MDA (TSE: MDA) is a relatively unknown company that has the potential to be a big winner, going forward. With a massive backlog and a long history of innovation, it’s not difficult to see why analysts are positive about the stock.

MDA is a Canadian developer and manufacturer of advanced technology and services to the burgeoning global space industry.

MDA: Under-the-Radar Company with Strong Growth Ahead

With an average daily dollar volume of less than C$1 million, MDA can easily be considered an under-the-radar stock. Sporting a market cap of C$923 million, the company isn’t listed on any major U.S. exchanges. Thus, this presents an opportunity for long-term investors that have the patience to stomach the volatility that accompanies low-volume stocks.

What makes MDA so interesting is its backlog. Indeed, the company had a backlog worth C$864.3 million at the end of Q4 2021. However, MDA has been awarded new contracts since then, including a C$415 million contract for Globalstar’s LEO satellite constellation and a C$269 million contract for its Canadarm3 phase B. This means that MDA’s backlog value exceeds its market cap.

The benefit of having such a large backlog is that it provides the company with great revenue visibility. With all the macroeconomic uncertainties, this should allow investors to feel more at ease holding onto the stock. In fact, management guided for 2022 revenue of C$750 to C$800 million with adjusted EBITDA of C$140 to C$160 million, equating to revenue growth of 55% to 65% year-over-year.

Another interesting development for investors with a long-term time horizon is MDA’s next-generation commercial Earth observation mission. In 2021, the firm revealed it was developing a new broad area satellite system with the most extensive coverage on the market.

Although this won’t boost revenue anytime soon, MDA plans to eventually launch it as a subscription service. This will provide the company with more predictable and recurring revenue that could potentially lead to profit margin expansion, going forward.

What Do Analysts Think of MDA Stock?

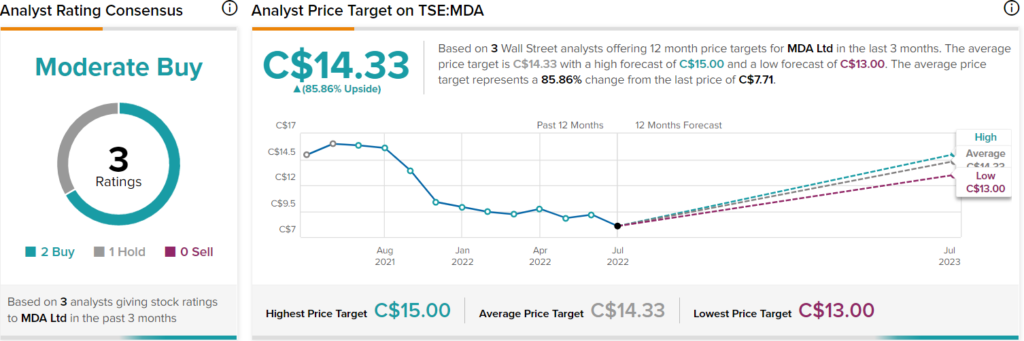

MDA has a Moderate Buy consensus rating based on two Buys and one Hold assigned in the past three months. The average MDA price target of C$14.33 implies 85.9% upside potential.

Final Thoughts: MDA Has Plenty of Potential

MDA is an established business that has a long history of success and innovation. With a growing backlog that exceeds its market cap, the company is poised to continue growing. As a result, it’s easy to see why analysts have a favorable view of the company.