Legal and General Group PLC (GB: LGEN) said it expects to see ‘double-digit’ growth in cash and capital in the first half of the 2022 financial year.

The company stated that it is on track to generate £1.8 Billion of capital in 2022.

After the update, the share prices shot up, trading 4% higher. Overall, the stock is down 16.5% YTD.

Good numbers in difficult times

The Group’s various segments include investment management, lifetime mortgages, pensions, annuities, and life assurance.

The pension risk transfer (PRT) portfolio grew to £4.5 Billion in the first half of 2022, up from £3.1 Billion last year. The company’s pipeline for the second half of 2022 and 2023 is pretty strong due to high PRT demand over falling pension deficit after interest rate hikes by central banks.

Market commentators expect UK PRT demand between £150 to £250 Billion over the next five years.

The company’s investment management segment saw 92% growth in external net flows. This was mainly due to higher volumes from high-margin products such as ETFs, fixed-income, and multi-asset.

The company’s expansion in global markets also led to the growth of this segment. It has £479 Billion of international assets under management which has doubled over the last five years.

Chief executive Sir Nigel Wilson said, “The company’s encouraging performance reflects the strong execution of our stated strategy – which is closely aligned to long-term structural growth drivers such as ageing demographics, investing in the real economy, and addressing climate change, both in the UK and, more recently, in the US.”

View from the city

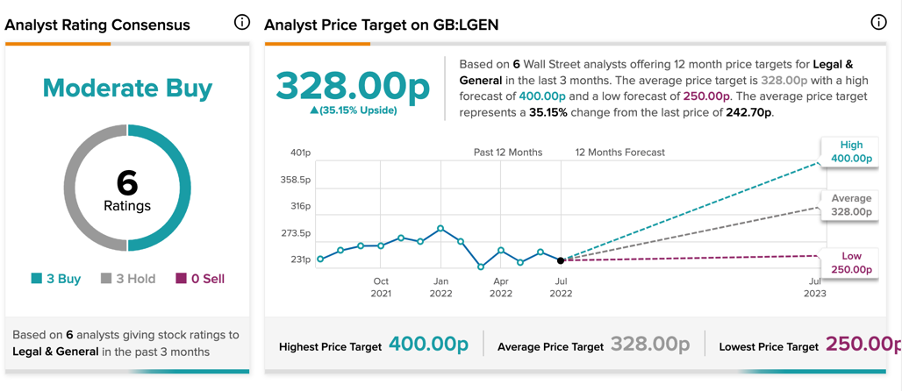

According to TipRanks’ analyst rating consensus, Legal and General stock is a Moderate Buy. This rating is based on six analysts, out of which three are Buy and three are Hold.

The average Legal and General price target is 328p, implying an upside of 35.2%. The analyst price target has a high and low forecast of 400p and 250p, respectively.

Conclusion

It seems to be reasonable to consider the company’s stock as an investment opportunity. The balance sheet is strong, and the guidance numbers are on track.

The investor’s returns are also promising with an attractive dividend yield of 7.9% way ahead of the industry average of 2.1%.