The retail sector bore the brunt of the macroeconomic headwinds this past year, including the collective impacts of inflation, labor shortages, and supply chain problems. Most retailers are not anticipating these headwinds to wane in the near-term, either.

So, is it all doom and gloom for the retail sector? The National Retail Federation (NRF) doesn’t think so. In a report earlier this year, the NRF stated that physical retail is “flexing its muscle as we head into 2022.” The report cited research from Forrester that expects 72% of retail sales in the U.S. will occur in brick-and-mortar retail stores in 2024.

Indeed, in 2021, retailers in the U.S. opened 8,100 new stores, roughly more than double the 3,950 stores that were closed.

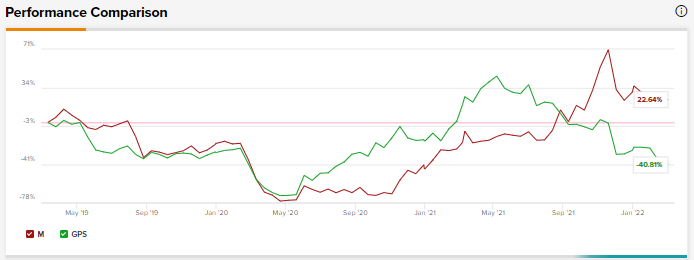

Using the TipRanks stock comparison tool, we compared two big-ticket retailers in the U.S., Macy’s and Gap, and took a look at what Wall Street analysts are saying about these stocks.

Macy’s (NYSE: M)

Shares of Macy’s have been volatile this year with the stock falling 2.9% in January and back up again by 1.3% in February, following the luxury omnichannel retailer’s strong Q4 results. Macy’s is headquartered in New York City and comprises three retail brands: Macy’s, Bloomingdale’s, and Bluemercury.

In 2021, the company delivered net sales of $24.46 billion, a leap of 41% year-over-year. Macy’s adjusted earnings of $5.31 per share came in much better than the FY20 adjusted loss of $2.21 per share. The healthy top-line and bottom-line results were despite supply chain constraints, labor shortages, and higher inflation.

The company’s management pegged these strong results to its Polaris strategy which as been bearing fruit. Around two years ago, Macy’s had unveiled its Polaris strategy which focused on six key points. This included the repositioning of its store fleet and posturing the company as an omnichannel retailer, modernizing its supply chain infrastructure, and revamping its digital shopping strategy.

This strategy bore results in 2021 as 44 million customers shopped with Macy’s, up 1% from 2019. The company added 7.2 million new customers in Q4, increasing by 11% over the fourth quarter of 2019, with 58% of these customers coming through the digital channel.

What’s more, the retailer’s app saw the largest quarterly gain in downloads in Q4 among its peers with an 81% rise in app downloads over Q3.

When it comes to this year, Macy’s continues to expect consumer demand to be strong as people return to office or attend social events. However, on the flip side, the company anticipates headwinds like supply chain issues, inflation, and potential new COVID variants to persist this year.

As a result, in FY22, Macy’s has forecasted net sales to be between $24.46 billion and $24.70 billion. Likewise, FY22 adjusted earnings are projected to fall in the range of $4.13 to $4.52 per share, much better compared to the consensus of $4.06 per share.

Financially, Macy’s balance sheet remained strong in 2021 as the company retired debt last year, resulting in its Adjusted Debt-to-Adjusted EBITDAR leverage ratio falling considerably lower than the company’s 2021 target of 2.5x.

Adrian Mitchell, CFO of Macy’s commented in its Q4 press release, “We generated $2.3 billion in free cash flow this year – a significant amount that allowed us to return capital to shareholders through our measured capital allocation plan while meaningfully improving the health of our balance sheet.”

Considering this strong financial performance in Q4 and a robust outlook for FY22 (even with macro headwinds), are analysts bullish about the stock? It doesn’t appear that way.

Guggenheim analyst Robert Drbul remained sidelined on the stock with a Hold rating, following the Q4 results. While the analyst remained optimistic about the improving fundamentals of the business, Drbul remained disappointed that the company was “still largely mall-based, which is one of the most significant structural risks we see at this point in time.”

Elaborating further, the analyst pointed out that with Macy’s stores located in the top malls in the country comprise 85% of its portfolio, and expressed that “the pace of foot traffic recovery within malls remains uncertain.” Considering this scenario, Drbul believes that Macy’s had plenty of potential to improve its market share by opening off-mall stores in a smaller format.

However, Drbul did approve of the company’s Board’s business review that decided against the separation of its ecommerce unit.

When it comes to the rest of the analysts on Wall Street, they also seem to be in a wait-and-watch mode and remain sidelined on the stock, with a consensus Hold rating based on 4 Buys, 4 Holds, and 3 Sells. The average Macy’s stock prediction is $32.64, which implies upside potential of approximately 45.91% from current levels for this stock, as of intraday trading on Monday 12:36 EST.

Gap (NYSE: GPS)

Shares of Gap have remained largely flat over the past five days even as the company delivered robust Q4 results. Gap is an omnichannel retailer that offers clothing, accessories, and personal care products under the Old Navy, Gap, Banana Republic, and Athleta brands.

In fiscal Q4, Gap reported net sales of $4.5 billion, up 2% year-over-year, in line with consensus estimates of $4.51 billion.

In 2021, the retailer delivered record sales of $16.7 billion, up 21% year-over-year. Adjusted operating margin was 5.5% in 2021, even as Gap absorbed around “2.4 points of estimated unexpected air cost as we navigated the supply chain disruption in the second half,” according to its CEO.

Sonia Syngal went on to state on its fiscal Q4 earnings call that Gap utilized “significant air freight to deliver as much of holiday product as we could. As a result, sales were muted and profits pressured.”

While Gap spent around $430 million on air freight in 2021, the company anticipates spending around 20% to 25% less than that in 2022. Elaborating further on this, the company’s management mentioned on its Q4 earnings call, “improvements we’ve made to our planning cycle, which we expect to fully come to bear in summer should reduce air usage beginning in Q2 and through the back half of the year.”

Syngal continued, stating that “after two years of restructuring, including divesting smaller non-strategic brands, transitioning our European market to an asset-light partnership model and shedding underperforming North American stores, our core business is strong and we are poised for balanced growth across our four billion-dollar lifestyle brands.”

Syngal was referring to the company’s Power Plan 2023 strategy that it unveiled in October 2020. In the past two years, Gap has completed significant restructuring including 70% of fleet rationalization in North America, and has closed 250 stores. As a part of this strategy, Gap aims to grow its Old Navy and Athleta brands while transforming and repositioning its Gap and Banana Republic brands.

Guggenheim analyst Robert Drbul remained “cautious” about Gap’s “mitigation efforts to maintain its market share [that] are driving significant transitory costs.”

While Drbul thinks that the Old Navy and Athleta brands “have the greatest growth potential,” he is also concerned that Gap and Banana Republic brands continue to be pressured. Moreover, the analyst feels that the company’s aim of achieving a 10% operating margin by 2023, including cost reductions and optimization of its store fleet is a “tad aggressive in this environment.”

A precursor of this is also indicated by the company’s outlook for FY22. Battling macroeconomic headwinds, for FY22, Gap has projected FY21 revenues to grow in “the low single-digit range” while sales in Q1 are projected to be down in “mid to high-single digits.”

As a result, Drbul is sidelined on the stock with a Hold rating as he believes “GPS shares are fairly valued, trading at ~6.3x our FY23E EPS of $2.25, given the company’s exposure to the highly competitive North America apparel market.”

Other Wall Street analysts echo Drbul and are also sidelined on the stock, with an analyst consensus Hold rating based on 3 Buys, 8 Holds, and 2 Sells. The average GPS stock prediction is $19.33, which implies upside potential of approximately 32.35% from current levels for this stock.

Bottom Line

While analysts are sidelined about both stocks, based on the upside potential over the next 12 months, Macy’s seems to have the upper hand.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure.