Despite Mastercard (MA) delivering solid first-quarter earnings results, broader market forces have enticed Wall Street analysts to lower the bar on their price targets. However, such target downgrades have been quite mild, as analysts still have a favorable view of the company. I am bullish on MA stock.

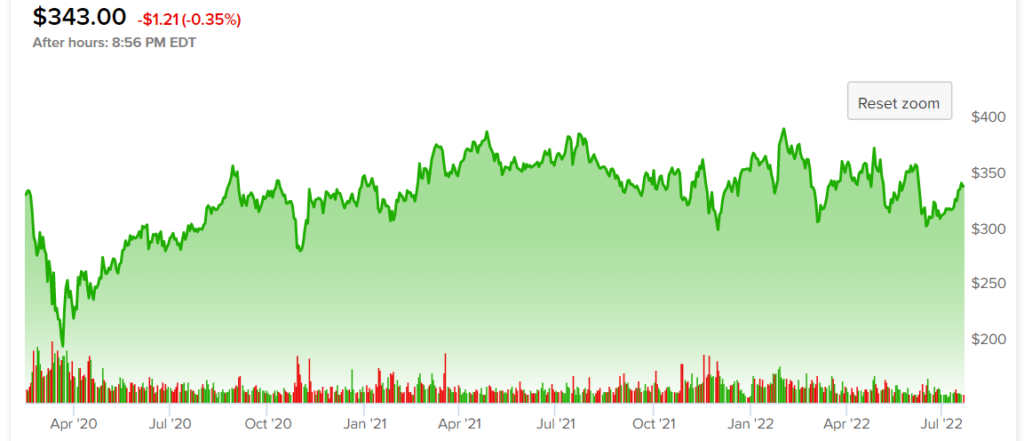

Shares of Mastercard have been under pressure for two-and-a-half years, with the stock trading around February 2020 levels.

Sure, the coming economic storm clouds could weigh on consumer spending. A consumer-facing recession does not bode well for any firm, especially those seeking to cut back on purchases with credit. Nevertheless, as digital payments continue to take the place of cash payments, Mastercard has a strong longer-term tailwind at its back.

Mastercard’s Tech-Savvy is Easy for Investors to Overlook

The advent of new financial technologies, like those offered by Apple (AAPL) Card, could further accelerate the move away from cash. Given that this transition is far from over, especially in emerging markets, it’s really hard to dismiss Mastercard as it looks to leverage technologies to outgrow its bigger brother Visa (V).

As outlined by the firm’s last Investor Day, Commerce, ESG, and technology remain Mastercard’s three pillars of growth. The technology pillar, I believe, is the most exciting and could allow Mastercard stock to command a much higher multiple.

It’s been quite a roller-coaster ride for shares of MA this year. Still, the stock has outperformed the market, now down just shy of 14% from its 2021 peak.

Indeed, the ultimate goal of any credit card company is to displace cash. As consumers embrace the convenience of digital payments, cash could be on its way out without having firms like Mastercard innovate further. In any case, Mastercard has its foot on the pedal, with exposure to emerging technologies such as artificial intelligence, cybersecurity, and even digital currencies.

Mastercard Might be a Stealthy Blockchain Play

Mastercard’s President of Data Services Raj Seshadri recently remarked on the numerous potential applications of blockchain technology, noting that there are “many fascinating applications of blockchain that have nothing to do with cryptos.”

As euphoria surrounding cryptocurrencies and blockchain begins to fade, Mastercard will likely keep tabs on where it can incorporate blockchain technologies. Digital currencies and enhanced security are just two benefits of blockchain infrastructure.

While Mastercard isn’t your typical fintech stock, I do think the firm is more than capable of out-innovating its smaller rivals, especially once rates rise and credit becomes tougher to come by.

For now, it’s hard to gauge how blockchain technologies will shape our future. When it comes to cryptocurrencies, there’s a lot of smoke and mirrors. Once the hype dies down, we’ll gradually see well-established firms like Mastercard embrace the nascent technology. For now, it’s a wildcard for payments giants like Mastercard, but not one to be ignored.

The blockchain remains an abstract concept for many. However, it may be easier to view the technology and its applications as akin to the metaverse. It’s an exciting frontier that exists today but might be years off before corporate America can fully embrace it.

Mastercard is a Growth Stock with a Modest Multiple

Mastercard stock has never been dirt cheap, but it doesn’t deserve to be, given its outstanding growth profile. At writing, MA stock trades at 16.9 times sales and 35.5 times trailing earnings, which are below their five-year historical average multiples of 17.9 and 43.2, respectively.

Yes, there are headwinds ahead as economic growth becomes challenged by rate hikes. However, if there’s a firm that can arise from the other side of the recession in a position of strength, it’s Mastercard.

For the most part, Wall Street is a raging bull on Mastercard stock amid its mild slump, and it’s not hard to see why, as the firm looks to narrow the gap with Visa.

Wall Street’s Take on Mastercard

Turning to Wall Street, Mastercard has a Strong Buy consensus rating based on 19 Buys and one Sell assigned in the past three months. The average Mastercard price target of $416.22 implies 20.9% upside potential. Analyst price targets range from a low of $298.00 per share to a high of $472.00 per share.

Conclusion: Mastercard Remains a Strong Buy on Wall Street

Mastercard is an incredibly well-run firm with a wide moat and tech-savvy. Certain analysts may be trimming away at their price targets, but Mastercard is one of few stocks hanging onto its Strong Buy rating among the analyst community.