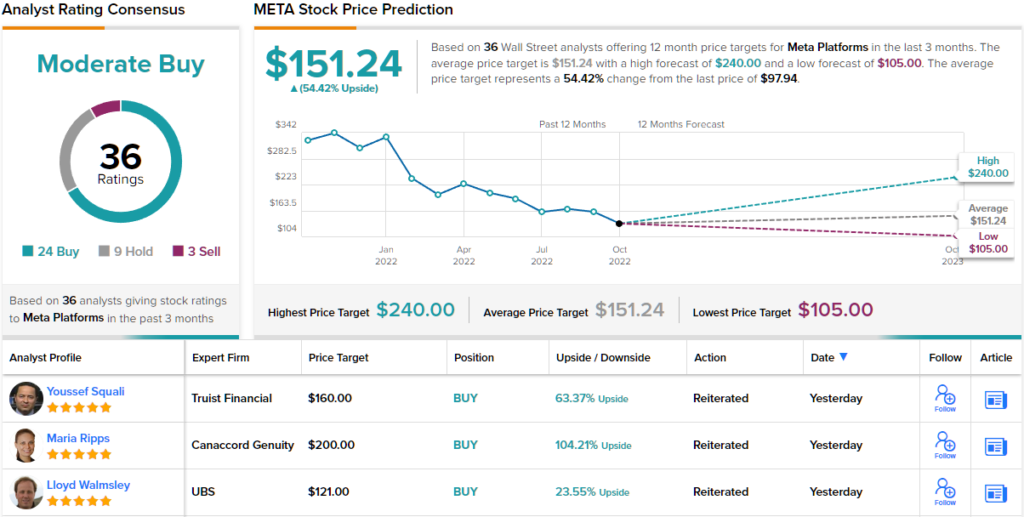

Looking at the consensus breakdown, with 24 Buys, 9 Holds and 3 Sells, the analysts’ view is that this stock is a Moderate Buy. Going by the $151.24 average target, shares now have room for 54% growth in the year ahead. (See Meta stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.