JPMorgan’s (JPM) earnings release for the third quarter is scheduled for October 13, before the market opens. Over the past year, shares of the investment banking giant have jumped 62.7%, and are currently trading at over $166. A strong print of numbers could send shares on an upward trajectory, so let’s take a closer look at what analysts on the Street are expecting.

JPM Earnings Preview

JPMorgan EPS is expected to be $3.00 on revenues of $29.7 billion in the third quarter. Meanwhile, the Earnings Whisper number, or the Street’s unofficial view on earnings, stands at $3.19 per share.

Prior Period Results

In the previous quarter, the company reported earnings of $3.78, which more than doubled from the prior-year quarter. That said, the result topped the consensus estimate of $3.10. On the other side, net revenue declined 7% to $31.4 billion but surpassed analysts’ expectations of $30 billion.

Markedly, JPMorgan’s earnings history depicts upbeat performance over the past four quarters, with both earnings and revenue topping consensus expectations.

See Insiders’ Hot Stocks on TipRanks >>

Factors to Watch For

JPMorgan works in various segments, including Investment Banking, Equity and Fixed-Income Trading, and Consumer and Mortgage Banking. Among these verticals, the bank experienced strong investment banking revenues, including a robust advisory and underwriting business, along with volatile trading revenues in recent quarters.

Across the economy, there was a record spike in deal volumes on the back of an improving macroeconomic outlook, decent cash reserves, low-interest rates, increasing pace of COVID-19 vaccines globally, and proposed tax reforms by President Joe Biden. Therefore, a rise in M&A activities might have boosted the company’s advisory revenues in the to-be-reported quarter. Additionally, ongoing restructuring business activities by companies to enhance profitability are likely to have added fuel to the fire, via payment of advisory fees to the bank.

The general economy also saw continued momentum in the underwriting business, with strong IPO market activities. Moreover, on elevated liquidity, follow-up equity issuances were on the rise. Therefore, underwriting fees might have recorded growth for JP Morgan in the third quarter as well.

On the trading front, JPM earnings and revenues are expected to be low compared to the year-ago period, as fixed-income markets have normalized in comparison to record trading volumes last year, and might have offset strong equity trading revenues.

In the U.S., mortgage originations, including both purchase and refinancing, were at normalized levels in the third quarter. However, there was an uptick in mortgage rates on a sequential basis. Consequently, mortgage origination activities might have subdued, with lower refinancing activity. Nevertheless, strong housing market conditions might have propelled home-buying activities, aiding purchase originations. Therefore, JPMorgan might have recorded decent mortgage revenue numbers.

Additionally, reserve release is likely to have marginally benefited the third quarter, as most releases occurred in prior quarters.

When it comes to the core banking front, loan demand remained subdued on soft commercial and industrial, and revolving home equity loans, as per the Fed data. Nevertheless, higher consumer and real estate loan demand might have offered some respite.

Additionally, a rise in the 10-year Treasury yield at the end of September might have driven net interest income, with a low interest-rate environment continuing to impact net interest margin.

On the expense front, rising expenses on technology and strategic plans might have hindered the bank’s profitability to some extent.

JPMorgan Analyst Recommendations

Prior to the third-quarter JPM stock earnings report, Bank of America Securities analyst Ebrahim Poonawala has reiterated a Buy rating on the stock and increased the price target to $190 (14% upside potential) from $182.

In a note to investors, Poonawala issued his first 2023 and 2024 EPS guidance for mega-cap bank stocks and said, “We believe that having a 2024 forecast provides investors with a lens into the earnings power for the group assuming a backdrop of higher interest rates, normalized credit costs, moderating capital markets/mortgage activity and some rebalancing in balance sheet mix following a historic influx of deposit liquidity.”

For JPMorgan, the analyst expects EPS of $13.96 in 2021, $11.50 in 2022, $12.30 in 2013, and $13.85 in 2024.

Another analyst, Jefferies’ Ken Usdin, reiterated a Buy rating on the stock and increased the price target to $198 (18.82% upside potential) from $177.

Overall, the stock has a Moderate Buy consensus rating based on 8 Buys, 3 Holds, and 1 Sell. The average JPMorgan stock price target of $174.73 implies 4.85% upside potential from current levels.

Bloggers Weigh In

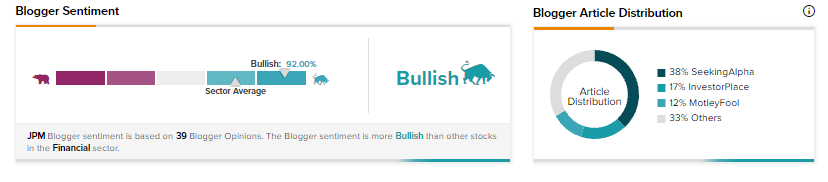

TipRanks data shows that financial blogger opinions are 92% Bullish on JPM, compared to a sector average of 72%.

Disclosure: At the time of publication, Priti Ramgarhia did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of Tipranks or its affiliates, and should be considered for informational purposes only. Tipranks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. Tipranks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by Tipranks or its affiliates. Past performance is not indicative of future results, prices or performance.