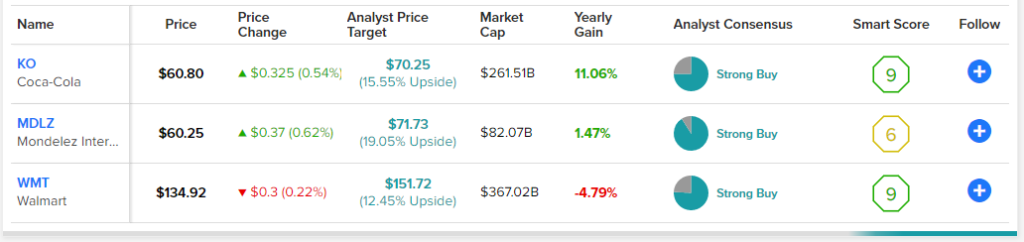

In this piece, we used TipRanks’ Comparison Tool to check out three blue-chip consumer staple stocks — KO, WMT, and MDLZ — with a “Strong Buy” consensus rating from Wall Street that can perform relatively well during a recession. Regarding upside potential from analyst price targets, MDLZ tops the list, but let’s look into each stock further.

Worries about a 2023 recession are picking up, with hot CPI numbers coming in yesterday. The inflation data was only a tad hotter, but that was enough to send the broader stock market spiraling down more than 4% on the day.

With rates continuing to rise, many fear that the soft landing will be tougher to engineer. Fed-induced recessions can be painful, and though there’s still a chance a soft landing will be in the cards, markets could start to price in a harder landing with every hotter-than-expected CPI report.

It’s not a great time to be a beginner investor, but there are places to hide as the economy goes into retreat mode. The consumer staples space is just one hiding place for those rattled by the wild market swings we’ve seen in recent months.

Of course, even a defensive dividend stock can get pummelled when the primary emotion on Wall Street is fear. Regardless, the following consumer staple stocks, I believe, are worth a second look going into a recession whose severity remains unknown.

Coca-Cola (NYSE: KO)

Coca-Cola is one of Warren Buffett’s favorite long-term holdings. He’s probably going to hang onto his shares for life. While Coke shares experienced a bit of chop during 2020 when restaurants locked down and stopped serving Coca-Cola in the process, the beverage giant tends to be less affected by exogenous factors weighing down the broader markets.

Unless there’s another wave of lockdowns (which is extremely unlikely), Coca-Cola seems ready to power higher, even if the S&P 500 (SPX) flatlines or sags further into a bear market. The company is starting to get over supply-chain disruptions, inflation headwinds, and labor issues. Indeed, these three headwinds have weighed down almost every firm these days.

Though Coke delivered magnificent second-quarter numbers, its rally has since fizzled out, now down around 9% from its all-time high just north of $67 per share. Defensive dividend stocks got a tad too expensive as investors rotated funds from risk-on to risk-off assets for most of the year.

At writing, shares of Coke trade at 27.6x trailing earnings and 6.4x sales. Though such a multiple seems ridiculous to pay for an old-time company, I’d argue that in today’s rocky climate that the sky-high price of admission is worthwhile for those looking for stability.

Looking ahead, Coke could begin to spread its wings further into other non-alcoholic beverage categories, including coffee and energy drinks. With such a stellar brand and impressive global reach, I do think it could prove difficult to stop Coke in its tracks here.

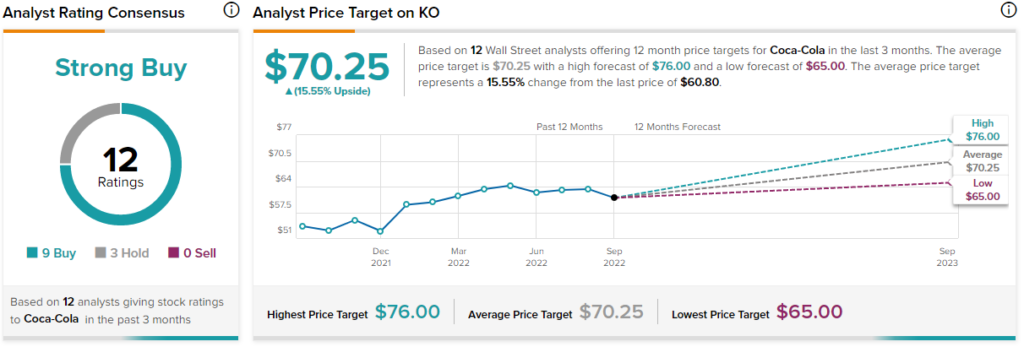

What is the Price Target for KO Stock?

Wall Street continues to love Coke shares, with nine Buys, three Holds, and 15.6% in year-ahead upside expected based on the average KO stock price target of $70.25.

Walmart (NYSE: WMT)

Walmart is another consumer staple stock that can perform far better than the market during tough times. The firm’s grocery business really helped it move through inflationary headwinds over the past year. As a recession approaches, discretionary demand could wane, but Walmart’s necessities business could begin lifting more of the weight.

As the tables turn and the recession turns into an expansion, Walmart will benefit from an uptick in discretionary demand. In any case, the well-run big-box retailer seems well-equipped to thrive through all types of macroeconomic climates.

With an inventory glut possible over the coming months, markdowns and discounting could eat into margins further. Regardless, Walmart has already been through more than its fair share of transitory headwinds. The company is continuing to adapt and power forward with investments in innovation. Bets on e-commerce and tech-driven efforts to improve supply-chain efficiencies should lead to long-lasting margin growth.

In the meantime, Walmart must continue to swim against the tides. As we march into a recession year, though, I expect Walmart could take share away from rivals that fail to stack up to the legendary retailer’s value proposition.

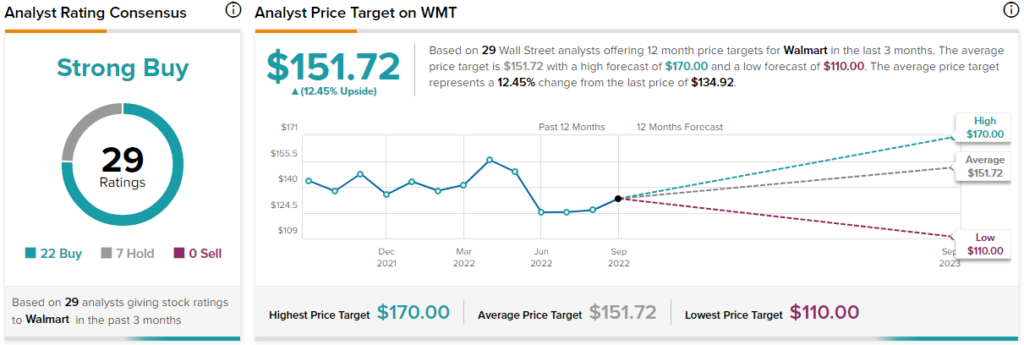

What is the Price Target for WMT Stock?

At 26.3x trailing earnings and 0.6x sales, Walmart is a glimmer of value. Wall Street stands by Walmart, with 21 Buys, seven Holds, and 12.5% in year-ahead upside potential based on the average WMT price forecast of $151.72.

Mondelez (NASDAQ: MDLZ)

Mondelez is the snack maker behind Cadbury, Oreo, Halls, Tang, and many other popular consumer-packaged goods. The stock has not gone anywhere in a hurry over the past three years. With shares not too far from pre-pandemic levels, the value proposition for the confectionary firm is enticing as we head into harsher times.

Many of the snacks created by Mondelez are quite affordable. As consumers tighten at the grocery aisle, snacking is less likely to be cut, given much of the food price inflation has been targeted at other fresh food product categories.

Even if sales slow, don’t expect Mondelez to sacrifice margins to preserve its top line. Further, the firm seems devoted to reinvesting to improve its snack food moat. Indeed, it’s tough to stack up against such brands as Oreo and Cadbury. The sweets business can be pretty sweet for incumbents. Just ask Warren Buffett, who bought See’s Candies outright many decades ago.

The stock trades at 21.9x trailing earnings and 2.8x sales – pretty reasonable for a quality staple.

What is the Price Target for MDLZ Stock?

Wall Street has a sweet tooth for Mondelez stock, with nine Buys and one Hold assigned in the past three months. The average MDLZ stock forecast of $71.73 implies 19.1% upside potential.

Conclusion: Analysts are Most Bullish on MDLZ Stock

Consumer staple stocks have gotten a tad more expensive amid the rise in volatility. Still, Wall Street loves the three names outlined in this piece. Mondelez takes the cake for having the greatest year-ahead upside potential.