JD.com, Inc. (JD) will reveal its financial results for the fourth quarter of 2021 before the market opens today.

JD.com is a Chinese e-commerce platform based in Beijing. It has been named to the Fortune Global 500 list of the world’s most successful firms.

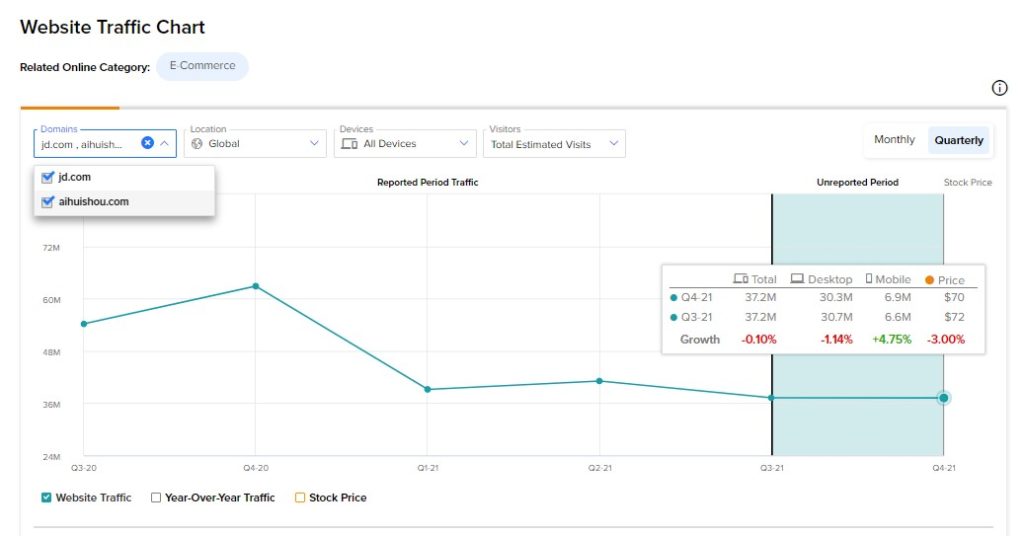

For an e-commerce company like JD, total website visits are a solid indicator of consumer involvement. The company’s primary online portal, jd.com, specializes in selling electronics, home appliances, and miscellaneous commodities. As a result, increasing user engagement indicates a stronger demand for the company’s items on its website, predicting higher sales and vice versa.

So, ahead of the Q4 print, we went into JD’s monthly user statistics using TipRanks’ new online tool to get a better picture of the company’s current state.

What do JD.com Q4 Website Visits Reflect?

We discovered through the tool that overall projected visits to the JD website decreased slightly in Q4. In particular, the total projected worldwide visits to jd.com decreased by 0.1% sequentially from the third quarter.

The dip in the monthly users suggests that JD’s e-commerce sales may have declined slightly in the yet-to-be-reported quarter.

Furthermore, the tool indicates that aihuishou.com, a Chinese electronics resale marketplace funded by JD, looks to be promising. In Q4, total estimated visits to aihuishou.com climbed by 2.2% sequentially to 67k in Q4. The increase implies that sales in the electronics category might have improved in the fourth quarter under review.

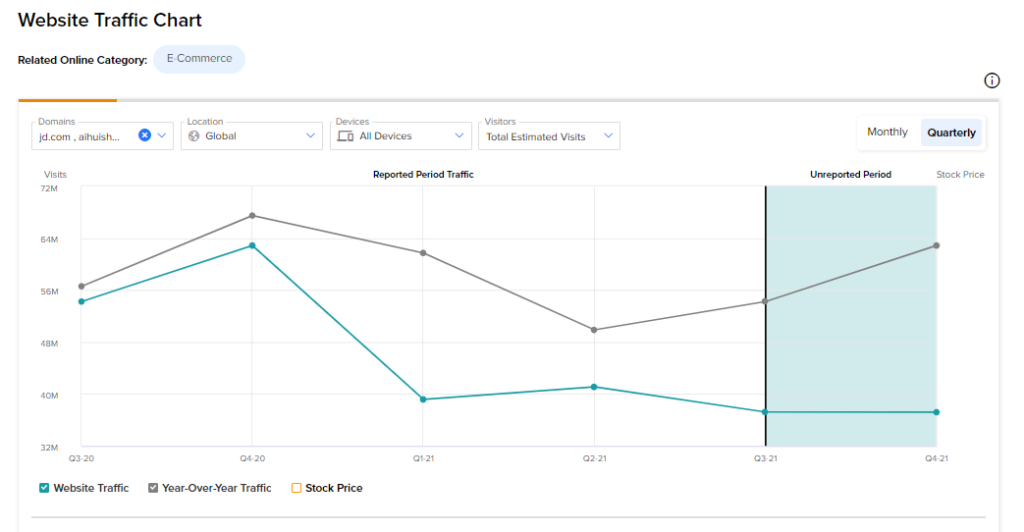

However, on a year-over-year basis, website visitors to jd.com plummeted 40.7% to 37.1 million in Q4 2021.

The year-over-year decrease in website traffic could be attributable to tough competition from other players such as Alibaba (BABA) and Amazon (AMZN). In addition, a slowdown in Chinese demand and ecommerce in general may have damaged JD’s business to some extent.

Wall Street’s Take

Wall Street analysts are optimistic on JD, with a Strong Buy consensus rating based on 7 unanimous Buys. The average JD stock prediction of $99.29 implies an upside potential of approximately 59% from current levels for this stock.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure.