What to make of the markets today? While last week ended on a down note, we’re still looking at a general rally trend, with year-to-date losses being heavily moderated and the major indexes having climbed out of bear territory. The key point for now, as it has been so often this year, is volatility.

Covering the markets for JPMorgan, global market strategist Marko Kolanovic tells investors to take advantage of down days and buy the dips. “Buying on weakness so far yielded positive returns and has worked better, than e.g. suggestions to stay out of the market and start ‘nibbling’ at 3500 or 3300, levels that have not been reached,” Kolanovic explained.

As for the market generally, Kolanovic describes last month’s inflation data as ‘quite encouraging,’ and goes on to say, “The decline in the July CPI can likely be repeated in August given the lower energy prices in August so far (data release Sep 13th) and provide room for a market-friendly Fed.”

Going forward, Kolanovic has forecast the S&P 500 to reach 4,800 by year’s end, a gain of 13.5% from current levels. His colleagues among the JPM stock analysts have picked out two beaten-down stocks for investors to consider, predicting 60% or better upside for the coming year. Running the tickers through TipRanks’ database, we learned that each has earned a “Strong Buy” consensus rating from the rest of the Street.

IHS Holding (IHS)

We’ll start in the tech sector, where IHS Holding is a telecom infrastructure company working on the development and expansion of wireless communications network towers in Sub-Saharan Africa, the Middle East, and Latin America. Overall, IHS boasts over 39,000 towers in its property portfolio, across 11 countries.

IHS is the leader tower operator and provider in its operating area, and offers solutions for a variety of telecom needs, including small cell ops, fiber connectivity, rural telephone networks. The company works to realize value and reduce costs, for itself and its customers, as part of a versatile network operation.

In the most recent financial quarter, 2Q22, IHS reported a top line of $467.7 million. This was down from $763.5 million reported in the year-ago quarter. Earnings were negative in Q2, coming in at a loss $177 million. That translated to a diluted EPS loss of 53 cents, a loss 60% higher than the year-ago quarter. Despite the earnings loss, IHS’s cash position improved modestly over he past 12 months. The company reported $191 million in cash from operations in Q2, compared to $174 million in the year-ago quarter, and y/y, cash and liquid assets rose from $541 million to $567 million.

Shares in this telecom firm have fallen over the last several months, and year-to-date the stock is down 48%.

Analyst Philip Cusick, in his coverage of this stock for JPMorgan, sees that share price decline as an opportunity for investors.

“We believe at the current 6.5x 2022E EV/EBITDA, IHS shares are significantly undervalued, and expect valuation to improve

over time… We like the strong growth profile in regions where IHS operates, which is fueled by high population growth, expanding economic activity, higher penetration and increased usage, and transition to 4G and eventually 5G. The company has a strong operating track record driven by its long tenured and experienced management team to deliver results in challenging markets,” Cusick opined.

This adds up, in the analyst’s view, to an Overweight (i.e. Buy) rating – and his $16 price target indicates room for substantial growth, on the order of ~119%, in the year ahead. (To watch Cusick’s track record, click here)

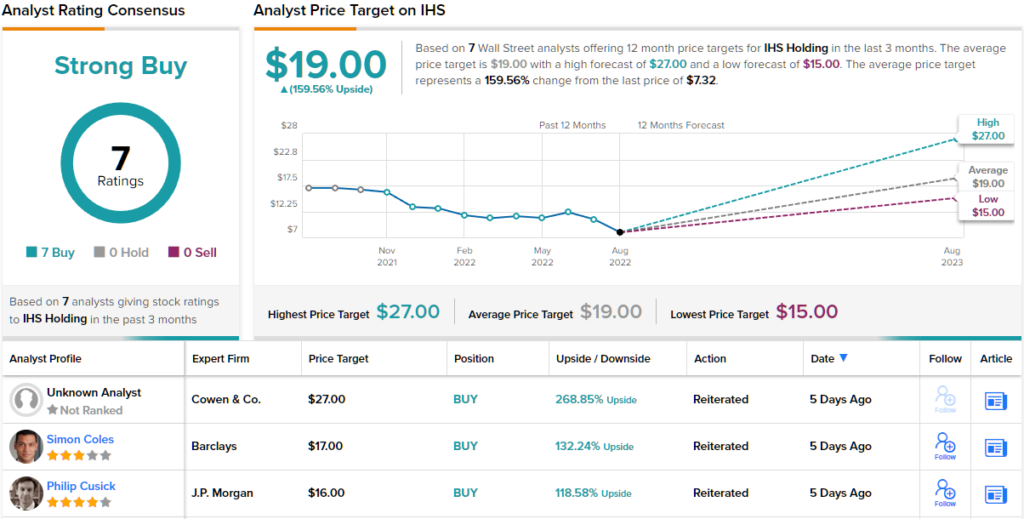

Overall, while the shares are down, the Street sentiment on IHS remains solid. The stock has 7 recent analyst reviews on record, and they are all positive – for a Strong Buy consensus rating. The stock is selling for $7.32 and its $19 average price target suggests a one-year upside potential of ~160%. (See IHS stock forecast on TipRanks)

Snap One Holdings (SNPO)

With the second JPM pick, we’ll turn to the smart home sector. Snap One is a leading distributor of smart home tech, offering customers solutions for entertainment and networking, home audio, home security and network, and even remote power management. Smart solutions put all this at the property owner’s fingertips. Snap One’s product lines and installations are available in both the residential and commercial markets. The firm operates as a holding company, delivering its products through a network of subsidiaries and brands.

Smart home tech has been growing in popularity over the past several years, and Snap One has been reporting quarter-over-quarter revenue growth for the past year, but SNPO shares have declined 47% so far this year. Several factors have impacted the stock price. The company’s revenue growth has decelerated, while the net loss is widening.

That doesn’t mean that the current numbers are bad – just not as good as investors would like to see. In 2Q22, the company reported $296.9 million, a gain of 17% year-over-year. At the same time, the net loss grew by 27% y/y, to reach $1.3 million. The company’s cash holdings fell from $40.6 million on December 31, 2021 to $31.3 million June 30, 2022. Looking forward, the company expects the full-year 2022 net sales to come in between $1.16 billion and $1.18 billion, a y/y gain of 15% to 17%.

JPMorgan analyst Paul Chung reminds us that Snap One’s Q2 results beat the forecasts, and goes on to say, “FY22 guidance was reiterated despite the beat, baking in some conservatism given the macro backdrop in our view; though still implies close to 20% y/y growth; a strong guide in our view when most firms are cutting guidance. Pricing actions in June should provide support for gross margins, coupled with more measured pace of opex spend to generate solid profitability and cash flow. Integrator demand feedback remains strong, and the higher end consumer is looking relatively more resilient in the current environment.”

To this end, Chung sets an $18 price target, implying a one-year upside of 62%, which backs up his Overweight (i.e. Buy) rating on the stock. (To watch Chung’s track record, click here)

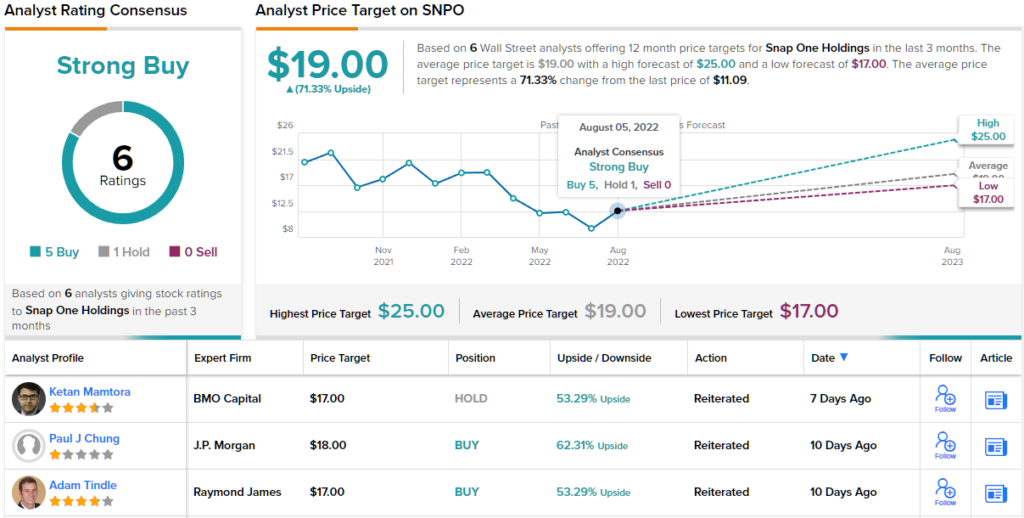

All in all, this interesting smart home firm has picked up 6 recent Wall Street reviews, and these break down 5 to 1 in favor of Buy over Hold, for a Strong Buy consensus rating. The stock is selling for $11.09 and its $19 average price target suggests a 12-month gain of 71% lies ahead. (See SNPO stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.