The healthcare sector is vast and complex, leading many retail investors to avoid it. The sector includes companies that develop elaborate pharmaceuticals and early-stage biotechnologies. However, there are also healthcare companies whose products and services are easier to understand. Johnson & Johnson (NYSE: JNJ) and Medtronic plc (NYSE: MDT), for instance, offer complex pharmaceuticals but also everyday consumer healthcare products and hospital supplies, which are easier to understand. In my view, both companies remain robust dividend-growth picks, moving forward. I find both stocks relatively fairly valued as well.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Accordingly, I am bullish on JNJ and MDT shares.

I have specifically picked these two healthcare companies for this article because, during the current highly-uncertain environment, their essential consumer goods and medical devices generate quite stable revenues.

Further, Johnson & Johnson and Medtronic are two of the only eight companies included in the Dividend Aristocrats Index, each featuring 60 and 45 years of consecutive dividend increases, respectively. In fact, Johnson & Johnson has the lengthiest dividend-growth track among all healthcare stocks.

Both track records reflect the power of Johnson & Johnson’s and Medtronic’s business models to produce resilient results and provide investors with growing payouts under various harsh economic environments.

Why Do JNJ and MDT Remain Two Robust Dividend-Growth Stocks?

The primary reason why Johnson & Johnson’s and Medtronic’s dividend-growth prospects remain robust is that their portfolios of brands generate non-cyclical sales.

Johnson & Johnson’s consumer health division sells everyday necessities like self-care and essential health products (e.g., band-aids), while its MedTech division develops various orthopedics and surgery-related products that hospitals need a consistent supply of.

Medtronics critical supplies, which include products such as cardioverter defibrillators, also generate sales volumes that are mostly uncorrelated with the state of the underlying economy.

Accordingly, the two companies do not experience violent shocks in their financials that threaten the sustainability of their underlying dividends. The companies’ most recent dividend hikes verify this.

Johnson & Johnson’s latest increase this past April was by a satisfactory 6.6%. This implies an acceleration from the company’s previous dividend hike of 5.0%, despite the underlying macroeconomic challenges and the general notion of compressing margins in the current market environment.

Based on the midpoint management’s guidance for Fiscal 2022, which targets adjusted earnings per share of $10.00 to $10.10, Johnson & Johnson’s current payout ratio stands at a comfortable 44.9%. This ratio is also quite encouraging, considering that Johnson & Johnson has already downgraded its outlook twice in the face of the ongoing macroeconomic turmoil.

Medtronic’s latest increase was also quite satisfactory, coming in at 7.9% this past May. Medtronic’s guidance has guided for adjusted earnings-per-share to be in the range of $5.53 to $5.65 in its Fiscal 2023, which implies 0.9% growth year-over-year at the midpoint. This is a rather solid outlook considering this estimate includes an estimated $0.17 to $0.22 negative impact from foreign currency (stronger dollar). Regardless, at the midpoint, it also implies a rather comfortable payout ratio of 49%.

Overall, both companies have once strongly demonstrated their resilience to economic downturns this year by delivering above-average dividend hikes. With their payout ratio at comfortable levels and earnings expected to resume growth once the current market landscape normalizes (buybacks help as well), I believe that Johnson & Johnson’s and Medtronic’s dividend-growth prospects remain rock-solid.

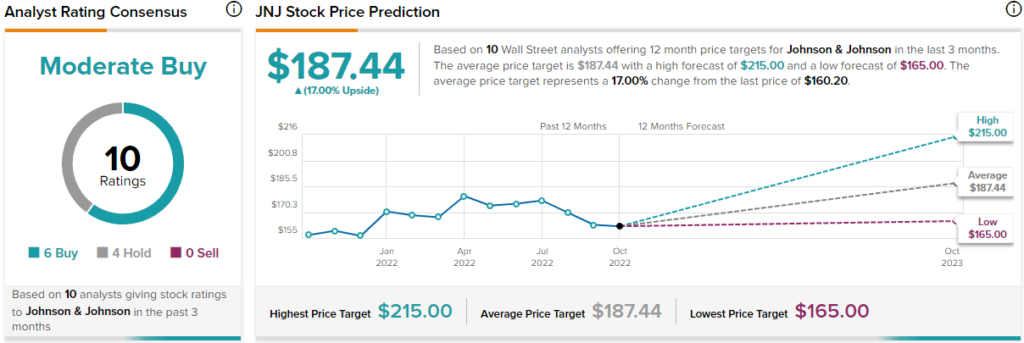

What is the Price Target for JNJ Price?

Turning to Wall Street, Johnson & Johnson has a Moderate Buy consensus rating based on six Buys and four Holds assigned in the past three months. At $187.44, the average Johnson & Johnson stock forecast implies 17% upside potential.

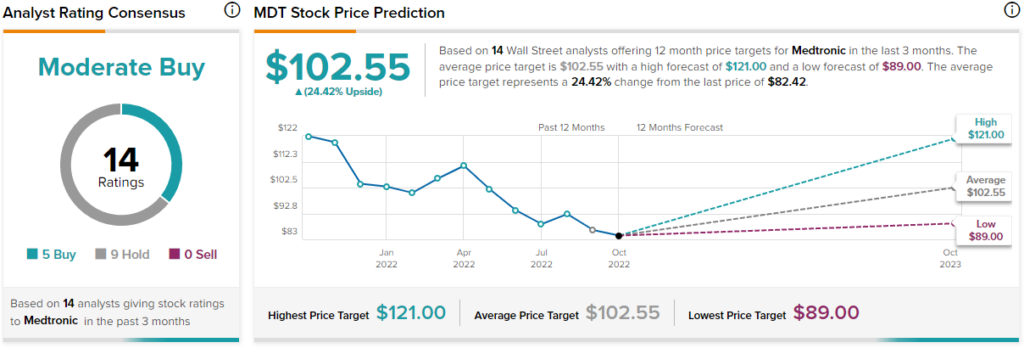

What is the Price Target for MDT Stock?

Wall Street has even higher upside expectations for Medtronic. The company has also obtained a Moderate Buy consensus rating based on five Buys and nine Holds assigned in the past three months.

Despite Medtronic’s loftier Holds/Buys ratio over Johnson & Johnson, the average Medtronic stock forecast suggests 24.4% upside potential.

Conclusion: Two Reasonably-Valued Healthcare Dividend Stocks

High-quality companies with excellent capital return growth track records tend to trade at a premium during periods of uncertainty due to the extra margin of safety they offer. Still, the recent headwinds have been strong enough that both Johnson & Johnson and Medtronic corrected notably year-to-date.

Following their decline, I find both of them reasonably valued. At the midpoint of both their management’s guidances, Johnson & Johnson and Medtronic trade at P/E ratios of 16.1x and 15.0x.

These are not totally inexpensive multiples, and both Johnson & Johnson’s and Medtronic’s yields are hefty at 2.8% and 3.3%, respectively. Still, their valuations are slightly below their historical averages and should provide a worthy entry point for dividend-growth investors looking to hold these two names over the long run.