Avaya Holdings (NYSE:AVYA) has garnered a lot of traction lately and is swinging wildly following meme stock traders’ volatile bets. AVYA stock has soared 151% in the past month alone, vis-à-vis losing 90.3% year-to-date.

AVYA stock was up more than 11% in midday trading yesterday. The share volume for AVYA stock was 25.3 million yesterday. This represents a massive 102.4% jump over its average volume for the last 100 days of 12.5 million.

Avaya is an American technology company that offers cloud communications and business collaboration services. The company has a current market capitalization of $174.56 million.

Avaya Holdings has become a recent darling of meme traders who are willing to risk their investments on a company that is on the brink of bankruptcy.

The company has been struggling to meet Wall Street expectations, and its troubles seem to have no end. Moreover, a looming $221 million convertible bond that is due in June is pressurizing the company’s finances. Cash bleeding is one of the major causes of concern for the technology company. Its cash balance stood at a mere $217 million as of September 2022. Analysts predict that Avaya will be cash-strapped by next June.

Here’s Why Avaya Caught the Meme Traders’ Attention

After Theodore Walker Cheng-de King of Altisource Asset Management continued to usurp large proportions of AVYA stock, the meme stock traders followed suit. Popularly known as “The King,” the investor has a huge belief in Avaya’s turnaround possibility. Moreover, the activist investor has confidence in Avaya’s ability to bolster its revenue from the existing 90,000 customer base. Currently, King owns approximately a 15.41% stake in Avaya Holdings.

The King has criticized analysts who are against the stock on his Twitter (TWTR) account. Similarly, he has beseeched Avaya’s board of directors to abandon the desire to file for bankruptcy and the consequential control to be taken by Apollo Global Management LLC (APO). As per King, Avaya should consider other strategic alternatives, like finding a strategic partner and restructuring its convertible bond that is due next year.

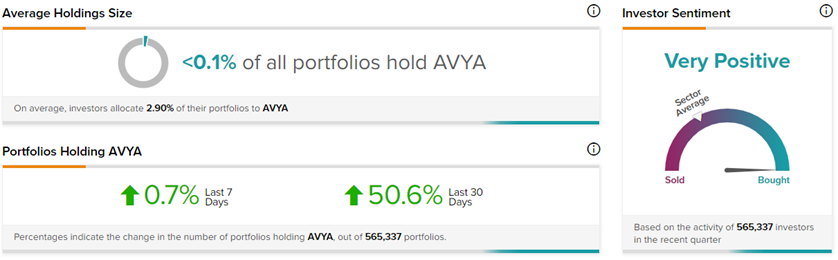

Notably, King’s enthusiasm has been passed on to retail investors, demonstrating a Very Positive investor sentiment signal on TipRanks. A whopping 50.6% of portfolios tracked by TipRanks have increased their exposure to AVYA stock over the past 30 days.

On the contrary, TipRanks’ Hedge Fund Trading Activity tool shows that confidence in Avaya Holdings is currently Very Negative, as four hedge funds decreased their cumulative holdings of AVYA stock by 1 million shares in the last quarter.

Is Avaya a Good Stock to Buy?

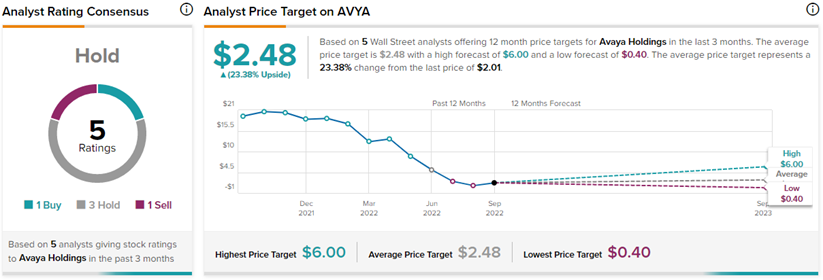

After all the deliberation, the question remains whether or not one should invest in Avaya Holdings. Amid all the meme stock frenzy and the dimming possibilities of a turnaround, Wall Street analysts remain cautious about Avaya Holdings.

On TipRanks, AVYA stock has a Hold consensus rating. This is based on one Buy, three Holds, and one Sell. The average Avaya Holdings price forecast of $2.48 implies 23.4% upside potential to current levels.

On one hand, a majority shareholder and retail investors are betting huge amounts on Avaya. On the other hand, analysts are highly skeptical of AVYA stock’s future trajectory. An investor may choose to invest in AVYA stock based on his sole risk-bearing capacity and after conducting thorough research.