Lululemon Athletica’s (NASDAQ:LULU) revenues in the fourth quarter of Fiscal Year 2022 increased by 30% year-over-year and surpassed analysts’ expectations of $2.7 billion. This impressive performance of LULU might not have surprised users of TipRanks’ Website Traffic Tool.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

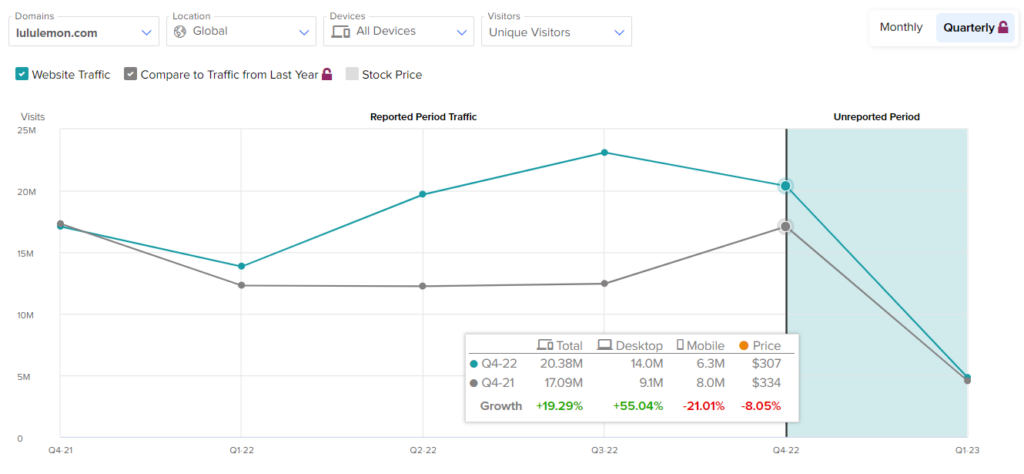

Our tool provides data about the performance of a company’s website domain, which can be used to predict the upcoming earnings report. Growth in online usage may point to higher sales, while a decline in traffic trends can suggest weak demand and hint at downbeat results.

According to the tool, global visits to lululemon.com climbed by 19.3% in Q4 compared to the year-ago quarter. The increase in website visits can be attributed to a strong holiday shopping season. In addition, the company’s efforts to introduce new products and expand its international presence likely attracted more customers.

Wondering how the current quarter is turning out? Well, a look at Lululemon’s February website traffic trend reveals a 5.8% rise year-over-year. Moreover, management expects net revenue in the range of $1.89 billion to $1.93 billion, compared with revenue of $1.6 billion reported in the first quarter of Fiscal Year 2022.

Will LULU Stock Go Up?

Following the Q4 earnings release, Guggenheim analyst Robert Drbul maintained a Buy rating on the stock but increased the price target to $440 from $400. The analyst believes that the reopening of China will support the company’s international revenues. He also thinks that there will continue to be a high demand for Lululemon’s athletic wear.

As a result, Drbul raised the Fiscal 2023 EPS estimate to $11.70 from $11.45.

Overall, Wall Street is cautiously optimistic about LULU stock. It has a Moderate Buy consensus rating based on 17 Buys, two Holds, and three Sells. The average price target of $368.68 implies 15.1% upside potential from current levels.

Concluding Thoughts

The company’s new expansion efforts, the opening of new stores in China, efforts to increase brand awareness, and increased penetration in the men’s segment should all expand revenues in the near term.

Learn how Website Traffic can help you research your favorite stocks.