Kinaxis (TSE: KXS) is a Canada-based provider of software solutions for sales & operations planning (S&OP) and supply-chain management. The firm’s flagship RapidResponse product is offered on the cloud.

Its capabilities include consequence evaluation and alerting, responsibility-based collaboration, high-speed analytics, and scenario simulation. Kinaxis’s S&OP solution capabilities include supply and demand planning, capacity and inventory planning, and inventory management.

The company has a measurable competitive advantage and strong support from analysts.

Quantifying a Competitive Advantage

There are a couple of ways to quantify a company’s competitive advantage using only its income statement. The first method involves calculating a company’s earnings power value (EPV).

Earnings power value is measured as adjusted EBIT after tax, divided by the weighted average cost of capital (WACC), and reproduction value (the cost to reproduce/replicate the business) can be measured using a company’s total asset value. If the earnings power value is higher than the reproduction value, then a company is considered to have a competitive advantage.

For Kinaxis, the calculation is as follows:

EPV = EPV adjusted earnings / WACC

$660 million = $54 million / 0.083

Since Kinaxis has a total asset value of $571 million, we can say that it does have a competitive advantage. In other words, assuming no growth for Kinaxis, it would require $571 million of assets to generate $660 million in value over time.

The second method to determine if a company has a competitive advantage is by looking at its gross margin because it represents the premium that consumers are willing to pay over the cost of a product or service. An expanding gross margin indicates that a sustainable competitive advantage is present.

If a company has no edge, then new entrants would gradually take away market share, leading to a decreasing gross margin over time due to pricing wars.

In Kinaxis’s case, its gross margin remained relatively flat for most of the past decade but has declined in recent years, going from 71.9% in Fiscal 2019 to 67.5% in the trailing 12 months. As a result, its gross margin indicates that a competitive advantage is not really present in this regard.

However, this could be a temporary issue caused by inflationary pressures such as higher wages. Thus, the company might be able to improve its gross margin, going forward.

The Rule of 40

A metric I like to look at when assessing SaaS companies is the rule of 40, which is calculated as revenue growth plus free cash flow margin. Companies with a number greater than 40 tend to outperform those with a number lower than 40.

For Kinaxis, this metric comes in at 32.7% — below the benchmark. However, it’s worth mentioning that Kinaxis has fluctuated above and below 40% over the past decade. Indeed, it was above 40% four out of the last 10 years.

Although the current reading is 32.7%, it is possible that this number could climb above the benchmark going forward as analysts expect 156% and 51% free cash flow growth in 2022 and 2023, respectively.

Analyst Recommendations

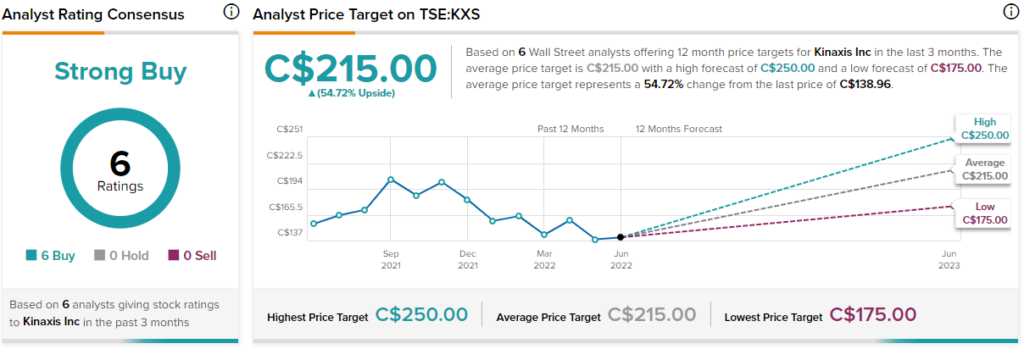

Kinaxis has a Strong Buy consensus rating based on six Buys assigned in the past three months. The average KXS stock price target of C$215 implies 54.7% upside potential.

Final Thoughts

As a provider of supply-chain software, Kinaxis is in an interesting position to benefit as companies look for more efficient ways to handle the ongoing disruptions. In addition, it has a measurable competitive advantage and the backing of analysts, who expect significant growth in free cash flow in 2022 and 2023.