Restaurant stocks have been walloped lately, thanks in part to mild consumer pressures and growing fears over the longer-term impact of weight-loss drugs. Indeed, it’s tough to gauge how much popular restaurant chains — like MCD, DIN, and PLTO — stand to be disrupted at the hands of GLP-1 agonists.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

There may be some sort of long-lasting impact as the average American looks to eat a bit less on any given day. That said, I think Ozempic (a weight-loss drug) ought to be low on the list of worries when it comes to restaurant stocks. They already have their hands full with inflation, a slowing economy (potential recession?), and fierce competition with one another. At the end of the day, it’s how firms deal with these three key concerns that will probably dictate whether or not they’ll be winners.

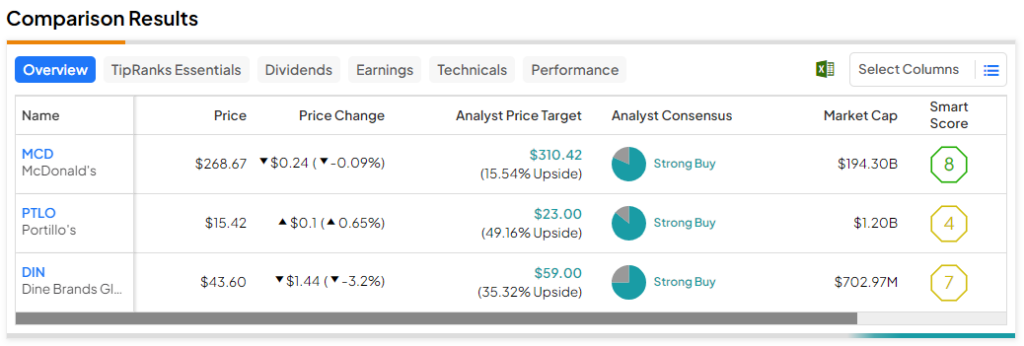

Therefore, in this piece, we’ll use TipRanks’ Comparison Tool to check out three Strong Buy-rated restaurant stocks that are likely to be winners over the year ahead.

McDonald’s (NYSE:MCD)

McDonald’s really puts the “fast” in fast food, with menu items that can be served up at a rapid pace, whether consumers opt for dine-in, takeout, delivery, or drive-thru. As McDonald’s continues innovating by incorporating new technologies to remove friction from the order process, I view McDonald’s as a restaurant firm that’s moving way too fast for rivals.

All the while, McDonald’s is continuing to engage younger consumers by pioneering celeb-endorsed meals and even tapping into its roots with the likes of old mascots (think Grimace and CosMc) to give itself a shot in the arm. All considered, I remain bullish on McDonald’s, just like your average analyst.

Moving ahead, I expect that McDonald’s will continue to be a pioneer in the fields of marketing and incorporating new tech. It’s a winning strategy for McDonald’s and one that will continue to pay big dividends.

At writing, shares trade at 23.7 times trailing price-to-earnings (P/E), quite a bit lower than the restaurant industry average of 26.25 times. With a winning strategy, extensive (and moat-worthy) prime real estate, and the ability to fare well in a harsh environment, I find it absurd that shares aren’t trading at a hefty premium to the peer group. Sure, McDonald’s is a nearly $200 billion behemoth now, but it’s used its size and scale to its advantage and will probably continue to do so under CEO Chris Kempczinski.

Kempczinski is confident McDonald’s can do well as consumers are hit with “difficult times.” Indeed, macro headwinds may very well be a tailwind for McDonald’s as more people gravitate toward convenience and affordability.

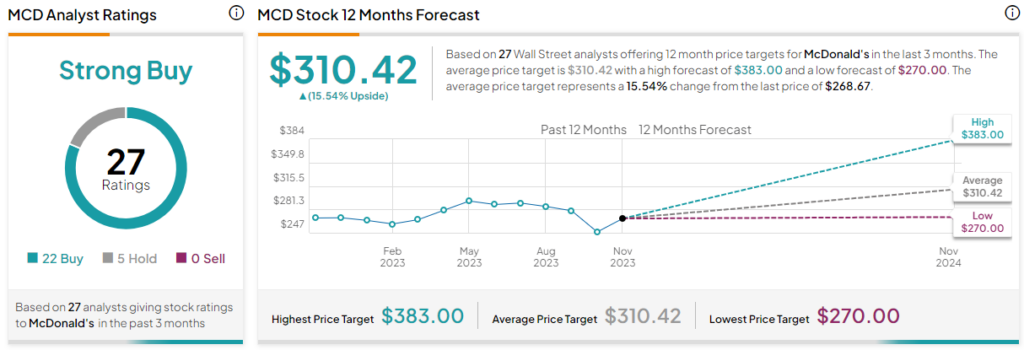

What is the Price Target for MCD Stock?

McDonald’s is a Strong Buy, according to analysts, with 22 Buys and five Holds given in the past three months. The average MCD stock price target of $310.42 implies 15.5% upside potential.

Dine Brands Global (NYSE:DIN)

Dine Brands is the firm behind dine-in restaurant chains such as Applebee’s and IHOP. The stock has been a colossal loser for quite some time, with shares now down 32.6% year-to-date and 60% from their 2015 all-time high. The firm has really felt the pain of the ailing consumer, and the advent of GLP-1 drugs is not helping to jolt the craving for IHOP pancakes.

The firm may not have much going for it, but many analysts view a strong contrarian case for owning the stock at these depths. I think the bulls on Wall Street will be proven correct. DIN stock is a deep-value play that may not require much to begin moving higher again. As such, I’m inclined to be bullish on the name, even in the face of seemingly insurmountable macro headwinds.

Just last week, after DIN reported earnings, five-star-rated Jake Bartlett over at Truist Financial reiterated his Buy rating on the stock, with a Street-high price target of $70.00 per share. The target is down from the original $78.00 but still implies a massive 60.6% gain from current levels.

The company’s third-quarter results were somewhat decent (earnings per share of $1.46 vs. $1.31 consensus on $203 million in revenue). Still, Applebee’s experienced yet another (its third-straight) quarter of negative comparable store sales (down 2.4% for Q3). It’s hard to imagine the tides turning anytime soon, given that economic contractions and slowdowns tend to hit dine-in restaurants really hard.

In any case, one has to imagine there’s more than just a recession priced in while shares trade at 9.3 times trailing P/E, miles below the restaurant industry average. It’ll probably take a healing economy and consumer to turn the tides over at Applebee’s. Regardless, value hunters should be more than willing to wait it out as shares are now at lows not seen since the lockdown days of 2020.

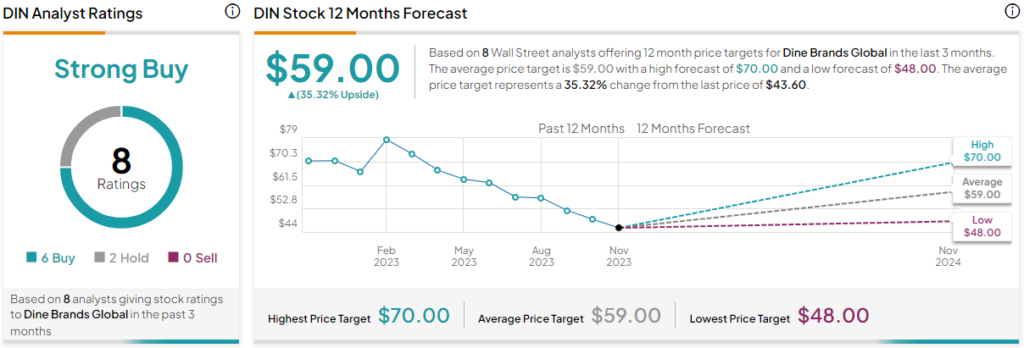

What is the Price Target for DIN Stock?

Dine Brands is a Strong Buy, according to analysts, with six Buys and two Holds assigned in the past three months. The average DIN stock price target of $59.00 implies 35.3% upside potential.

Portillo’s (NYSE:PTLO)

Portillo’s is a fast-casual hot-dog-focused chain that’s quite close to all-time lows, currently trading at around $15 and change. Indeed, consumers are feeling the pinch, and some analysts are starting to lose patience, with the likes of Morgan Stanley (NYSE:MS) recently downgrading PTLO over the cooling appetite for hot dogs. In such an uncertain environment, you can’t blame Morgan Stanley for moving to the sidelines while the stock trades at a pretty rich valuation.

Portillo’s may have tasty hot dogs, but that’s no reason to pick up the stock while it’s trading at 57.1 times trailing P/E. Indeed, Portillo’s still has a massive long-term growth runway. But a stormy macro environment could cause less-patient growth-savvy investors to look elsewhere. As such, I’m inclined to be neutral on the stock and follow in the footsteps of Morgan Stanley. It’s far more comfortable to wait and see how things pan out from the sidelines.

However, other analysts are notably more upbeat following the firm’s recent unit growth target increase. Portillo’s expects unit growth of 10%+ and 12%+ in 2024 and 2025, respectively, while 2026’s growth rate could be 12% to 15%.

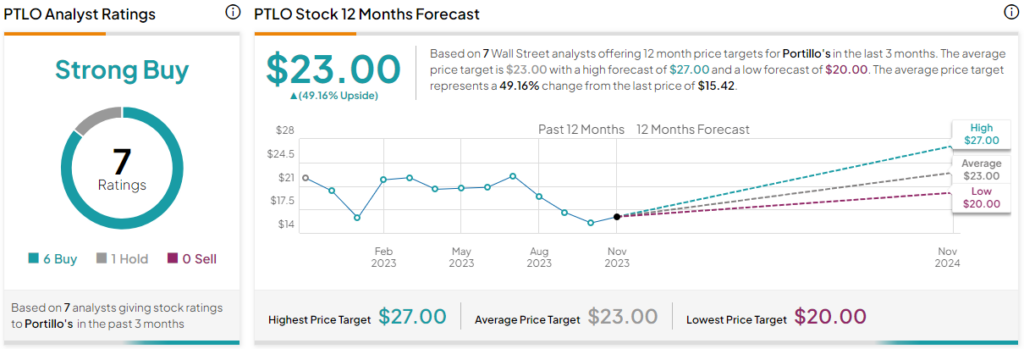

What is the Price Target for PTLO Stock?

Portillo’s stock has a Strong Buy rating, with six Buys and one Hold assigned in the past three months. The average PTLO stock price target of $23.00 implies 49.2% upside potential.

Conclusion

Restaurant stocks may be under pressure, but there are plenty of reasons to consider buying the dip now that pessimism is at a high point. Of the trio, analysts expect the most upside from PTLO (49.2%). Indeed, paying up for growth could prove wise, even in this environment, if Portillo’s can keep raising the bar on its growth targets.