The auto industry, especially electric vehicle (EV) makers, have been locking horns with each other due to escalated macro headwinds, including geopolitical conflicts, severe supply challenges comprising prolonged chip shortages, and battery and commodities supply disruptions.

Despite current economic issues and other headwinds, EVs remain a secular trend. The overall EV sector will most likely bottom out following a sharp selloff in recent months.

Let us compare two trending EV stocks, Nio and Rivian, and see what Wall Street analysts are saying about these EV giants.

Nio (NYSE: NIO) has dropped 41% over the past year. Recently, however, it recovered from its lows following a pledge by the Chinese central bank to keep capital markets stable and stimulate economic growth.

Rivian Automotive (NASDAQ: RIVN), on the other hand, has plunged over 55% in the last twelve months.

Nio

Founded in 2014, and headquartered in Shanghai, NIO is a Chinese multinational automobile manufacturer specializing in EVs. Nio has gained leadership in the premium EV segment, as its solid battery technology, attractive pipeline as well as targeted global expansion could be strong catalysts spurring future growth.

Despite being in the development stage, Nio has an impressive order book and strong demand for its models in the high-end EV market.

However, like its peers, Nio is expected to face margin pressures in FY2023 due to input costs escalations. On top of that, Nio’s margins will further feel the squeeze from higher research and development (R&D) and capital expenditures, as it invests aggressively in R&D and new products.

During the recently reported mixed December-end fourth quarter, Nio deliveries improved significantly at 44.3% year-over-year to 25,034 EVs and included 5,683 ES8s, 12,180 ES6s, and 7,171 EC6s. For full-year fiscal 2021, Nio delivered 91,429 EVs, implying a robust 109.1% year-over-year growth over FY20.

In terms of the product pipeline, Nio unveiled three new models in 2021 and will add three new models during 2022: ET7 premium sedan, mid-size premium sedan ET5, and SUV ES7.

Following the Q4 results, Nick Lai from J.P. Morgan reiterated a Buy rating and $30 price target on Nio. Investors could be pocketing returns of 50.68%, should Lai’s thesis play out as expected.

For FY22, Lai forecasts significant year-over-year growth of 78% in Nio’s sales volumes based on the upcoming launches in FY22 as well as new capacity from mid-2022.

In the long run, the analyst believes content and software monetization will gain a higher share in revenues/profit and could lead to a change in the business model in the automobile industry.

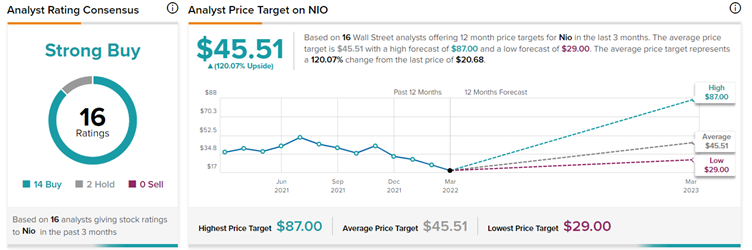

The Street is also bullish about the stock with a Strong Buy consensus rating based on 14 Buys and two Holds. Meanwhile, the average Nio average price target of $45.51 implies 120% upside potential from current levels, at the time of writing.

Rivian Automotive

Founded in 2009, Rivian is an American EV manufacturer and automotive technology company. Rivian makes an upscale truck and a sport utility vehicle, both designed to be driven off-road and can support future vehicles.

Recently, Rivian reported weaker-than-expected Q4 results lagging both earnings and revenues expectations.

Rivian’s adjusted loss of $2.43 per share was much inferior to the street’s estimated loss of $1.64 per share. Revenues at $54 million also failed to keep up with the consensus estimate of $61.2 million. During the year, the company delivered 920 vehicles, out of which 909 vehicles were delivered in Q4.

According to Vijay Rakesh, an analyst at Mizuho Securities, Rivian could see some relief during the second half of 2022 with even higher deliveries expectations in the forthcoming years.

Rakesh expects deliveries of 23000, 86,000, and 189,000 in the coming years of FY2022, FY2023, and FY2024, respectively, noting that some additional units were pushed out into FY2023 from FY2022 due to supply and other constraints.

Rakesh continues to believe that Rivian is a strong pure-play EV in the early stages of ramping and well-positioned to grow at a strong compound annual growth rate (CAGR) of 30% till 2030.

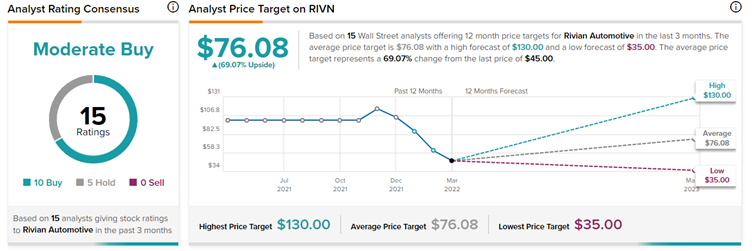

According to TipRanks’ analyst rating consensus, Rivian is a Moderate Buy, based on 10 Buys and five Hold ratings. The average Rivian analyst price forcast is $76.08, implying 69.07% upside potential.

Conclusion

For now, analysts are bullish on both stocks, albeit both the companies acknowledged the impact of the near-term economic and supply chain headwinds on their deliveries during their recent earnings calls.

Once supply constraints start to ease in the second half of 2022, continued strong demand and a ramp-up in production should drive a re-acceleration in deliveries and revenue in 2H22.

However, based on upside potential over the next 12 months, Nio seems to be a better Buy than Rivian.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure