“Won’t you be my number 2?” sang a broken-hearted Joe Jackson on his mid- 80s ballad. We can’t confirm that Uber (UBER) has sent a messenger to Postmates with that exact enquiry, but that seems to be the gist of its suggestion, if recent media reports are anything to go by.

Following the failed acquisition of food delivery rival Grubhub – who opted to tie the knot with European player JustEatTakeaway instead – it appears Uber has turned its attention to a merger with another rival. The regulatory hurdles in this instance don’t appear quite as high as the ones presented by the Grubhub acquisition. Moreover, the addition of Postmates would claw back some of Uber Eats’ clout and re position it as a major player in the battle for market share in the margin tight food delivery sector.

Wedbush analyst Ygal Arounian, believes such a deal – one likely to be worth roughly $3 billion – would amount to a “a very good strategic fit.”

“Postmates, which is the clear #4 player behind DoorDash, Uber Eats, and Grubhub would be both a defensive and offensive acquisition in the food delivery space for Uber at a time with its core ridesharing business seeing massive headwinds in this COVID-19 pandemic,” said Arounian.

Arounian estimates that in the first quarter, Uber Eats took a 24% cut of market share, while Postmates’ slice amounted to 10%. Together, the two would command a third of the market. Doordash currently leads the industry with 44% of market share.

Although there has been a surge in demand for food delivery services during the pandemic, the industry is still one operating at a loss. The fierce competition has resulted in companies using various marketing strategies such as free deliveries, loyalty programs and discounts in order to gain a bigger slice of the pie. Despite recent disappointing developments, Arounian believes Uber can still be the dominant force in the sector.

“We’ve been noting that despite the increased headwinds on the profitability front for Uber on Uber Eats, it remained the best positioned to be the consolidator with the ability to leverage Eats across its Rides platform, but also through initiatives like grocery delivery (through the Cornershop acquisition), and Uber Direct/Uber Connect with the Postmates platform fitting in well as part of this strategy,” the analyst concluded.

All in all, Arounian kept his Outperform rating on Uber intact, along with a $47 price target. Investors could be riding home with a 54% gain should Arounian’s forecast materialize over the coming months. (To watch Arounian’s track record, click here)

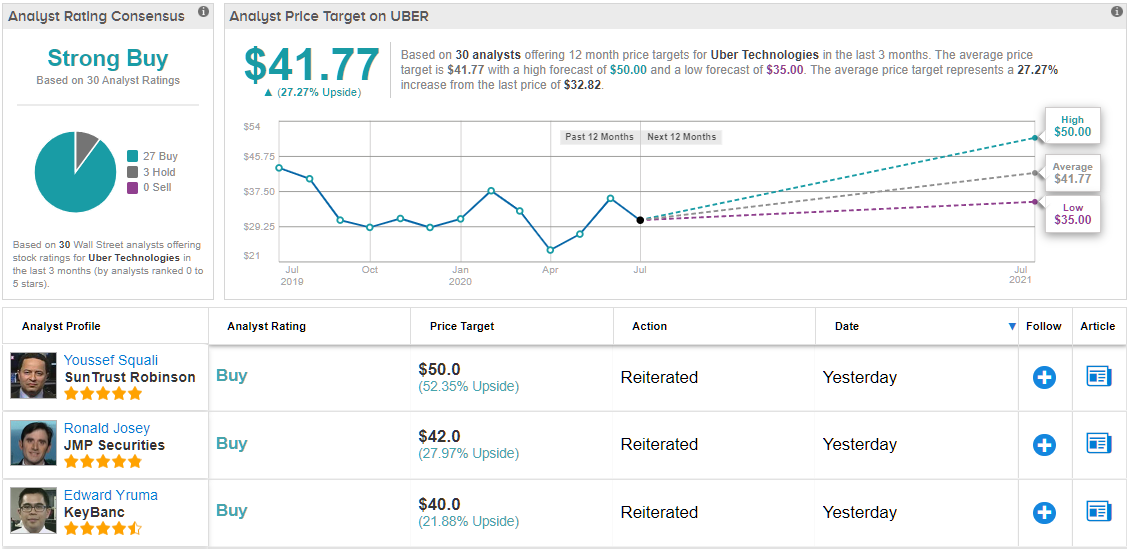

The vast majority of Arounian’s colleagues agree with his sentiment. Uber’s Strong Buy consensus rating is based on 26 buys, 3 Holds and 1 Sell. At $41.01, the average price target suggests upside of 27% in the year ahead. (See Uber stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.