Fast-food behemoths McDonald’s Corporation (NYSE: MCD) and The Wendy’s Company (NASDAQ: WEN) are in the news over misrepresentation of their scrumptious offerings in advertisements.

On Tuesday (May 17th), New York-based Justin Chimienti filed a lawsuit in the U.S. District Court for the Eastern District of New York alleging that the two burger-makers are fooling consumers by delivering smaller/shorter-than-advertised cheeseburgers. The lawsuit is seeking class-action status.

The plaintiff alleged that the companies use undercooked patties (beef) to make the burgers appear 15% to 20% larger in their marketing campaigns. Specifically for Wendy’s, he said the company cheats on the amount of its burger toppings too.

In the lawsuit, Chimienti cited his personal experience with McDonald’s Big Mac and Wendy’s Bourbon Bacon Cheeseburger and supported the matter through a pictorial comparison of the advertised and delivered burgers of both the companies.

While the two burger giants refrained from commenting on this matter, the downward movements in their share prices mirrored the market sentiments towards the allegations.

Since May 17th, shares of McDonald’s have slipped 5.2% (from $241.63 to $229). Similarly, Wendy’s stock has declined 6.8% (from $17.62 to $16.42).

Can such lawsuits impact these deep-rooted companies? A company-wise synopsis of growth prospects and risks is given below to help investors gauge the matter.

McDonald’s

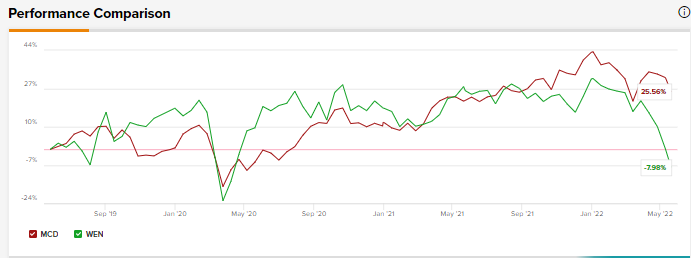

The $169.4-billion burger-maker operates globally through at least 40,000 franchises and restaurants (data as of Q1 2022 end). It was founded in 1940. Over the past five years, shares of MCD have surged 52.8%.

It believes in serving people from all communities with good quality food. Taking proper care of its employees and the animals engaged in the supply chain are priorities too.

Over the years, the company has strengthened its brand value by serving consumers with delicious menus, often topped with the introduction of innovative products and loyalty programs. It is worth noting here that revenues from its digital channels were $18 billion in 2021 and $5 billion in the first quarter of 2022.

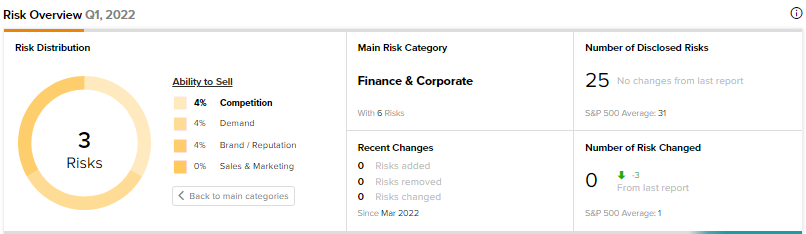

Per the TipRanks’ Risk Analysis tool, McDonald’s Ability to Sell category contributes just three risks to the total 25 risks identified for the stock. Further, the breakdown of this category reveals that the company’s exposure to the Sales & Marketing risk is ‘nil’.

According to TipRanks, the analyst community loves MCD and has awarded it a Strong Buy consensus rating based on 22 Buys and six Holds. Also, McDonald’s average price target of $281.07 suggests 22.74% upside potential from current levels.

Wendy’s

Founded in 1969, the company has emerged as one of the most preferred burger brands globally. It operated approximately 7,000 restaurants across nations at the end of the first quarter of 2022. The $3.5-billion burger giant exhibited a marginal growth of 0.6% in the past years.

With solid product offerings and zeal for innovation, the company has created a solid customer base for itself. It believes in further strengthening its brand image and enhancing its revenue growth opportunities, including working on the digital front, acquisition of restaurants, and working on its breakfast dayparts.

At the end of the first quarter of 2022, the digital businesses of Wendy’s accounted for 10.6% of the company’s global sales.

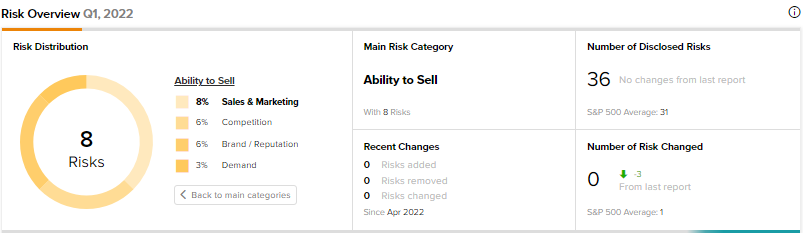

A look at TipRanks’ Risk Analysis suggests that Wendy’s main risk category is Ability to Sell, contributing eight risks to the total 36 risks identified for the stock. In this category, the company is exposed to three risks related to Sales & Marketing.

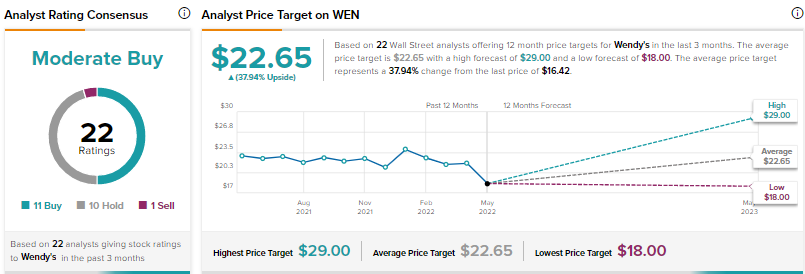

The shakiness in the stock is visible from its Moderate Buy consensus rating, which is based on 11 Buys, 10 Holds, and one Sell. Wendy’s price target of $22.65 mirrors 37.94% upside from current levels.

Conclusion

There is no doubt that both McDonald’s and Wendy’s have strong footholds in the markets served by them and are working hard to expand their market share. Lawsuits, such as the one discussed above, are unlikely to cause much harm to McDonald’s considering its low-risk profile. On the other hand, Wendy’s risky profile raises concerns.

It will be prudent if McDonald’s and Wendy’s avoid such hiccups to help both customers and investors keep ‘loving’ them.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure