On Monday, the Nasdaq dropped about 2%. Other U.S. indexes also closed lower as investors sold off stocks from the technology sector and other high growth names. This market sell-off has been prompted by multiple factors, including soaring inflation and commodity prices, and geopolitical risks regarding Russia’s war on Ukraine.

Moreover, due to the the rising inflation in the U.S., expectations are high that the Fed is likely to increase interest rates this week.

In this market environment, is any sector immune to this volatility? According to Mizuho Securities analyst Dan Dolev, the payments sector is poised to bounce in the second half of this year. Additionally, it could “see a higher positive inflection vs. some other tech verticals.”

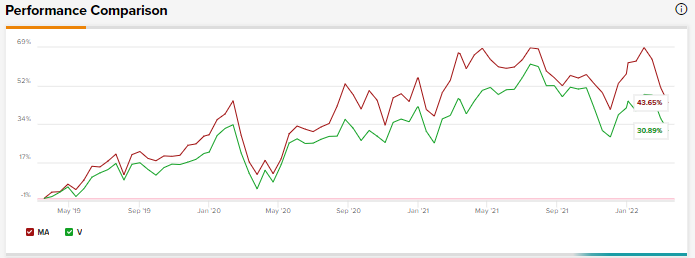

Using the TipRanks stock comparison tool, let us compare two such payment stocks, Mastercard and Visa, and see what Wall Street analysts are saying about these financial giants.

Mastercard (NYSE: MA)

Shares of Mastercard have also been swept up in the stock market volatility and are down 13.8% over the past month. Should investors buy this stock amid this sell-off or shirk away from it? According to most analysts, it appears that the underlying fundamentals of the business are still intact for this large payment transaction processing company.

Mastercard has not been unaffected by Russia’s war on Ukraine, niehter has it stayed silent on the issue. On March 5, MA announced the suspension of its Russian operations.

According to Mizuho Securities analyst Dan Dolev, even after excluding Mastercard’s exposure to Russia and Ukraine, the company is headed for 23% revenue growth in the second half of this year on a two-year stack basis. By the analyst’s estimate, Mastercard has approximately a 6% revenue exposure to Russian and Ukrainian markets.

This is also borne out by the company’s 8-K filing, which states that in 2021, while 4% of its net revenues came from Russia, around 2% of its revenues came from Ukraine.

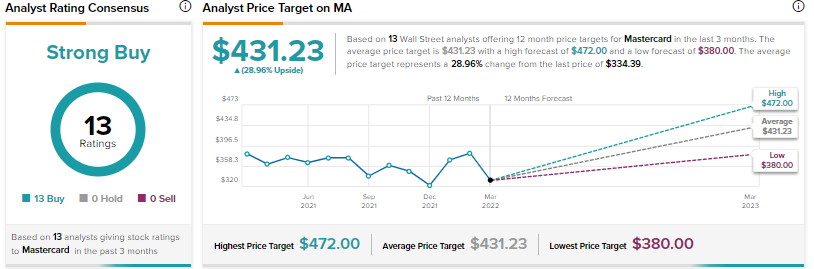

Dolev is bullish on the stock with a Buy rating and a price target of $435.

The last few weeks of developments aside, the underlying business fundamentals for MA stay healthy. Last week, the company stated in a press release that according to the Mastercard SpendingPulse, which measures online and in-store retail sales across all forms of payment, the U.S. consumer’s spending momentum remained robust. In the month of February, retail sales (excluding auto) rose 8.7% year-over-year.

Tigress Financial analyst Ivan Feinseth is also positive about the growing post-pandemic recovery in consumer spending. Although, will rising inflation in the U.S. affect this rate of consumer spending?

Michael Miebach, Mastercard’s CEO addressed this issue at its Q4 earnings call, “There is an impact on GDV [gross dollar volume] if it’s moderate inflation that would be showing in our numbers.”

When it comes to Q4, Mastercard’s net revenues increased 27% year-over-year to $5.21 billion. The company’s management, while acknowledging the geopolitical uncertainties, noted that supply chain constraints and rising inflation on its Q4 earnings call had remained positive about its outlook for FY22.

On a base case scenario basis, MA expects net revenues to grow “at the high end of a high teens rate” on a currency-neutral basis in FY22, excluding acquisitions. In Q1, Mastercard anticipates revenues to grow again at the upper end of the same rate.

Feinseth also considers MA to be “well-positioned to benefit the post-pandemic recovery in consumer spending.”

The reasons for the analyst’s optimism are the recovery in post-pandemic cross-border travel, that has resulted in a higher number of transactions. This has also improved the company’s ability to introduce “new technologies, new features, and new ways to pay.”

Some of these new features include the introduction of Buy-Now Pay-Later (BNPL) capabilities, contactless payments, payments based on QR codes, and the expansion of its crypto card program.

As a result, the top-rated analyst maintained a Buy rating on the stock and raised his price target from $460 to a Street-high $472.

Other analysts on the Street are also bullish about the stock with a Strong Buy consensus rating based on unanimous 13 Buys. Meanwhile, the average Mastercard stock prediction is $431.23.

Visa (NYSE: V)

Similarly to Mastercard, Visa has also seen its shares drop about 12% in the past month. The global payments technology company also announced on March 5 that it was suspending its operations in Russia.

In an 8-K filing, Visa stated that for FY21, revenues driven by domestic as well as cross-border transactions from Russia comprised 4% of its net revenues while net revenues from Ukraine comprised 1%.

Mizuho Securities analyst Dan Dolev is similarly optimistic about Visa and again expects this company to perform well in the second half of this year. Excluding Visa’s exposure to Russia and Ukraine, Dolev anticipates Visa’s revenues to grow 20% in the second half of this year on a two-year stack basis.

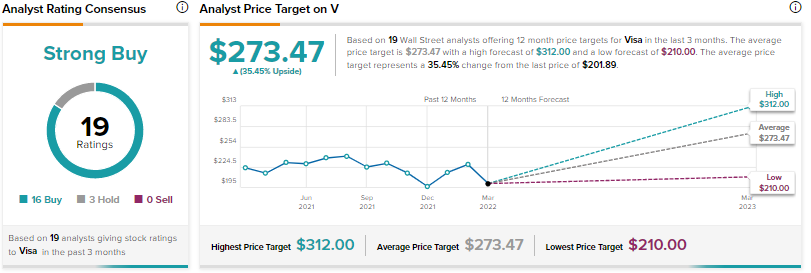

The analyst is sidelined on the stock with a Hold rating and a price target of $235.

For payment companies like Visa and Mastercard, rising inflation is a key concern as people tend to spend less when inflation is high.

Visa’s Vice-Chair and CFO Vasant Prabhu admitted on its Fiscal Q1 earnings call that “inflation as it relates to our revenues, as you know, our service fees, cross-border, etc., are denominated primarily in basis points on ticket size. So, to the extent that there’s inflation driving up ticket size, clearly, it’s beneficial to us.”

For credit card companies, ticket size refers to the credit or debit card payment transactions processed by merchants.

Elaborating further, Prabhu commented that when it comes to its transaction processing fees, they are closely linked to the number of transactions. He added that individuals ordering online have higher ticket sizes these days due partially to inflation.

On a net-net basis, Prabhu stated that Visa was “a beneficiary of inflation.”

Another positive for Visa is that like Mastercard, the company is also seeing a rebound in U.S. consumer spending as the Visa Spending Momentum Index (SMI) was 109.3 in February (seasonally adjusted), an increase from 102.4 in January.

The company’s financial metrics continue to be strong. In Fiscal Q1, it reported quarterly net revenues of $7.1 billion, up 24% from the prior year, beating analysts’ estimates of $6.79 billion. Earnings per share (EPS) for the quarter stood at $1.81, up 27% from the previous year.

Other analysts on Wall Street remain upbeat about the stock with a Strong Buy consensus rating based on 16 Buys and three Holds. The average Visa stock prediction is $273.47.

Bottom Line

While both the companies acknowledged the impact of inflation on transactions during their earnings calls, for now, analysts are bullish about both. This is because these companies seem to be better positioned to benefit from the current uncertainty. Based on the upside potential over the next 12 months, Visa seems to be a better Buy.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure.