Mea culpas come few and far between on Wall Street, where analysts who make mistakes would really prefer that you forget about them — let bygones be bygones as it were. That’s not the case with RBC Capital, and its upgrade of Tesla (TSLA) stock to “sector perform.”

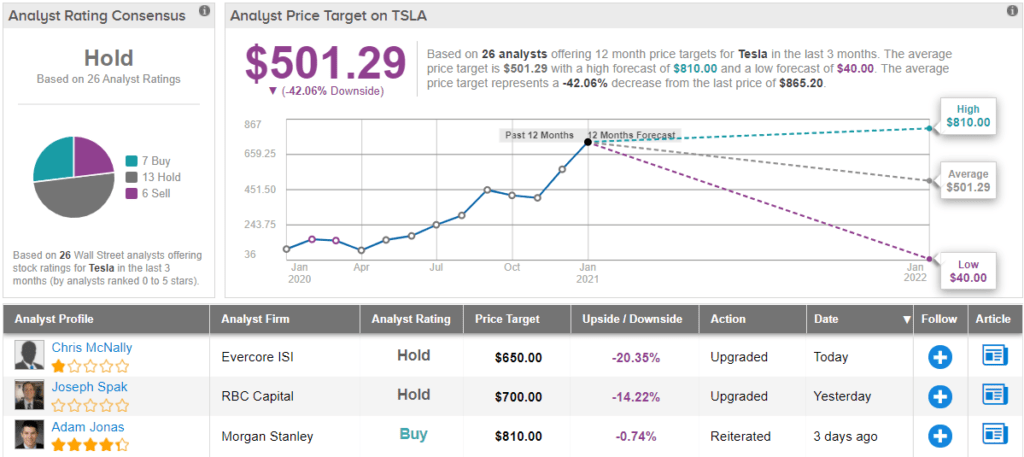

Admitting straight up that “we got TSLA’s stock completely wrong” when rating it an “underperform,” analyst Joseph Spak came out with a belated upgrade Thursday evening, and a raised $700 price target. (To watch Spak’s track record, click here)

Spak admits that now that Tesla stock has run up nearly seven times in price, its new price is likely to be something of a “self-fulfilling” prophecy, giving Tesla the financial firepower to essentially buy for itself the valuation it thinks it deserves.

How does that work?

“Our biggest miss was how TSLA can take advantage of its stock price to raise capital inexpensively and fund capacity outlays and growth,” explains Spak. With Tesla’s current elevated stock price, the company is able to both avoid taking on debt and still raise massive amounts of cash through minimal stock issuances that don’t dilute existing shareholders much at all.

Tesla can then take that cash and invest it in buying up competitors and new technology, and in “capacity additions” (i.e. new factories), enabling it to rapidly expand production and produce more cars (and thus collect more revenue).

In contrast, companies like General Motors and Volkswagen, hobbled by workaday P/E ratios in the high teens, (or Ford, which can only dream of getting back to earning enough profit have a teenage P/E ratio again), have the choice of either taking on debt, or producing cash — slowly and painfully — “from existing operations to fund their transition to electrification.” They cannot simply sell stock to fund their own electric revolutions, because the dilution levels would be too great.

Result: Tesla, which has a 25% global market share in battery electric vehicles at present, is expected to grow that market share to 27% even in the face of rising competition from the mass-market automakers first of all, and also from Byd, Nio, Xpeng, and all the other Chinese competitors now coming online.

Sure, eventually, all these new competitors are going to catch up and collectively out-produce Tesla, and long term, Spak believes that Tesla’s sustainable global market share is probably closer to the 16% level. But even then, the lead Tesla will have built up in technology, in production scale, and in resulting cost advantages is going to work in the company’s favor.

So how much does Spak believe all of these advantages are worth to Tesla? Positing a valuation based on enterprise value to sales (which in Tesla’s case is basically the same thing as price-to-sales, because Tesla carries less than $1 billion in net debt), Spak suggests that going forward, the company should be valued at about eight times projected fiscal 2025 sales.

Overall, Wall Street is pretty evenly split between the bulls and bears. Based on 26 analysts tracked by TipRanks in the past 3 months, 7 suggest Buy, 13 say Hold, while 6 recommends Sell. The bears, however, have the edge, as the average price target clocks in at $501.29 and implies shares will tumble ~42% over the next 12 months. (See TSLA stock analysis on TipRanks)

To find good ideas for EV stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.