Mercado Libre (MELI) is the largest e-commerce and payments ecosystem in Latin America.

I am bearish on the stock. (See Analysts’ Top Stocks on TipRanks)

Q3 Earnings

Mercado released its third-quarter earnings results in November, and although the firm beat its EPS estimate by $0.63, it missed on its revenue expectation by $30 million.

During the quarter, the conglomerate’s year-over-year stats were as follows. Net revenues increased by 72.9%, total payment volume by 59%, and gross merchandise volume by 29.7%.

Although the firm did produce growing numbers this quarter, it still slowed down in growth versus previous quarters. I anticipate growth to stagnate exponentially going into 2022; the key drivers explain why.

Key Drivers

Latin America’s final GDP growth result for 2021 is estimated to be 6.1%; however, that data point is anticipated to decline to the 3% handle.

Although a 3% growth in GDP may be appetizing for developed nations, developing jurisdictions prefer growth of around the 5% mark and beyond. Technology company earnings tend to have an exponential linkage to GDP oscillation, meaning that it increases and declines abruptly along with rises and declines in growth.

Furthermore, Mercado’s operating in an increasingly competitive sphere with e-commerce and fintech market entrants piling up.

Heated competition is arising from the likes of Sea Ltd. (SE), whose Shopee app has just exceeded Mercado’s user base in Brazil. I also think smaller market entrants will slowly start diluting previous monopolies in emerging market e-commerce and fintech industries.

Valuation Metrics

This stock is significantly overvalued. Mercado’s price-to-sales ratio is 655.8% higher than its sector average, and its price-to-cash flow ratio is 840.6% higher than its sector average.

On a fair note, we need to consider all the synergies available to Mercado as it’s a diverse company and revise in the future. However, for now, this is an overvalued stock.

Wall Street’s Take

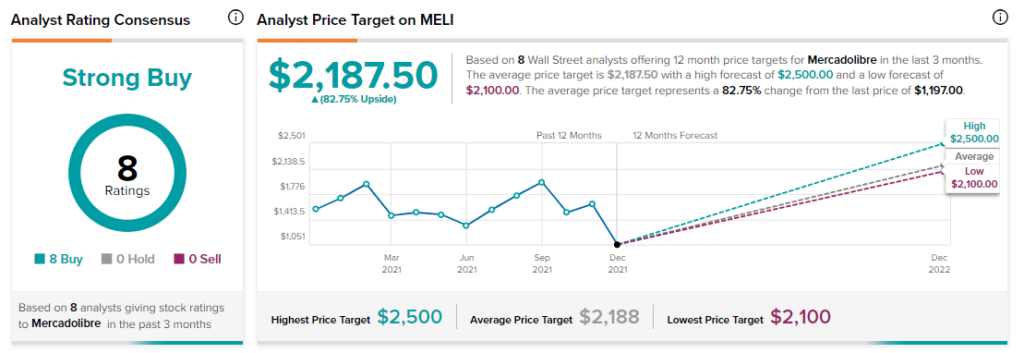

Wall Street analysts are generally bullish on the stock, with a Strong Buy consensus, based on eight Buy ratings. The average Mercadolibre price target is $2,187.50, which represents 82.8% upside potential.

Concluding Thoughts

Mercado stock has suffered as a consequence of rising competition and slowing growth in the e-commerce and fintech space. I believe the stock will continue its decline in 2022 until it reaches its fair price level.

Disclosure: At the time of publication, Steve Gray Booyens did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates Read full disclaimer >