With dating venues now largely back to full steam post-COVID-19, you’d think this would be a renaissance in the making for dating service titan Match Group (MTCH). Based on its latest earnings report, however, a renaissance seems like a forlorn hope. The company is currently down 17% on the day. While adjusted earnings beat expectations, revenue was a miss.

The company posted a loss of $0.11 per share. However, following adjustments for stock options and asset impairment, it ended up with a gain of $0.89 per share. The adjustments proved something of a saving grace as the Zacks consensus estimate called for earnings of $0.69 per share.

However, regarding revenue, the company posted revenue of $794.5 million, and the Zacks consensus estimate was $802.1 million. Worse, future guidance did the company no favors. The company projected that growth figures would be flat for the year’s second half.

The last 12 months for Match Group shares are mostly a loss. Though the company started a rally from mid-August 2021 that lasted well into October, a long, slow slide immediately followed, starting with early November. That slide continued to this very day, as the company saw shares plunge from just over $175 per share to just under $60 per share in today’s trading.

It’s not looking good for Match Group right now. As such, I’m bearish. The company definitely seems to have a good entry point going, with about two-thirds of its value gone.

However, the combination of macroeconomic conditions and even social issues will likely hinder the company’s growth going forward. The loss of several upcoming projects doesn’t help, either.

Wall Street’s Take on MTCH Stock

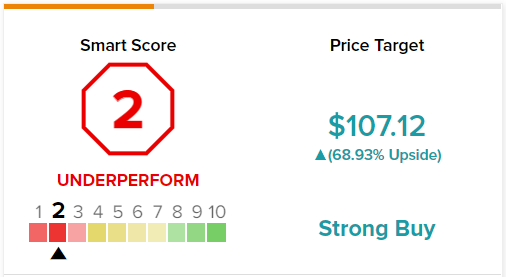

Turning to Wall Street, Match Group has a Strong Buy consensus rating. That’s based on 16 Buys and two Holds assigned in the past three months. The average Match Group price target of $107.12 implies 68.7% upside potential.

Analyst price targets range from a low of $65 per share to a high of $145 per share.

Match Group’s Smart Score Rating Suggests Weak Performance Ahead

It doesn’t look good for Match Group, and I’m not alone in thinking that. The company currently has a Smart Score of 2 out of 10 on TipRanks. That’s the second lowest level of “underperform” and suggests that Match Group is very likely to lag the broader market.

However, insider trading is the one great bright spot in investor sentiment. Match Group is littered with uninformative buys of various sizes. In the last three months alone, Match Group recorded 23 Buy transactions to zero Sell transactions.

The last time an insider sold stock was back in February when its Chief of Business Affairs and Legal Officer Sine Jared F. sold an unknown quantity of stock. His was one of just four sales recorded over the last 12 months, putting the ratio of Buy transactions to Sell transactions at a staggering 45 to four.

Multiple Factors are Slamming Match Group Performance

It’s like I said: it doesn’t look good for Match Group here at all, no matter what the insiders seem to think. Match Group has a range of factors from internal issues to macroeconomic issues weighing it down. With even Match Group itself on record saying that performance is likely to be flat for the rest of the year, you know there are significant problems afoot.

Let’s start with one of the biggest signs of trouble ahead: internal developments. The company is losing its Tinder CEO, Renate Nyborg.

Nyborg didn’t even stick around long enough to blow out the candles on her first-anniversary cake. Nyborg’s position will be filled by Match Group CEO Bernard Kim. That all but ensures that leadership’s focus will be split and diluted for some time to come.

This may not be such a problem, however, as several developments within the company have been scuttled outright. Tinder’s plans to offer its own virtual currency, as well as expand into metaverse operations, have been shut down.

Bernard Kim himself noted in a letter to shareholders that Tinder’s current performance proved frustrating. That’s particularly in terms of “disappointing execution on several optimizations and new product initiatives.” Kim also, notably, expressed hope that Tinder’s execution and overall direction could still be improved.

Yet, there’s a problem beyond Tinder itself for Match Group. It’s a growing macroeconomic problem. Just a couple of weeks ago, Bloomberg writer Paulina Cachero offered up a piece whose title alone spells out dating in a nutshell. It also spells out Match Group’s biggest problem to come. The title? “It’s Not You, It’s Inflation.”

With prices at the gas pump and grocery store still hitting every walk of life hard, the notion of even going out to dinner is proving a stretch for some budgets. The notion, in turn, of paying for someone else is even worse.

Leave aside the complaints heard throughout the dating market, particularly the rise of the philosophy known as Men Going Their Own Way (MGTOW). These days, just finding the cash for gas to pick up a potential suitor, drive them to a restaurant, and pay inflated prices for dinner seems like too much risk for too little reward.

Overcoming that dilemma is going to prove a serious uphill battle for Match Group. Match Group may have a secret weapon here, as evidenced by its acquisition of The League. The League was a dating app geared toward the career-focused and highly ambitious. Those are the sort of people who are least likely to balk at picking up a tab for dinner.

It remains to be seen, however, just how much dating the ambitious will do and, of course, if it’s enough to close the gap posed by literally everybody else.

Conclusion: Match Group’s Troubles Run Too Deep

Right now, about the only attractive things going for Match Group are its insider trading levels and its noteworthy entry point. The company has taken a beating over the last year. With the stock trading close to its lows, it might look like a good time to get in. It’s even well below its lowest price target. However, its Smart Score has a different opinion, and internal strife rakes the company.

Macroeconomic conditions hover overhead like the Sword of Damocles. Even philosophical constructs weigh on the company’s potential. All of these points together suggest that Match Group can fall even farther. That leaves me bearish overall.