MDA Ltd. (TSE: MDA) is a Canadian developer and manufacturer of advanced technology and services to the burgeoning global space industry. It is an international space mission partner and a robotics, satellite systems, and geo-intelligence pioneer.

The company has been around for over 50 years and has contributed to the aerospace industry in many ways. Indeed, it allowed Canada to become the first country with a domestic communications satellite in geostationary orbit in 1972.

Furthermore, it developed the Canadarm, a robotic arm that is used in space. Due to its successful history, relative efficiency, and attractive valuation, we are bullish on the company.

MDA is an Efficient Company

The speed at which a company can move inventory and convert it into cash is very important in predicting its success. To measure its efficiency, we will use the cash conversion cycle, which shows how many days it takes to convert inventory into cash. It is calculated as follows:

CCC = Days Inventory Outstanding + Days Sales Outstanding – Days Payables Outstanding

MDA’s cash conversion cycle is 34 days, meaning it takes the company 34 days for it to convert its inventory into cash. Since the company became public in 2021, there isn’t enough data to identify a trend, although the number increased from 16 days in 2020.

Nevertheless, 34 days is still below the industrial sector average of 49 days and below its peer Maxar Technologies’ (MAXR) figure of 48 days, suggesting that MDA is more efficient than its average competitor.

In addition to the cash conversion cycle, we can consider MDA’s gross margin. Although not enough data to establish a reliable trend, it is encouraging to see that its gross margin increased from 35.6% to 40.1% in the past fiscal year.

In addition, its gross margin is also better than the sector average of 27.4%, indicating that MDA has better profit potential than most of its peers.

Growth Catalysts

MDA is still a relatively unknown mid-cap stock with a market cap of C$1.15 billion. This is likely because it isn’t listed on a major U.S. exchange. However, this presents a great opportunity for patient long-term investors.

At the end of Q4 2021, MDA had a backlog of C$864.3 million. In addition, the company has received new contracts since then, which include a C$415 million contract for Globalstar’s LEO satellite constellation and a C$269 million contract for its Canadarm3 phase B. As a result, its has contracted business that exceeds its market cap.

This also provides the firm with strong visibility for 2022, something that has not been very common with most companies as of late. Management has guided for 2022 revenue of C$750 to C$800 million with adjusted EBITDA of C$140 to C$160 million, equating to revenue growth of 55% to 65% year-over-year.

Another interesting future growth catalyst is MDA’s next-generation commercial Earth observation mission. Back in September, the company announced that it was working on a new broad area satellite system that will provide the most extensive coverage on the market. More specifically, it will cover a 700 km swath in a single pass.

This program is still in the development phase, so it likely won’t boost revenue anytime soon. However, it caught our attention because MDA plans to launch it as a subscription model. This will provide the company with more predictable and recurring revenue that could potentially lead to a margin expansion going forward.

Risk Factors

One of the main risks investors need to be aware of is the fact that MDA has very low trading volume. Although this does not impact the company’s fundamental performance, it can cause a lot of volatility in the share price.

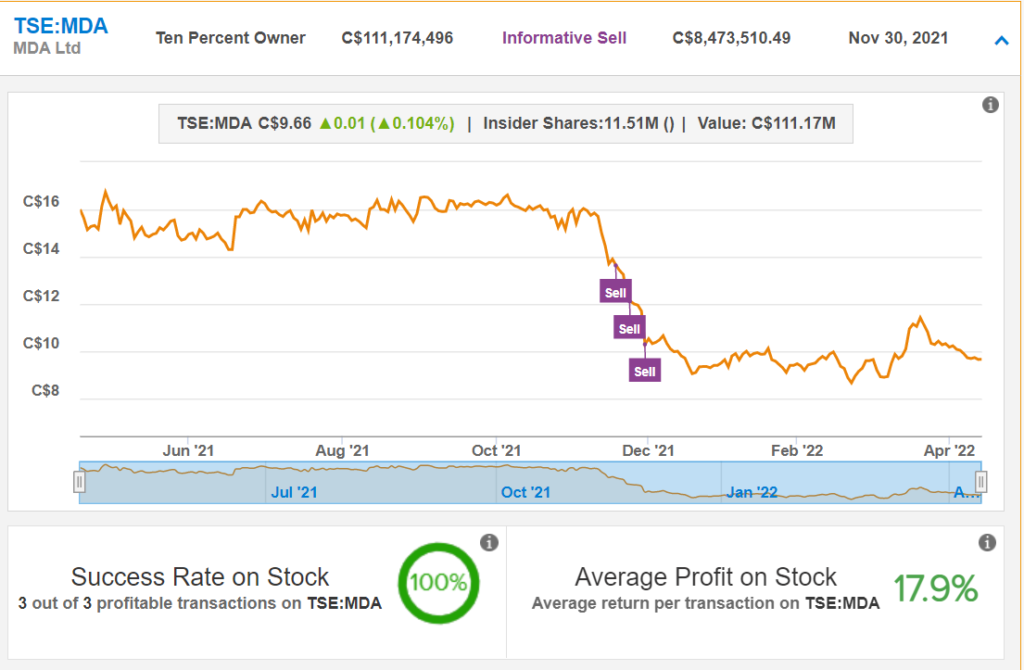

MDA shareholders who have been holding onto the stock since its IPO know firsthand the pain that this volatility can cause. Beginning five months ago, the company’s largest shareholder, Edgepoint Investment Group, began offloading millions of dollars worth of shares.

Due to the low volume, the stock price cratered from the mid-teens to the single digits. Edgepoint still has a significant stake in the company, suggesting that the selling was likely due to portfolio rebalancing. However, it demonstrates the impact on the share price whenever the volume is elevated.

Thus, investors need to be able to expect and stomach the volatility if they choose to invest in the company. Otherwise, they may become too emotional which tends to lead to mistakes.

Wall Street’s Take

Turning to Wall Street, MDA has a Moderate Buy consensus rating, based on two Buys, one Hold, and zero Sells assigned in the past three months. The average MDA price target of $16 implies 65.63% upside potential.

Final Thoughts

MDA is an established company that has a long history of success and innovation. It is currently more efficient than the average company in the industrial sector when measured by cash conversion cycle and gross profit margins.

In addition, it has secured business contracts that amount to a total value that is greater than its market cap, with more contracts to be won going forward.

Although the stock is likely to be volatile, that doesn’t mean the underlying business is risky. Therefore, from a fundamental perspective, we are bullish on the stock.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure