LiveRamp Holdings (RAMP) stock closed 22.3% higher on Friday after it announced better-than-expected Q1 financial numbers and raised its FY22 outlook.

LiveRamp’s Q1 revenues increased 20% year-over-year to $119 million and came well ahead of the Street’s estimates of $112 million. The enterprise data connectivity platform provider said that higher adoption of its platform, upsell to existing customers, and rebound in spending on digital advertising gave a boost to its Q1 revenues.

LiveRamp delivered adjusted earnings of $0.09 a share, significantly better than analysts’ estimate of a loss of $0.02. Moreover, it compared favorably to the prior-year period’s earnings of $0.01 a share.

In response to the strong Q1 performance, LiveRamp’s President and CFO Warren Jenson said, “Revenue growth is accelerating, we had another elevated bookings quarter, and we again delivered a record gross margin performance.”

Thanks to the improving prospects, LiveRamp increased the numbers in its FY22 outlook. It now expects to deliver revenue of $522 million in FY22, compared to its earlier forecast of $509 million. Furthermore, it projects to report adjusted operating income of $15 million, up from its previous guidance of $0-$5 million.

While Q1 performance drove LiveRamp stock higher, it is still down about 35% this year. (See LiveRamp Holdings stock chart on TipRanks)

Notably, cookie-based headwinds have weighed on LiveRamp stock. Last year, Google announced that that it intends to block third-party cookies for Chrome. Meanwhile, Apple’s Safari browser had stopped supporting third-party cookies. This is important as LiveRamp’s “cookies are used to record information” that supports digital advertising.

Per the TipRanks’ new Risk Factors tool, LiveRamp’s Technology-related risks account for 11% of its total risks. Indeed, the company said in its SEC filing that blocking of third-party cookies is likely to hurt digital advertising and marketing ecosystems, which in turn, could negatively impact its business.

While challenges persist, Needham analyst Jack Andrews expects the rebound in demand to “eclipse the waning cookie headwinds.” Andrews added that “some of the headwinds from the deprecation of 3rd party cookies have subsided, and we continue to believe RAMP is well-positioned as a next-generation data subscription company for identity-related solutions.”

The analyst further listed new customer additions, growing bookings, and acceleration in marketplace growth for his bullish stance. He noted that LiveRamp added 30 net new customers during the reported quarter, while its gross bookings improved by 30%.

Andrews maintains a Buy rating on the stock with a price target of $82 (72.7% upside potential).

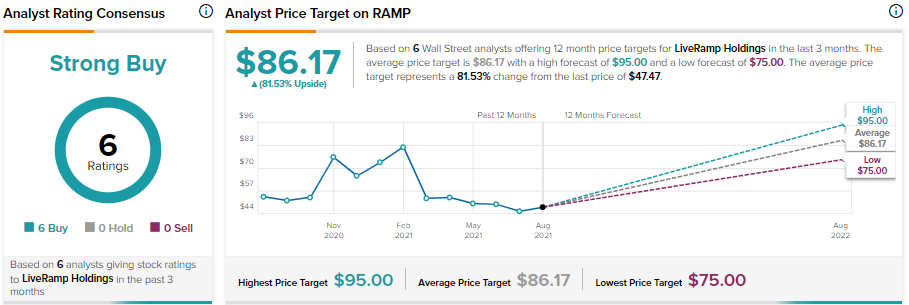

Along with Andrews, the rest of the Street is also bullish on the stock. LiveRamp’s Strong Buy consensus rating is based on 6 unanimous Buys. The average LiveRamp Holdings price target of $86.17 implies 81.5% upside potential to current levels.

Disclosure: Amit Singh held no position in any of the stocks mentioned in this article at the time of publication.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.