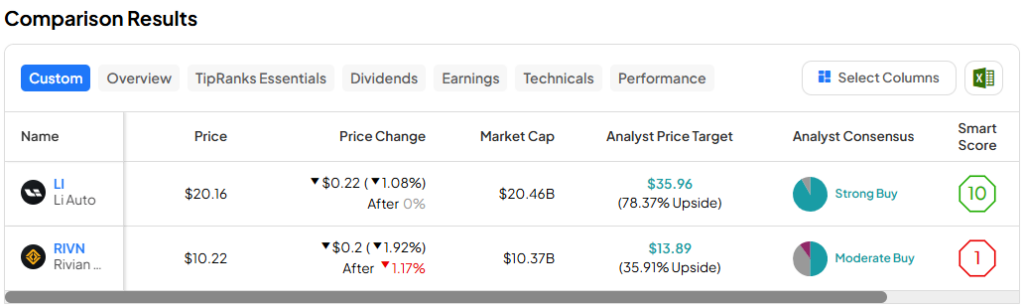

In this piece, I evaluated two electric-vehicle stocks, Li Auto (NASDAQ:LI) and Rivian Automotive (NASDAQ:RIVN), using TipRanks’ Comparison Tool below to see which is better. A closer look suggests a bullish view of Li Auto and a neutral view of Rivian Automotive.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Li Auto is a Chinese EV maker that has historically focused on premium plug-in hybrid SUVs but is now expanding its lineup to include battery electric vehicles. Meanwhile, Rivian started with an electric pickup truck before expanding into electric SUVs and an electric delivery van.

Shares of Li Auto have plummeted 46% year-to-date, dragging their one-year return into the red at -30%. Meanwhile, Rivian Automotive stock as plunged 56% year-to-date and is also off 30% over the last year.

The fact that both stocks are so far in the red year-to-date and over the last 12 months is a symptom of the problems in the broader EV market, which have dragged most or all of the sector into the red. Even the “magnificent” Tesla (NASDAQ:TSLA) is off 28% year-to-date and 11% over the last year.

Li Auto (NASDAQ:LI)

While Li Auto hasn’t been immune to the industry-wide issues affecting EV sales, it may be one of the more successful EV startups, having become profitable on a full-year basis in 2023 and now reporting steady increases in deliveries. Despite that success, the stock’s plunge has priced the company for utter failure, presenting a buy-the-dip opportunity and calling for a bullish view.

First, let’s put Li Auto’s stock price drop into perspective. The Chinese automaker went public on the Nasdaq in July 2020 at $11.50 per American depository receipt (ADR) share, with each ADR share representing two actual shares of the company.

Li Auto is now trading at around $20 per ADR share — close to the bottom of its 52-week range. Additionally, the stock was just starting to slip into oversold territory right before the three-day holiday weekend and now has a relative strength index of 29, suggesting a rally may not be far away.

These negatives for Li Auto stock suggest that the company has run into some serious issues, but as things stand now, it looks like the recent sell-off could be overdone. In 2023, the Chinese automaker delivered 376,030 vehicles, a 182% year-over-year increase.

In March, Li became the first Chinese EV startup to cumulatively sell over 700,000 cars, and it originally guided for 800,000 deliveries in 2024. That same month, the company also slashed that initial guidance to a new, more realistic range of between 560,000 and 640,000 deliveries this year.

Li Auto stock has shed one-third of its value since then, dropping from around $30 per ADR share on March 21 to about $20 per share on May 24. However, the new lower range still represents a massive amount of sales growth that suggests this sell-off could be overdone.

During the first quarter, Li Auto delivered 80,400 vehicles, up significantly from 52,584 vehicles in the year-ago quarter. Vehicle sales rose 32.3% year-over-year to RMB24.3 billion ($3.4 billion) in the quarter, while total revenues rose 36.4% to RMB25.6 billion ($3.6 billion).

Unfortunately, Li Auto’s net income fell 36.7% year-over-year and 89.7% sequentially to RMB591.1 million ($81.9 million) in the quarter. There appears little doubt that investors balked at these declines despite the bigger picture.

Li Auto stock has been getting steadily cheaper on a price-to-sales (P/S) basis over the last few years. The company’s P/S has plummeted to a mere 1.2x — something that shouldn’t be happening to a company that’s putting up as much long-term growth as Li Auto.

In all of 2023, the automaker’s total revenues soared 173.5%. As a result, on a P/S basis, Li Auto has never been this cheap. The automaker’s price-to-earnings ratio of 13.7 also seems quite reasonable.

Of course, there are some risks with investing in U.S.-listed Chinese companies, but those risks seem more than priced in with the extreme pessimism we’re seeing with LI stock. It also didn’t help that Li Auto pushed back the launches of three of its new SUVs to next year due to a lack of available EV chargers, so some additional risks could emerge if the recent declines continue.

What Is the Price Target for LI stock?

Li Auto has a Strong Buy consensus rating based on 11 Buys, one Hold, and zero Sell ratings assigned over the last three months. At $35.96, the average Li Auto stock price target implies upside potential of 78.4%.

Rivian Automotive (NASDAQ:RIVN)

While Li Auto is profitable, Rivian Automotive still is not, although it could become profitable by the second half of this year. Rivian sells a fraction of the number of vehicles Li sells every year, so its P/S of 2.1x makes it look overvalued versus its much-larger Chinese competitor. Thus, a neutral view seems appropriate — pending more solid, positive results.

Rivian stock did plunge to a record low in February after the company cut jobs and slashed its production outlook, and it hasn’t really recovered from that. However, it’s not putting up the sales growth that Li Auto is, and it’s still losing quite a bit of money.

The company expects to produce only 57,000 vehicles in 2024 — far below the previous guidance of 80,000 vehicles and a drop in the bucket compared to its peers. Additionally, Rivian lost nearly $39,000 on every vehicle it sold during the first quarter, so it clearly has a long way to go before it will become profitable.

In fact, Rivian’s first-quarter earnings result came in far short of the consensus numbers, with an adjusted loss of $1.24 per share versus the estimate of $1.15 per share in losses. Finally, RBC analyst Tom Narayan expressed concerns about competition for Rivian, a situation that bears monitoring. He’s especially concerned about hybrid vehicles made by legacy automakers and similar EV models with lower price tags.

What Is the Price Target for RIVN Stock?

Rivian Automotive has a Moderate Buy consensus rating based on 10 Buys, eight Holds, and two Sell ratings assigned over the last three months. At $13.89, the average Rivian Automotive stock price target implies upside potential of 33.05%.

Conclusion: Bullish on LI, Neutral on RIVN

While Li Auto appears to be taking a near-term hit from the industry-wide issues affecting EV sales, its stock has pulled back so much that it’s looking like a buy-the-dip opportunity. The Chinese automaker’s valuation now looks quite compelling, especially considering its rapid growth. Additionally, the fact that it addresses the world’s largest auto market and EV market, which accounts for over 55% of all EV sales, bodes well for it over the long term.

On the other hand, Rivian Automotive remains a show-me story, so a wait-and-see approach may be best for its stock.