As the rise of financial technology (fintech) platforms confirms, more people are interested in integrating connectivity with convenience when it comes to their personal and business needs. In this space, Lemonade (LMND) – a full-stack insurance firm that leverages the power of artificial intelligence to make decisions – presents an intriguing narrative. However, the company learned that tradition can’t just be dismissed outright. I am bullish on LMND stock, though this idea will likely require patience.

On paper, Lemonade cuts a conflicting profile. However, over the trailing year, the AI-driven insurance provider lost more than 70% of market value, a staggeringly awful statistic. On top of that, since the conclusion of the company’s first public trading session, LMND finds itself down close to 70%. Arguably most investors would dismiss the company as a failed enterprise.

On the other hand, Lemonade knows how to deliver the goods when it counts. Earlier this year, when management disclosed its results for the first quarter, the fintech specialist rang up revenue of $44.3 million, representing an 89% lift from the year-ago level. On the bottom line, Lemonade posted a net loss of $1.21 per share, narrower than the consensus estimate of a $1.39 loss.

According to TipRanks reporter Richika Biyani, what was special about Q1 was that it was the “first complete quarter in which all of the company’s products were available in the market.” In the most recent disclosure for Q2, Lemonade continued to impress onlookers.

According to TipRanks reporter Pathikrit Bose, “Lemonade reported quarterly revenues of $50 million, which signifies an impressive growth of 77.3% from the year-ago quarter. Further, the figure outpaced the consensus estimate of $47.56 million.

However, the company’s losses widened to $1.10 per share from $0.90 per share in the previous year’s quarter. Yet, the figure came in narrower than the consensus estimate of a loss of $1.32 per share.”

Still, as mentioned earlier, LMND stock is down deep for this year. What gives?

LMND Stock and the Net Loss Problem

Arguably, one of the biggest problems facing Lemonade is that it’s essentially structured as a technology firm that provides insurance products. While that may have flown during the heyday of 2021, that’s simply not going to cut it. Instead, Lemonade must become an insurance firm that utilizes tech to service its customers. However, it can’t get there without addressing its net loss problem.

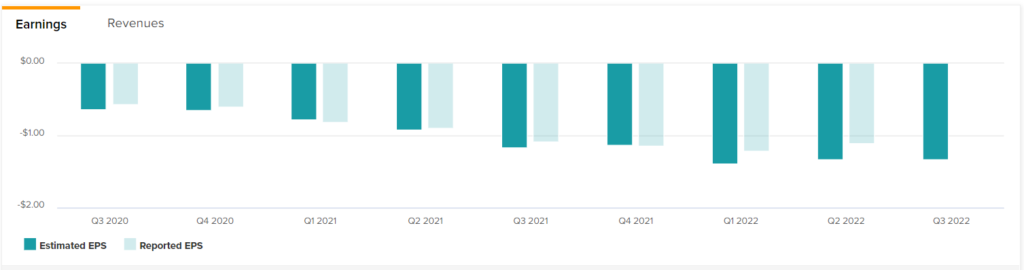

Nominally, Lemonade’s net loss in Q2 came out to $67.9 million, representing an unfavorable expansion of 22% against Q2 2021. If investors consider the long-term track record, it’s not very encouraging.

For instance, in 2018, Lemonade posted a net loss of $52.9 million. In 2019, the red ink expanded to $108.5 million. A year later, Lemonade was staring at a loss of $122.3 million. Finally, last year, the metric came out to a conspicuous $241.3 million. Notably, on a trailing-12-month (TTM) basis, Lemonade’s net loss stands at $279.4 million.

However, with the company again providing full-stack insurance products (such as auto insurance), this year, along with the previous year, should have been a bonanza.

In May of this year, TipRanks reporter Radhika Saraogi called to attention two insurance firms, Allstate (ALL) and Progressive (PGR), that could benefit from the unique circumstances associated with the COVID-19 pandemic. Interestingly, ALL and PGR are up nearly 6% and 23% on a year-to-date basis.

Much of that has to do with these two firms’ profitability metrics. On a TTM basis, Allstate has a net income of $996 million, while Progressive has $852 million. As dividend-bearing companies, these firms enjoy relevance during an inflationary cycle.

On the other hand, LMND stock trades like a public tech startup, benefiting only during particularly pronounced bullish cycles but fading badly as inflationary pressures build. That’s the opposite of how a typical insurance firm should react.

Looking to the Future

Certainly, Lemonade has its fair share of challenges. Over the near-to-intermediate term, it’s likely that LMND stock will trade in a choppy manner. Nevertheless, patient investors should take heart with the issuing company’s AI-driven insurance platform.

As NBC News reported last year, a “prominent group of insurance regulators on Tuesday agreed to examine more closely the use of credit scores by companies in pricing auto insurance, an incremental step toward reining in a practice many experts say amounts to a form of economic racism.”

Many are concerned about how certain biases can detrimentally impact members of historically disenfranchised groups. To be fair, NBC News stated that “Large auto insurance companies and trade groups have routinely defended their credit-including formulas, claiming it’s part of a more comprehensive, risk-based methodology based on research they say shows that better credit correlates to fewer claims and accidents.”

Nevertheless, when humans make policy decisions, it’s truly difficult to eradicate deeply ingrained biases. However, this angle is where Lemonade can expand upon its social-good ethos. By mitigating human involvement with more AI-focused decision-making, Lemonade can help address the bias problem. Over the long run, it may help bring some healing to a very sensitive topic.

Is LMND Stock a Buy, Hold, or Sell? Analysts Weigh In

Turning to Wall Street, LMND stock has a Hold consensus rating based on two Buys, two Holds, and two Sell ratings. The average LMND price target is $26.25, implying 20.9% upside potential.

Conclusion: LMND Stock Requires Patience

Again, it’s worth repeating that Lemonade suffers from many challenges. Primarily, it must start pivoting its business to one that uses technology instead of being a tech firm. Nevertheless, the implementation of AI in the insurance business is extraordinarily compelling, particularly due to the social angle. Therefore, LMND stock may be appropriate for the patient market participant.