Shares of Meta Platforms (NASDAQ: META) have halved in value this year, down by 51.6%, as investors have been concerned about the tough macro environment impacting the social media giant’s advertising revenues coupled with slowing user engagement amid rising competition.

However, Deutsche Bank analyst Benjamin Black remains upbeat about META with a Buy rating and explained his bullish thesis on the stock in his research report. Meta will release its Q2 results on July 27, after the markets close.

Meta’s Q2 Outlook

Meta expects to generate revenues in the range of $28 billion to $30 billion in Q2, reflecting the “softness in the back half of the first quarter that coincided with the war in Ukraine.” This guidance also assumes that currency exchange fluctuations are likely to impact the year-over-year growth in Q2 by around 3%.

Wall Street analysts expect Meta to generate revenues of $28.9 billion, at the lower end of its Q2 outlook. In contrast, Black estimates Meta to post revenues of $29 billion, at the higher end of the company’s outlook.

Meta Platform’s earnings are anticipated to come in at $2.55 per share in Q2 by analysts.

Black expects that the Q2 earnings could be “better than feared” as the social media company has indicated “more cost discipline over the next 6-12 months.”

Meta Platforms’ management had stated on its Q1 earnings call that it was lowering its expense outlook for FY22 and expected it to be in the range of $87 billion to $92 billion, down from its prior range of $90 billion to $95 billion.

On the earnings call, Dave Wehner, Meta’s CFO, added that this expense was more likely to be driven by the Family of Apps and Reality Labs business segments.

Ad Spend on Meta Platforms is Growing

Black’s channel checks have indicated that there have been “no major changes in terms of sentiment and spend across major platforms” and ad spending from advertisers across the Facebook and Instagram platforms remains “stable” while advertisers’ appetite to spend remains “consistent” relative to earlier quarters.

Black’s checks with two advertising agencies indicated that their clients ramped up their ad spending on Meta Platforms in the range of 8% to 8.5% in Q2.

Advertising comprises a major component of Meta’s revenues and made up around 96.7% of its total revenues in Q1.

Meta Platforms’ Reels Could Be a Growth Catalyst

As Meta increasingly focuses on short-form videos through Reels, Black believes that given “Meta’s first party data and audience advantage, we think it could become a potential growth catalyst even in the face of modest slowdown.”

Meta’s management indicated on its Q1 earnings call that Reels currently make up “more than 20% of the time that people spend on Instagram” and its popularity is growing on Facebook as well.

Black pointed out that Meta has increased its efforts to improve the advertising format on Reels and, in the second quarter, introduced additional tools and features to improve Reels.

Meta Could See a Slight Slowdown in MAUs in Q2

Black cited data from the SensorTower app which suggested that Facebook and Instagram monthly active users (MAUs) likely grew by approximately 1% in Q2 year-over-year, versus a growth rate of around 3% in Q1.

The analyst believes that this slowdown in growth is due to Russia’s war on Ukraine and the “loss of Russian users, as Meta ceased its business in Russia in late March.”

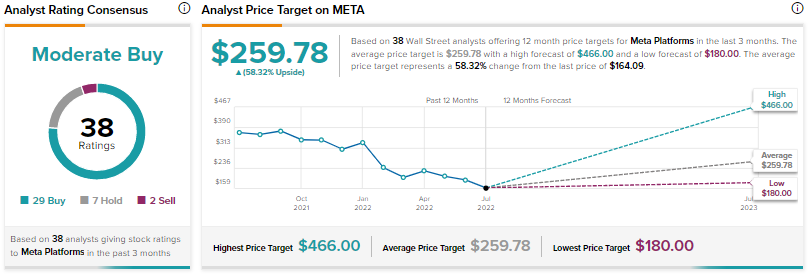

Wall Street’s Take on META

Black, however, reduced his price target on the stock to $235 from $265, implying an upside potential of 41% at current levels.

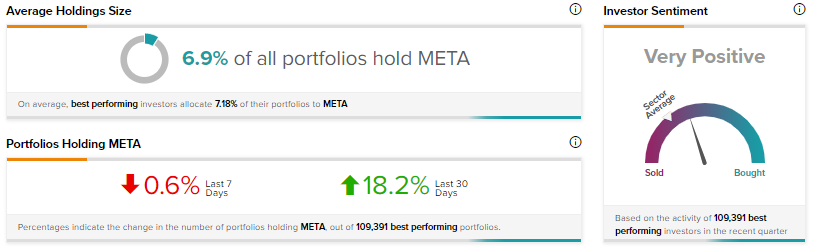

Other Wall Street analysts, however, are cautiously optimistic about the stock with a Moderate Buy consensus rating based on 29 Buys, seven Holds, and two Sells. The average Meta Platforms price target of $259.78 implies an upside potential of 58.3% at current levels.

Bottom Line

Going by Black’s opinion, Meta is unlikely to see a drastic drop in its advertising revenues in Q2 and could possibly rise up to this challenging macro environment.

Investor sentiment is very positive about the stock, according to the TipRanks Crowd Wisdom tool. According to this tool, investors have upped their holding of the META stock by 18.2% over the last 30 days.