Due to supply-chain issues and other factors, China’s economic recovery has been uneven in 2023. If you expect the situation to improve in China, however, then you’re invited to take a closer look at JD.com (NASDAQ:JD). I am cautiously bullish on JD stock and feel that it may be appropriate for people with an open mind to international investing.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

JD.com offers a range of electronics, appliances, and other products online, as well as logistics services in China. It’s not the size of Alibaba (NYSE:BABA) by any means, but JD.com is a well-known business in China.

Granted, it’s risky to expose one’s portfolio to China’s fragile economy now. Yet, JD.com’s fresh round of financial results indicates that this company can thrive even in challenging circumstances.

Is JD.com Stock Undervalued Right Now?

Even while America’s “Magnificent Seven” technology stocks surged in 2023, JD.com stock continued to print new short-term lows throughout the year. The stock started 2023 with a rally to $66, only to drop into the $20s recently.

This, I would suggest, reflects uncertainty about China’s recovery prospects and isn’t necessarily the market’s statement about JD.com in particular. Quarter after quarter, JD.com has consistently beaten Wall Street’s EPS forecasts. So, there’s been no compelling reason for investors to dislike JD.com as a company.

The result might be a hidden gem for value investors. JD.com stock is obviously trading at a depressed price. What about the company’s valuation, though? As it turns out, JD.com has a non-GAAP trailing 12-month price-to-earnings (P/E) ratio of just 9x. In contrast, the sector median P/E ratio is 13.2x, which itself is reasonably low.

Of course, this isn’t a reason to just go out and buy JD.com stock. Investors should want some assurance that the company is surviving in China’s current economy. Fortunately, JD.com’s third-quarter 2023 financial results gave the company another earnings beat and plenty of reasons to be confident about the future.

JD.com Grows, Even if China’s Economy Slows

Despite the bigger-picture challenges, JD.com proved that it can still grow and provide excellent value to the shareholders. Impressively, JD.com announced adjusted earnings of RMB6.70 or $0.92 per American Depository Share (ADS) for the third quarter of 2023.

Let’s put this in context. In the year-earlier quarter, JD.com only earned RMB6.27 per ADS. In addition, the company’s Q3-2023 EPS result beat the analyst consensus estimate of $0.82 per ADS.

This isn’t to suggest that JD.com had a perfect quarter. The company’s net revenue increased by 1.7% year-over-year to RMB247.7 billion or $34 billion, so there was moderate growth. However, this result fell short of the consensus estimate of $34.34 billion.

Still, the bottom-line beat can’t be denied. Furthermore, JD.com’s free cash flow (excluding certain items) for the 12 months ended September 30, 2023, came in strong at RMB39.4 billion (US$5.4 billion). That’s a notable improvement over the company’s free cash flow of RMB25.8 billion for the 12 months ended September 30, 2022.

How did JD.com achieve a surprisingly positive quarter? The company’s CFO, Ian Su Shan, attributed JD.com’s “record profitability for the quarter and healthy cash flow” to “successful business evolvement and supply chain strengths.” If the CFO is confident about JD.com’s supply chain, even while China struggles in this area, I’d say that’s a great sign for the company.

Is JD.com Stock a Buy, According to Analysts?

On TipRanks, JD comes in as a Moderate Buy based on 13 Buys and six Hold ratings assigned by analysts in the past three months. The average JD.com stock price target is $44.34, implying 55.5% upside potential.

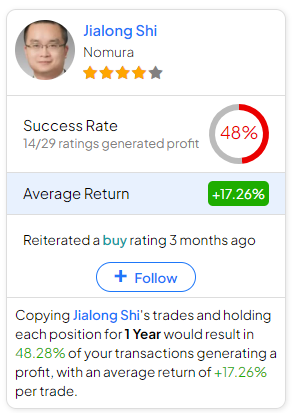

If you’re wondering which analyst you should follow if you want to buy and sell JD stock, the most profitable analyst covering the stock (on a one-year timeframe) is Jialong Shi of Nomura, with an average return of 17.26% per rating. Click on the image below to learn more.

Conclusion: Should You Consider JD.com Stock?

Many U.S.-based investors might not have ever looked at JD.com. That’s why international investors can have advantages — since hidden gems can sometimes be discovered abroad.

JD.com looks like a hidden gem, though there are still risks involved since China’s economy remains uncertain. Nonetheless, the data demonstrates JD.com’s surprising resilience and growth despite ongoing macroeconomic challenges. Therefore, if you don’t mind dealing with potential share price volatility, I think JD stock is worth considering.