The holiday shopping season is the most critical sales period for retailers and generally accounts for a substantial portion of their annual sales. However, high inflation and the fears of an economic downturn could impact the holiday sales for items like toys, chocolates, alcoholic beverages, and clothing, which generally witness strong demand. Retailers and toy makers like Mattel (NASDAQ:MAT), Hasbro (NASDAQ:HAS), and Funko (NASDAQ:FNKO) have been offering attractive discounts to boost holiday sales.

The National Retail Federation (NRF) has projected holiday sales, including e-commerce, to grow between 6% and 8% to the range of $942.6 billion and $960.4 billion in the November to December 2022 period. This marks a slowdown compared to the 13.5% growth in 2021 holiday sales. Nonetheless, toys are generally seen as a resilient category compared to other merchandise during the holiday season.

Jefferies Analyst Noted Early Weakness

Earlier this month, Jefferies analyst Andrew Uerkwitz stated that the “sentiment remains terrible as investors brace for the potential for more headline revisions” in December. Uerkwitz added that the pessimism surrounding the sales comes even as major toy retailers are extending promotional offers to clear inventory.

Channel checks by Jefferies indicated a sharp deceleration in toys and game sales. That said, sales of Lego, Hasbro’s Magic: The Gathering, and Mattel’s Barbie dolls reflected strength. The analyst estimated that there should be a double-digit sales acceleration in the two weeks prior to Christmas for retailers to clear their elevated inventories.

In the case of retailers, Uerkwitz stated that Target (TGT) was better than Walmart (WMT). Coming to toy manufacturers, the analyst noted that Mattel was seeing stronger sales than Hasbro in the holiday season, while Funko’s results were “mixed” as collectible sales were slow. Uerkwitz has a Buy rating on Hasbro and a Hold rating on Mattel.

Let’s take a look at how Wall Street analysts rate the major toy stocks.

Is Mattel a Good Stock to Buy?

During its Q3 earnings call, Mattel, which owns popular brands like Hot Wheels and Fisher-Price, stated that it expects its point-of-sale (POS) numbers to accelerate in the fourth quarter. However, the company’s margins could be under pressure due to higher advertising expenses and promotional activity to stay competitive.

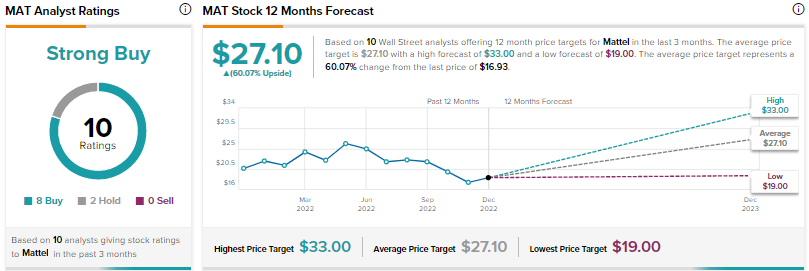

Mattel stock scores a Strong Buy consensus rating, backed by eight Buys and two Holds. The average MAT stock price target of $27.10 suggests 60.1% upside potential. MAT stock has declined over 21% so far this year.

What is the Target Price for Hasbro Stock?

In October, Hasbro, which owns popular brands like Monopoly, Nerf, and Play-Doh, guided for Q4 revenue growth to be nearly flat compared to the prior-year quarter on a constant currency basis. The company expects strength in its Wizards of the Coast and Digital Gaming segment, particularly in the Magic: The Gathering franchise.

Interestingly, in November, Bank of America analyst Jason Haas double downgraded Hasbro stock from a Buy to Sell over concerns that the company was overproducing its Magic: The Gathering game cards and destroying the brand’s long-term value.

Wall Street is cautiously optimistic about Hasbro stock, with a Moderate Buy consensus rating based on five Buys, three Holds, and one Sell. The average HAS stock price target of $88.63 implies 52.3% upside potential. Shares have plunged nearly 43% year-to-date.

Is Funko Stock a Buy?

Earlier this month, Funko announced leadership changes, including a CEO transition and a new COO position. The leadership changes were triggered by poor third-quarter results and a cautious forecast. Analysts expect the company’s Q4 sales to decline and the bottom line to be impacted by higher expenses and inventory management efforts.

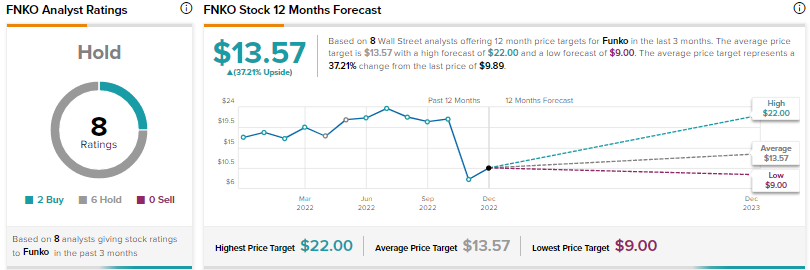

Wall Street is sidelined on Funko stock, with a Hold consensus rating based on two Buys and six Holds. The average FNKO stock price target of $13.57 implies 37.2% upside potential. FNKO stock has tumbled over 47% year-to-date.

Conclusion

Generally, parents refrain from cutting down on their expenditures on toys during the Christmas season, which makes this category resilient. Nonetheless, ongoing macro challenges are expected to put pressure on toy sales this holiday season. Also, promotional activities and higher costs are expected to weigh on the profitability of toy companies.

Special end-of-year offer: Access TipRanks Premium tools for an all-time low price! Click to learn more