Johnson & Johnson’s (NYSE:JNJ) market-beating third-quarter results reflected the company’s resilience in a challenging macro environment. However, the healthcare giant is not completely immune to high inflation, currency headwinds, and a potential economic downturn. The company has indicated that it might reduce its headcount ahead of the spin-off of its Consumer Health business next year.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Headcount Reduction Amid Macro Challenges

During the Q3 conference call, JNJ’s chief financial officer, Joseph Walk, stated, “We have the opportunity, as we said on prior calls, to rightsize our infrastructure for a two-segment company versus a three-segment company that we’ve had historically. And so we’re looking at opportunities there as well.”

Last year, JNJ announced the spin-off of its Consumer Health division, which includes popular brands like Band-Aid, Tylenol, Neutrogena, and Listerine, into a separate entity called Kenvue. The spin-off is scheduled to be completed in November 2023. The move is expected to help the company focus on its higher-growth pharmaceutical and medical device businesses.

In an interview with the Wall Street Journal, CFO Walk explained that the company is not immune to some of the economic challenges faced by companies in several industries. “So we’re taking this opportunity to really look at the resources, how we deploy them,” added Wolk.

JNJ’s Q3 sales increased 1.9% year-over-year to $23.8 billion, surpassing analysts’ estimate of $23.4 billion. Higher revenue from the Pharmaceutical and MedTech divisions more than offset the weakness in the Consumer Health segment. Currency headwinds had a 6.2% adverse impact on Q3 sales. Meanwhile, adjusted EPS declined 1.9% to $2.55 but topped the Street’s forecast of $2.48. Profitability in the quarter was hit by forex headwinds and higher costs.

The company lowered its full-year sales guidance to the range of $93.0 billion to $93.5 billion from the prior range of $93.3 billion to $94.3 billion, mainly due to adverse foreign currency fluctuations. It revised its 2022 adjusted EPS outlook range to $10.02 to $10.07 from $10.00 to $10.10.

What is the Target Price for JNJ?

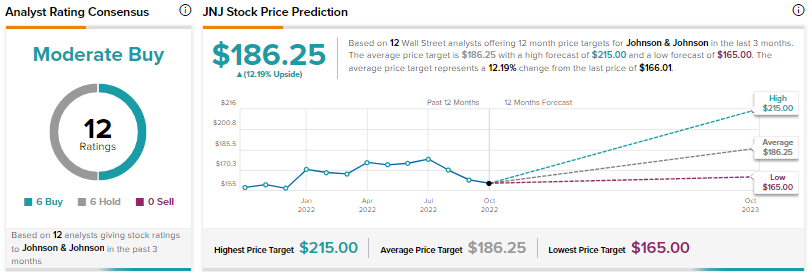

Overall, the Street is cautiously optimistic about Johnson & Johnson stock, with a Moderate Buy consensus rating based on six Buys and six Holds. The average JNJ stock price target of $186.25 implies 12.2% upside potential from current levels. JNJ stock has declined 3% year-to-date, faring better than the broader market.

Conclusion

Johnson & Johnson is contemplating headcount reductions due to a challenging macro backdrop and ahead of the separation of its Consumer Health division. However, it is optimistic about its long-term vision of being a $60 billion pharmaceutical company by 2025.