Today, we are highlighting Sanofi (SNY), an innovative global healthcare company. SNY has a robust product portfolio, has been delivering strong performance consistently, and can help protect your portfolio with an added cushion of steady dividends.

Recent Positives for Sanofi

Last month, the Sanofi-GSK collaboration became the first to deliver successful efficacy in a study of its COVID-19 Beta-containing vaccine against Omicron. This is a major win considering new COVID-19 cases are on the rise again across the globe.

Additionally, in June, Sanofi launched its first digital accelerator with a drive to become a leader in digital healthcare. The accelerator has already brought 75 experts under one roof and continues to increase its talent pool. It is focusing on atopic dermatitis patients in France, Italy, and Spain and is developing an integrated platform and data solution targeted at healthcare professionals. The company expects this platform to drive digital experiences and support new digital businesses while driving innovation across research, development, and commercial undertakings.

SNY’s Promising Financials

The top line has expanded from $42.2 billion in 2019 to $44.6 billion in 2021, while earnings per share (EPS) have inflated at a faster pace from $3.30 per share to $3.75 per share during this period. Its global sales are diversified across segments (Vaccines, Specialty care, General Medicines, and CHC) and across geographies (the U.S., Europe, and the rest of the world), giving the company an edge against global geopolitical challenges.

Additionally, its Dupixent continues to score regulatory wins and saw sales jump 45.7% in the most recent quarter.

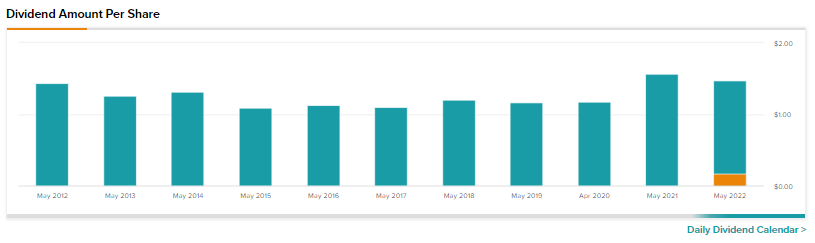

Moreover, while broader indexes have shed nearly 20% so far in 2022, Sanofi has held its ground, dropping only 0.79%, and is available at a price-to-earnings ratio of 17.1. Moreover, it has gradually increased its dividend from $1.09 in 2015 to $1.47 in 2022. The stock currently offers a dividend yield of 2.51% and has a payout ratio of 42.27%.

Analysts Are Moderately Bullish About SNY

In the meantime, the Street has a Moderate Buy consensus rating on Sanofi alongside a price target of $93.62. This implies a mouth-watering potential upside of 86.16% for the stock.

Closing Note

In a challenging backdrop over the past six months, Sanofi shares have proven resilient, offering capital preservation for investors.

The company continues to deliver on financial performance while maintaining a focus on innovation. Additionally, a consistent dividend should help savvy investors keep their portfolios protected against market gyrations and inflation in the current environment.

Read the full Disclosure