“The shine,” declared The Wall Street Journal on Wednesday, “has come off clean-energy stocks.”

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Green energy has lost favor among investors as supply chain problems combine with weak customer demand and rising interest rates, and make safe, high-yielding bonds seem more attractive than profitless green energy stocks.

As a result, even with the Biden Administration trying to throw some $400 billion at clean energy investments via the curiously-named “Inflation Reduction Act,” renewable energy plays such as Plug Power (NASDAQ:PLUG) have turned unpopular with Main Street.

On Friday, investment bank J.P. Morgan begged to differ with WSJ’s broad assessment of clean energy’s unpopularity. While admitting that “sentiment” on clean energy has been “challenged” in 2023, J.P. Morgan analyst Bill Peterson sees “several positive catalysts on the horizon” that could turn sentiment around. And even if things do get worse temporarily before they get better, Peterson sees hydrogen stocks in particular as “relatively safer” investments for the long-term.

And right now, arguably the most important player in hydrogen is Plug Power.

Valued at $3.6 billion and with $880 million in annual revenue, Plug Power is already the biggest hydrogen energy stock in terms of market capitalization, and the second biggest (after Bloom Energy) in terms of revenue. Admittedly, the company announced earlier this month that 2023 revenues will come in towards the low end of previous guidance. But seeing as that low end was $1.2 billion, that still works out to 71% year over year growth — pretty impressive.

But now here’s the really curious part about Peterson’s report. He doesn’t believe Plug Power when it says it will do $1.2 billion in sales this year. Even though Plug has already admitted it is reducing guidance, Peterson thinks things are worse than Plug has acknowledged.

As Peterson argues, Plug’s material handling (hydrogen fuel cell-powered forklifts) business isn’t living up entirely to expectations. If the liquid hydrogen production business isn’t growing as fast as hoped, either, then it’s unlikely Plug will be to more than double Q3 expected revenues of $200 million to $530 million in Q4 — as implied in Plug’s guidance.

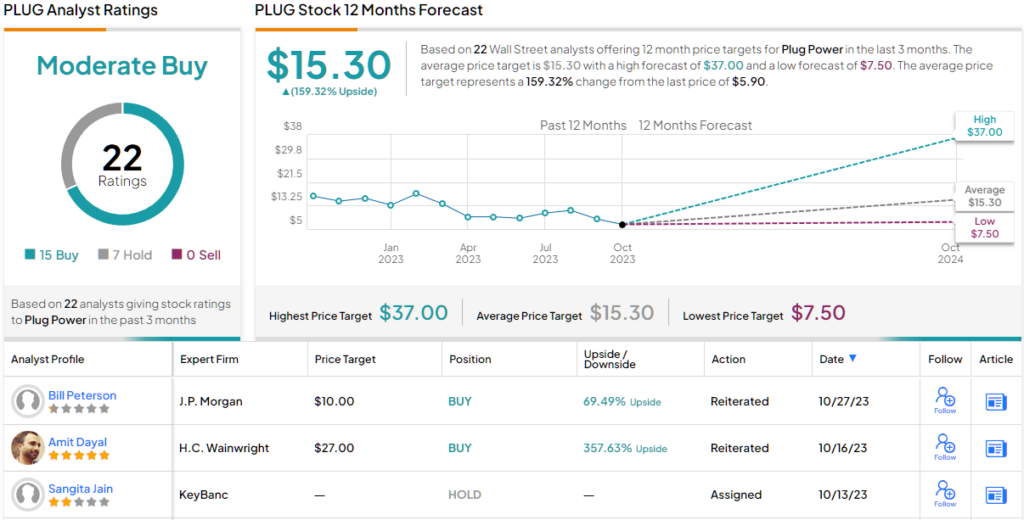

As a result, Peterson’s prediction is that Plug will deliver less than $1.1 billion in sales this year, missing its own sales guidance right after lowering that guidance. And yet, Peterson is still rates this stock “overweight,” and predicts Plug shares will soar 69% over the next 12 months, to a target price of $10 per share. (Watch Peterson’s track record)

Does this make sense? For one thing, Plug has lowered guidance once, and if Peterson is right, it’s about to miss that guidance anyway. It’s logical to think that if this happens, investors are not going to look too fondly upon Plug stock when the news comes out.

For another, after crunching the numbers, Peterson concludes that Plug will report a bigger than expected adjusted EBITDA loss as well — $549 million this year, versus Street expectations of a $492 million loss.

Smaller revenues, bigger losses, and Plug missing its own guidance estimate three months from now? If you ask me, there’s a reason “the shine has come off” this particular clean energy stock. Plug Power is clearly cruising for a bruising.

However, looking at the consensus breakdown, the majority of analysts are bullish on PLUG’s prospects; 15 Buys and 7 Holds add up to a Moderate Buy consensus rating. The $15.30 average price target suggests upside of 159% in the year ahead. (See PLUG stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.