Lululemon Athletica (NASDAQ: LULU) plans to double its FY21 revenue of $6.25 billion to $12.5 billion by FY26. On Wednesday, the company revealed its five-year growth plan, but the Street seemed unimpressed, and shares declined 4.8%.

Long-Term Goals

Lululemon is one of the leading players in women’s athletic apparel. Over recent years, the company has been expanding its men’s offerings as well. As part of its long-term growth plans, Lululemon aims to double its revenue from men’s products and digital business.

The company’s enhanced digital capabilities helped it immensely in meeting customer demand when stores were closed during lockdowns. Lululemon’s direct-to-consumer or digital revenue continued to be impressive even after the reopening of stores and grew 22% in FY21, accounting for 44% of overall revenue.

Meanwhile, Lululemon aims to quadruple its international business by FY26 compared to FY21 levels. In FY21, international revenue (business outside North America) grew 53% and accounted for 15% of overall revenue. The company intends to strengthen its presence in Mainland China and enter new markets across Asia Pacific and Europe. It also plans to launch its first stores in Spain and Italy.

Lululemon expects its women’s business and North American revenues to grow at low-double-digit compound annual growth rates (CAGR) over the next five years. Further, the company expects store revenue to grow in the mid-teens.

Word on the Street

Following the Investor Day event on Wednesday, Guggenheim analyst Robert Drbul stated, “Despite sector-related headwinds, we are encouraged by the continued broad strength across LULU’s product portfolio and expect the brand to deliver strong results throughout FY22, as active/casual and health/wellness trends remain firmly intact.”

Drbul continues to view Lululemon as “one of the strongest brands in retail,” supported by secular tailwinds and a rapidly growing, high-margin online business that justifies a premium valuation.

The analyst reaffirmed a Buy rating with a price target of $475.

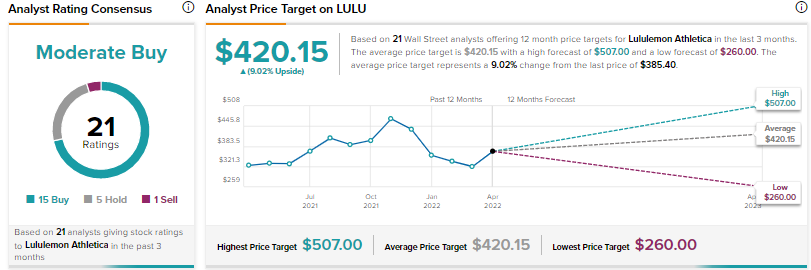

The Street is cautiously optimistic, with a Moderate Buy consensus rating based on 15 Buys, five Holds, and one Sell. The average Lululemon price target of $420.15 suggests 9.02% upside potential from current levels. Shares are down 1.6% year-to-date but have jumped nearly 22% over the past 52-weeks.

Conclusion

Despite intense competition from giants like Nike (NKE) and Adidas (ADDYY), Lululemon is well-positioned to expand over the long term, driven by an increased focus on health and fitness, continued innovation, and the ability to expand into additional international markets.

However, the near-term performance might be hit by cost headwinds, supply chain bottlenecks, and the impact of inflation on discretionary spending.

It’s worth noting that Lululemon scores a “Perfect 10” on TipRanks’ Smart Score rating system, indicating that it is likely to outperform market expectations.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure