If you’re just starting out as an investor and looking for some foundational choices to build your portfolio around, the iShares Core S&P Total U.S. Stock Market ETF (NYSEARCA:ITOT) looks like a great building block to get started with. This $42 billion juggernaut from BlackRock (NYSE:BLK) offers tremendous diversification, an ultra-cheap expense ratio, and a strong track record of long-term performance, all in one convenient investment vehicle.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

I’m bullish on ITOT as a long-term portfolio building block based on these factors. Even if you are a longtime investor with many years of experience in the markets, ITOT can still be a good choice for your portfolio for the same reasons.

What is the ITOT ETF’s Strategy?

ITOT seeks to track the S&P Total Market Index, a broad-based market of U.S. equities that gives investors comprehensive exposure to the entire U.S. stock market, “ranging from some of the smallest to largest companies,” according to iShares.

ITOT’s Extensive List of Holdings

While there are many popular S&P 500 (SPX) funds that simply invest in the S&P 500 Index, which gives investors exposure to 500 of the largest companies listed in the United States, ITOT goes a step further by investing in the much larger S&P Total Market Index.

This makes ITOT an incredibly diversified ETF. The fund holds an incredible 2,758 stocks, and its top 10 holdings make up 26.9% of the fund. For comparison, the popular Vanguard S&P 500 ETF (NYSEARCA:VOO), one of the stock market’s largest and most popular ETFs, invests in the S&P 500 and owns 504 stocks, with its top 10 holdings accounting for 26.9% of the fund.

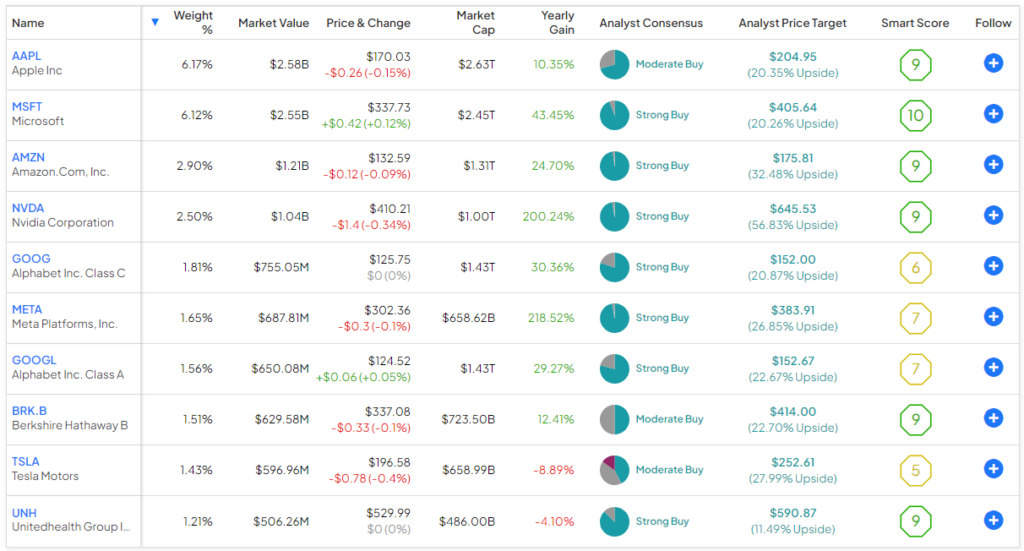

Below, you’ll find a comprehensive overview of ITOT’s top 10 holdings using TipRanks’ holdings tool.

As you can see, ITOT’s top holdings consist of the “Magnificent Seven” tech stocks like Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), Amazon (NASDAQ:AMZN), Nvidia (NASDAQ:NVDA), and Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL), which dominate the top of the S&P 500.

However, at the other end of the spectrum, ITOT also invests in plenty of microcap stocks like Harpoon Therapeutics (NASDAQ:HARP), Mustang Bio (NASDAQ:MBIO), and Jaguar Animal Health (NASDAQ:JAGX) with market caps in the $10 to $20 million range that you won’t find in many other ETFs.

While these microcap stocks can be risky, they make up such minuscule parts of this massive fund that the downside from any individual one of these names is fairly limited while giving investors some upside if one of them turns into the next big thing.

As you can see, ITOT owns the market’s largest and smallest stocks and pretty much everything in between.

Long-Term Track Record

In addition to this excellent diversification and comprehensive exposure to all corners of the U.S. stock market, ITOT has given its investors great returns for a long period of time, which is another important thing to consider when choosing an ETF to invest in.

You can’t really say that ITOT has “beaten the market” — because ITOT is the market. That isn’t a bad thing, as investing in broad-market indices has proven to be a successful way to build wealth over time, and very few actively-managed ETFs or strategies manage to “beat the market” over the long run.

What do ITOT’s returns over time look like? As of the end of the most recent month, ITOT has returned 9.3% on a three-year annualized basis. Over the past five years, it has returned 9.0%. Going all the way out to the last 10 years, ITOT has generated an impressive 11.3% annualized return. Finally, since its inception in 2004, the fund has generated an annualized return of 8.9%.

Investing in a vehicle that is producing returns like this is likely to be a winning strategy over time. Think of it this way: an investor who put $10,000 into ITOT 10 years ago would have $19,292 today, nearly doubling their initial investment. If you invested $10,000 into ITOT at its inception in 2004, you would have $43,675 today.

Cost Structure

Another attractive aspect of ITOT is its investor-friendly expense ratio of just 0.03%. This means that if you put $10,000 into ITOT today, you will pay just a barely-noticeable $3 in fees during your first year of investing in the fund. Assuming that the fund returns 5% a year going forward and continues to charge 0.03%, you’ll pay just $39 in fees over the course of a decade.

When you’re just starting out, investing in low-cost funds like this is an important consideration, as it helps you to preserve more of your principal investment over time and saves you from spending large amounts of money on fees, which can really snowball over the years.

For example, let’s say you instead invest $10,000 into an ETF with an expense ratio of 0.35% (which is still reasonable compared to many of the expense ratios you will see out there) — using the same parameters listed above, you’d pay $443 in fees over the course of 10 years.

Whether you’re a beginner or an experienced investor, it never hurts to own ETFs with low-cost expense ratios.

Is ITOT Stock a Buy, According to Analysts?

Turning to Wall Street, ITOT earns a Moderate Buy consensus rating based on 1,857 Buys, 831 Holds, and 71 Sell ratings assigned in the past three months. The average ITOT stock price target of $112.72 implies 23.8% upside potential.

A Solid Building Block

Adding it all up, ITOT serves as a robust building block and can be a cornerstone of investors’ portfolios. This is due to the comprehensive, diversified exposure it offers to the entire U.S. stock market. Additionally, it boasts a strong track record of long-term performance compiled over many years. Furthermore, its attractively low expense ratio helps investors preserve their investment gains over time.

These features make ITOT an ideal choice for investors who are just getting started. Furthermore, these attributes make it a commendable ETF for investors of all experience levels to consider for long-term inclusion in their portfolios.