It is well known by now that several companies were particularly well positioned to use the pandemic to their advantage. Peloton (PTON) is a good example. As the populace moved indoors for the majority of 2020, so did people’s workout regimes, which led to outsized demand for Peloton’s stationary bikes.

Indeed, Peloton’s FQ2 earnings were much better-than-expected. The company had its first $1 billion sales quarter with revenue hitting $1.06 billion, a 127.3% year-over-year increase and beating the Street’s forecast by $30 million. EPS of $0.18 beat consensus estimates by $0.10.

In the quarter, 333,000 new connected fitness subscribers came on board to bring the total to 1.67 million subs, above the Street’s 305,000 new subs estimate. Paid digital subscriptions increased by 472% year-over-year to reach 625,000.

Looking ahead to FQ3, Peloton anticipates sales will reach $1.10 billion, above the analysts’ forecast for $1.09 billion. For FY21, the company raised its outlook and now expects at least 123% revenue growth,

Peloton’s problem – if you can call it that – is that the growing demand is causing supply chain bottlenecks. Shipping congestion at ports have resulted in long waiting times for its products.

To ease near-term logistics headwinds, over the next 6 months, Peloton said it will be investing over $100 million in air freight and expedited ocean freight. By the end of the fiscal year, the company anticipates order-to-delivery times will be normalized.

Stifel analyst Scott Devitt applauds the “impressive F2Q results,” and tells investors to focus on the long-term opportunity.

“With a path to normalized delivery and growing manufacturing capacity, Peloton is well positioned to deliver strong growth through the balance of the fiscal year,” the 5-star analyst said. “In the long-term, we continue to see a number of opportunities to support sustainable growth as the company expands its product line, develops broader fitness content and enters into new geographies.”

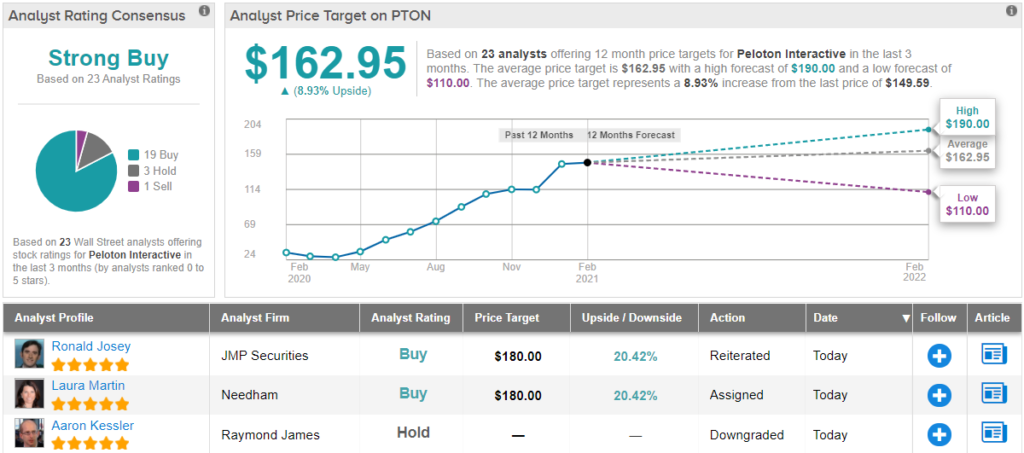

To this end, Devitt reiterated a Buy rating on PTON shares along with a $170 price target. This figure implies ~13% upside from current levels. (To watch Devitt’s track record, click here)

Overall, Peloton’s growth has inspired confidence in Wall Street’s analysts, and the consensus view here is unanimous: a Strong Buy. The shares are selling for $149.74, and their $162.95 average price target suggests 9% upside from current levels. (See PTON stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.