With AI hogging all the headlines this year, and many of its offerings catering to the needs of those building AI tools, Nvidia (NASDAQ:NVDA) has positioned itself as one of the companies to ride this huge secular trend. To wit, NVDA shares are up by 165% year-to-date.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

It’s no wonder, then, that after hosting a meet up between investors and Nvidia’s VP of IR Simona Jankowski, J.P. Morgan analyst Harlan Sur came away confident in the chip giant’s ongoing success.

In fact, Sur still thinks the stock has more room to run. Along with his Overweight (i.e., Buy) rating, the 5-star analyst’s $500 price target implies the shares will add another 29% over the course of the year. (To watch Sur’s track record, click here)

So, what’s behind the optimistic outlook? Well, for one, Sur is assured of a “continued strong growth profile” based on multi-quarter order/backlog visibility for its Datacenter segment. Shipments of Nvidia’s fastest AI GPU so far, the H100, continue to “ramp in higher volumes” in 2Q and into 2H. At the same time, its predecessor, the A100 is still witnessing “strong demand.”

That said, aside from the boost anticipated in the second half of the year from the H100 compute platform, other big revenue generators are expected to come into play shortly.

These include the anticipated contribution from the inferencing chipsets/platform (L4, L40, H100NVL) and the Grace/Grace Hopper (ARM CPU/GPU) chipsets. “This suggest that newer products could be a strong revenue driver next year,” notes Sur.

Elsewhere, while last year demand in China was soft, in the April quarter, Nvidia noted demand was recovering, and although it has yet to return to normalized levels, the company is optimistic on seeing sequential growth in the July quarter and further down the line.

Looking ahead, over the next 2-3 years, the auto segment should also start making a meaningful contribution, particularly as the collaborations with Mercedes-Benz (ramp in 2025) and Jaguar (ramp in 2026) unfold.

Lastly, based on the expectation of 10% ASP growth and 9-10% unit growth, Nvidia is confident the Gaming business will expand at a 20% CAGR (compound annual growth rate).

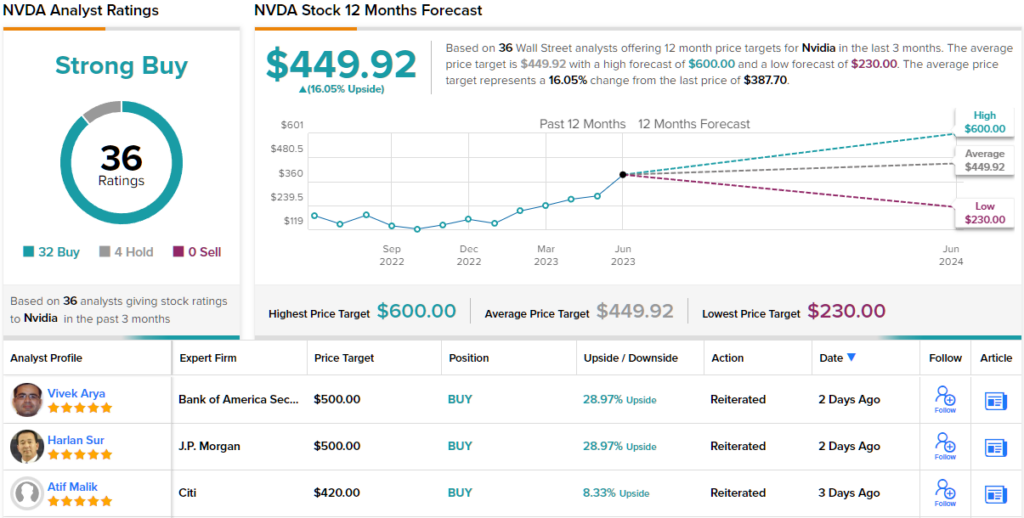

So, that’s JPM’s take, what does the rest of the Street have in mind for NVDA? Most are also expecting further success. The stock garners a Strong Buy consensus rating, based on 32 Buys vs. 4 Holds. The forecast calls for 12-month returns of 16%, given the average target clocks in at $449.92. (See Nvidia stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.