Investors have really soured on shares of athletic apparel firm Lululemon (LULU) despite reporting better-than-expected results for its first quarter of the fiscal year 2023. With a remarkable 32% in revenue growth and a slight per-share earnings beat, it seems Lululemon didn’t get the memo that we’re on the cusp of a recession.

Though demand for the athleisure pioneer’s apparel remains remarkably strong, it’s important to note that things could change on a dime.

In recent months, the consumer has felt the pinch of higher inflation. With May’s inflation numbers coming in at a white-hot 8.6% (a new 40-year high), there’s concern that consumers could tighten their purse strings further going into year’s end.

With considerable stock market losses and anticipation of a 2023 recession, demand for upscale discretionary (nice-to-have goods) merchandise like those offered by Lululemon is at risk of taking a hit at some point down the road.

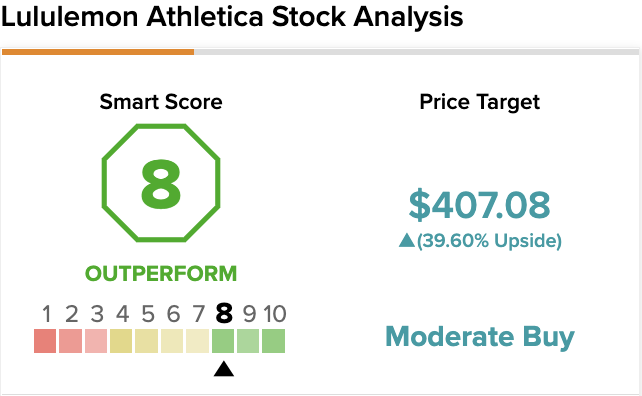

On TipRanks, LULU scores an 8 out of 10 on the Smart Score spectrum. This indicates a potential for the stock to outperform the broader market.

Lululemon: Demand Could Slip as Recession Risks Surge

Though more affluent consumers are less likely to change spending habits in response to sudden price increases, it’s quite a stretch to classify Lululemon as a luxury brand. Lululemon may have above-average prices, but at the end of the day, they don’t sell Veblen goods — goods that tend to see demand increase when prices increase.

Lululemon’s latest quarter saw a bit of pressure on its gross and operating margins due to higher transportation costs and shipping delays. Sure, the Lululemon brand has more pricing power than other players in the apparel space. However, as we enter a recession, Lululemon’s lower-cost peers could gain the upper hand, given its reluctance to discount merchandise for the risk of harming its upscale brand.

In any case, a milder economic downturn seems likelier than a catastrophic 2008-style downturn. As such, a stock plunge over 80% seems highly unlikely this time around.

Shares have nearly been cut in half from peak to trough before recovering to around $291 per share — a level that sees shares down around 38% from their peak. Despite the magnitude of the decline and recent quarterly strength, I am bearish, primarily due to the lofty price tag on shares.

At writing, LULU stock trades at 37.1 times trailing earnings, 28.4 times cash flow, and 5.4 times sales. That’s not all that expensive when you consider the premium brand and the firm’s technological capabilities (direct-to-consumer strength and unique fabric innovations), which act as a moat source.

However, as every rate hike pushes us closer to a drastic economic slowdown or downturn, I’d argue that Lululemon isn’t as cheap as it could be, given the potential severity of storm clouds that could be moving in.

Lululemon: Longer-term Fundamentals Still Strong

It’s going to be a slog for almost every discretionary firm as a potential consumer recession approaches. Though Lululemon is at risk of disappointing over the nearer term, it’s hard to dismiss the company’s long-term growth profile, which remains as strong as ever.

The company’s e-commerce efforts paid off big-time when the pandemic hit two years ago. Still, having a solid direct-to-consumer presence isn’t enough to stay ahead of the pack.

Many firms, including Gap (GPS) and its Athleta brand, have embraced digital retail. To stay ahead, Lululemon relies on the power of its brand, but most importantly, its ability to out-design and out-innovate its peers. Undoubtedly, Athleta and many other rivals have attempted to replicate Lululemon’s designs and fabric innovations.

Lululemon prides itself on blending technology with apparel, and it’s hard to argue that the firm’s ability to leverage technology in its favor. Arguably, Lululemon is a tech company that happens to make athletic apparel. The company’s fabric patents and its MIRROR smart home gym product signify that Lululemon is worth more of a growth multiple versus its lower-cost rivals.

Sure, it’s easy to dismiss Luon or Nulu as some sort of fabric marketing gimmick. But the consumers can’t seem to get enough of the products, and they’ll continue talking with their wallets. Despite starting out as a retailer focused on women’s leggings, the company has made significant strides in men’s wear, and that’s likely thanks to intriguing fabric technology, like those behind the firm’s ABC pants.

Though high-tech pants with the latest fabric innovations are nice to have, it’s harder to justify their price when economic tides turn south. In due time, innovation and outstanding design will power LULU stock higher again.

Wall Street’s Take

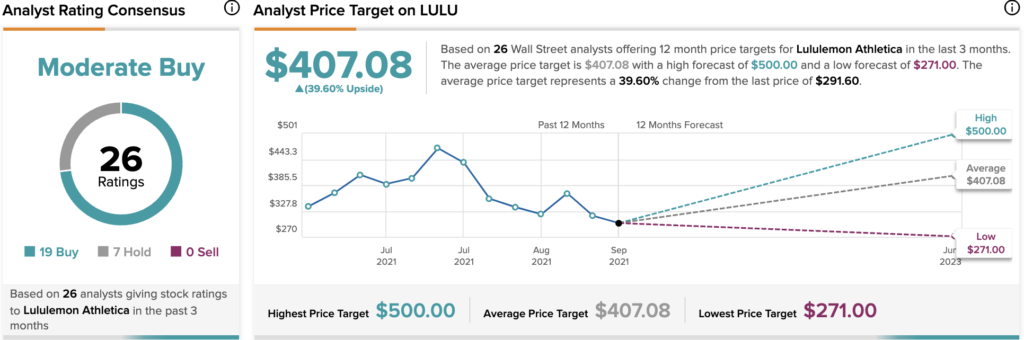

According to TipRanks’ analyst rating consensus, LULU stock comes in as a Moderate Buy. Out of 26 analyst ratings, there are 19 Buy recommendations and seven Hold recommendations.

The average Lululemon price target is $407.08, implying an upside of 39.6%. Analyst price targets range from a low of $271.00 per share to a high of $500.00 per share.

The Bottom Line on Lululemon Stock

Lululemon stock is worthy of a premium, given its unmatched brand affinity and innovative capabilities. Though Lululemon has many strong growth days ahead of it, this market will continue to punish the firms with valuations that reflect forward-looking growth.

As a discretionary firm, the company is also at risk of demand destruction if rate hikes spark a severe recession. Personally, I’m staying on the sidelines, as it may be too soon to chase risk-on plays ahead of what could be a long-lasting bear market.

Read full Disclosure