As the chorus of a possible recession grows louder and louder, companies are beginning to tighten belts and look to shed extra weight. In another such ominous development, Facebook parent Meta Platforms (META) is looking to optimize its workforce.

According to the Wall Street Journal, the Head of Engineering at Meta has asked managers to zero in on employees that are not performing up to the mark so Meta can fire them.

The Wall Street Journal reports that the Engineering Head wants Managers to understand the company’s high-performance bar and hold their team accountable.

This development comes on the heels of Meta CEO Mark Zuckerburg’s comments last month that the company would be doing away with employees who could not meet its aggressive targets.

Meta shares have nosedived nearly 52% this year as a multitude of factors, including inflation, rising rates, heightened competition from new entrants on the block, and shifting user interests, have weighed on its price.

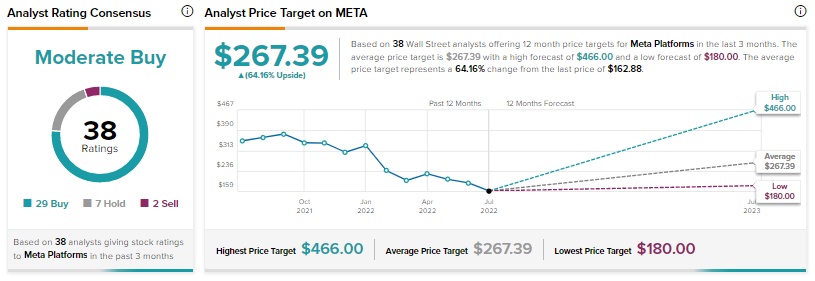

Amid this correction, the Street is cautiously optimistic about Meta, with a Moderate Buy consensus rating and an average price target of $267.39, implying a 64.16% potential upside.

The move at Meta is not an isolated instance and is part of a growing trend echoed across major names. Twitter (TWTR) just did away with 30% of its talent acquisition team, and Tesla (TSLA) exited nearly 200 employees. Tesla supremo Elon Musk had only recently conceded that he had, ‘a very bad feeling about the economy.’

Furthermore, Coinbase Global (COIN), Robinhood Markets (HOOD), and real estate broker Redfin (RDFN) have all undertaken significant headcount reductions in recent months.

Analysts Have a Mixed Stance on Meta

A deeper look at analysts’ views shows opinions at both extremes of the spectrum. Tigress Financial’s Ivan Feinseth has reiterated a Buy rating on Meta with a price target of $466, which indicates a massive 186.10% potential upside.

Needham’s Laura Martin, on the other hand, has decreased the stock’s rating to Sell from Hold without assigning it a price target. The analyst believes Meta’s cost woes would outpace top-line gains and investors might be better off selling the stock to generate funds.

Closing Note

The focus on reducing headcount further reinforces the fears of a looming recession and the challenges as companies face a difficult environment.

In the meantime, all eyes will be on July 27, when Meta is expected to report its second-quarter numbers. Analysts expect earnings of $2.59 per share. In the year-ago period, Meta delivered an EPS of $3.61, outperforming estimates of $3.04.

Read the full Disclosure