Lowe’s (LOW) has been a popular investment choice for many years, while displaying a respectable growth record and business resilience.

Dividends and consistent buybacks have also been part of the case for the stock. I am bullish on Lowe’s.

Business Resilience

Lowe’s has been in business in the United States for a very long time, producing excellent shareholder returns, while growing its well-known business.

Most of the products the company offers are more likely to require in-store client presence than other retail, and even wholesale product categories. In the sense that the growing e-commerce trend could negatively affect sales for any traditional, established company in the consumer discretionary sector, Lowe’s should be one of the companies to display resilience.

With housing prices inflated, more consumers turn to home-improvement ventures. Increasing borrowing costs for real-estate purchases should also encourage homeowners to resort to renovations of already-owned properties.

On the other hand, building materials are facing strong inflationary pressures, caused also by supply chain disruptions, challenging the affordability of Lowe’s products.

Despite its mature profile, Lowe’s still manages to maintain a respectable growth record. Over the past five years, revenue has grown at an 8.1% CAGR to reach $96.2 billion in January 2022, while net income has increased at an even more impressive 22.2% CAGR, amounting to $8.4 billion.

Analysts expect the company to reach the $100-billion milestone in the next couple of years.

As a result, gross profit margins have also improved, even though they still stand relatively lower than 10-year average levels. The company reported a gross margin of 33.3%, for Fiscal Year 2021. Looking better, however, LOW’s net margin stands at a 10-year high (8.7%).

Cash flow generation has been consistently strong, with cash from operations increasing from $5.6 billion in 2017 to $10.1 billion in 2021 (15.9% CAGR).

Return on capital has also increased from 17.2% in 2017 to 29.3% in 2021, aided by management’s shareholder-friendly dividend and share-buyback strategy.

Dividend Consistency & Buybacks

Lowe’s has been viewed as a safe heaven for dividend growth investors for many years now, and for good reason. While the current yield of 1.6% is nothing to brag about, it is the consistency in growth and payments that distinguishes Lowe’s as a prime dividend choice.

The company’s income distributions have grown for over 50 consecutive years, displaying extraordinary resilience, while navigating through multiple recessions and economic downturns.

Lowe’s is one of the few “dividend kings” in the U.S stock market. Over the last five years, dividends have grown at an impressive 18% CAGR, beating the sector’s 8.6% average annualized growth rate.

Ten-year growth is even higher, at 19% CAGR. Given its dividend performance, it is fair to praise the stock as an important addition to a portfolio, with battling inflationary pressures in mind.

Increases in shareholder value are also derived from a consistent record of share repurchases. Lowe’s average share count has decreased from 1.15 billion shares in 2013 to 700 million in 2021, marking a sizable reduction,and a consequential increase in shareholders’ value.

The Home Depot Alternative

Probably one of the most thought and argued over comparisons between rival companies is the one regarding Home Depot (HD) and Lowe’s. While many analyses are readily available by different analysts, most tend to conclude that Home Depot is relatively superior in terms of financial performance.

Summarizing the case for Home Depot, we should mention a higher 2.5% dividend yield versus the 1.6% yield LOW offers, Home Depot’s marginally higher five-year revenue CAGR of 9.8% (8.2% for LOW), and broader net margin of 10.9% (8.8% for LOW). Moreover, analysts often tend to hint at HD’s larger market share and its sales per store advantage.

However, a quick look at valuations for both companies will reveal that whatever edge Home Depot maintains is, in fact, already priced in. To be more specific, HD trades at a P/E of 19.8x while LOW carries a 17x multiple.

The premium the HD valuation implies might even appear a bit exaggerated given the limited breadth of the differences between the companies. Price-to-sales ratios point to a similar conclusion, with Home Depot carrying a 2.1x P/S multiple versus LOW’s 1.5x.

While the valuation spread is evident when examining P/E ratios over a five- or even 10-year period, currently it stands at a higher-than-average height, implying that, perhaps even from a trading perspective the risk-reward case for Lowe’s is attractive.

Considering the impact valuations can have on long-term performance, it is important to note that over the past decade, Lowe’s has slightly outperformed Home Depot (654% versus 644% total return). Outperformance is even wider over the last five years, with LOW returning 170%, compared to 125% for HD.

Wall Street’s Take

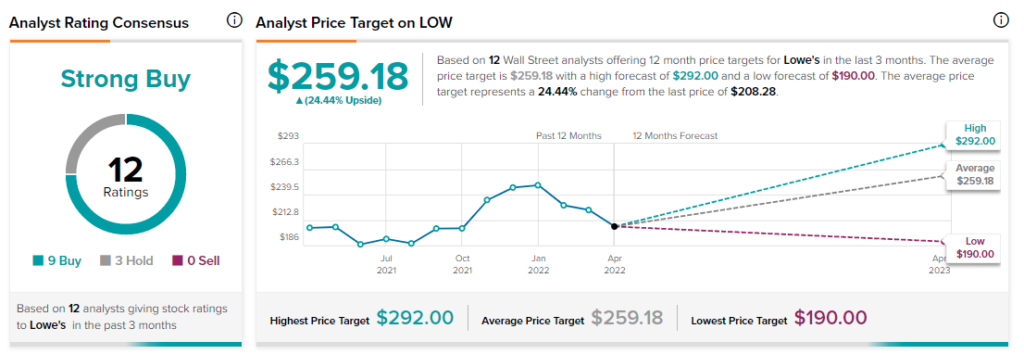

Turning to Wall Street, Lowe’s has a Strong Buy consensus

rating, based on nine Buys, three Holds, and zero Sells assigned in the last three

months.

The average Lowe’s price target is $259.18, representing 24.4% upside from current price levels, with a high forecast of $292 and a low forecast of $190.

Conclusion

Lowe’s has been and will likely remain a safe long-term choice for investors. Good financial metrics are also supported by management’s shareholder value appreciation focus.

After marking some significant YTD losses in the midst of the market’s pullback, Lowe’s appears attractively valued

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure