Investors did not seem to initially respond well to the latest quarterly statement from Snowflake (SNOW). The company said some of its large clients, specifically those in the consumer-facing cloud sector, noted a drop-off in demand. However, after digesting the results, investors appeared to take a more forgiving approach.

In F1Q, product revenue increased by 84% year-over-year to $394.4 million, although at 2.3% above the midpoint of guidance, that amounted to the lowest beat since the September 2020 IPO.

All in, the data warehousing specialist generated revenue of $422.4 million, above the $413 million Wall Street had expected. However, the company didn’t manage that feat on the bottom-line, as EPS of -$0.53 fell short of the -$0.51 forecast.

The company saw out the April quarter with 6,322 customers compared to just 5,944 at the end of January, whilst also boasting a net revenue retention rate of 174%.

As for the outlook, Snowflake called for product revenue growth between 71% to 73% ($435 million to $440 million) in FQ2, and a -2% adjusted operating margin. Wall Street was looking for growth of 72% but with an adjusted margin of 0.3%.

The company said the slowdown was particularly acute in April but that more recently things were picking up again.

Although William Blair’s Kamil Mielczarek calls the results “mixed,” he still believes the “long-term vision remains intact.”

“While we see risk of continued noise in the model through the end of the year, the company remains well positioned to achieve long-term targets,” the analyst said. “Management increased long-term margin guidance, is currently accelerating sales investments, and noted that the upcoming Summit Conference will feature the most significant product announcements in four years. The company achieved adjusted free cash flow margin of 22% in the last 12 months, suggesting ample room for increased investment into the business.”

To this end, Mielczarek reiterated an Outperform (i.e., Buy) rating, without providing a fixed price target. (To watch Mielczarek’s track record, click here)

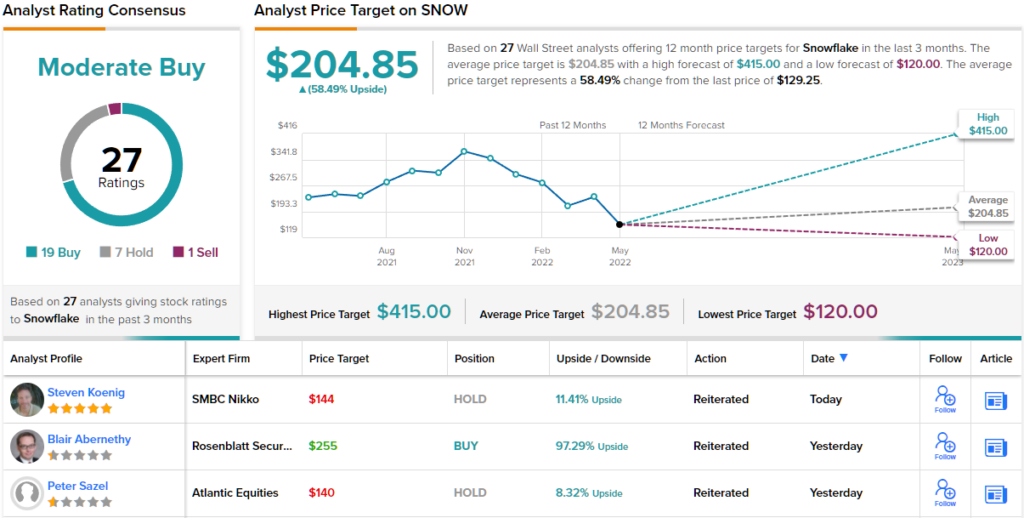

Following the shares’ 67% pullback since last November’s highs, other Street analysts appear to think the stock is now significantly undervalued. The average target clocks in at $204.85, making room for 12-month growth of 58%. Overall, the stock claims a Moderate Buy consensus rating, based on 19 Buys, 7 Holds and 1 Sell. (See SNOW stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.