Palantir (PLTR) surprised the Street in its latest quarterly report. Unfortunately, the surprise was to the downside after the big data specialist failed to live up to expectations.

Investors were left disappointed by a bottom-line miss and the company’s guidance and sent shares down 22% in the subsequent sessions.

That’s not to say Palantir’s 4Q20 results were all bad. In the quarter, the company generated revenue of $322.1 million, up 40% year-over-year and beating the estimates by $22 million. However, the company delivered an unexpected loss per share of $0.08, while the Street was was anticipating EPS to be positive at $0.02.

For the full year, revenue grew by 47% to $1.1 billion, while average revenue per customer reached $7.9 billion, a 41% year-over-year uptick.

Looking ahead to Q1, Palantir anticipates top-line growth of 45% which should see revenue land at $348.87 million, higher than the Street’s $309.47 million forecast.

For 2021, the company anticipates revenue growth to stay over 30%. In fact, Palantir believes that 30% growth is doable in each of the next 5 years, culminating in 2025 revenue passing $4 billion.

In contrast to the negative reaction, overall, RBC analyst Matthew Hedberg views the latest results as “positive” and thinks the company is heading in the right direction.

“Palantir delivered another strong quarter and guided up 1Q just as much. While some may lament the unchanged 2021 guidance, we view that as management balancing a relatively aggressive 5-year view with being sure to not overpromise near term,” the 5-star analyst said. “We believe the modularization of the company’s offerings has helped it land more broadly, and likely will help it this year to seed future growth and look for the just announced IBM partnership to drive much stronger distribution in the Commercial space.”

Investors might have sent shares down following the fourth quarter results, but it is worth remembering the massive run up the shares had prior to the report’s release.

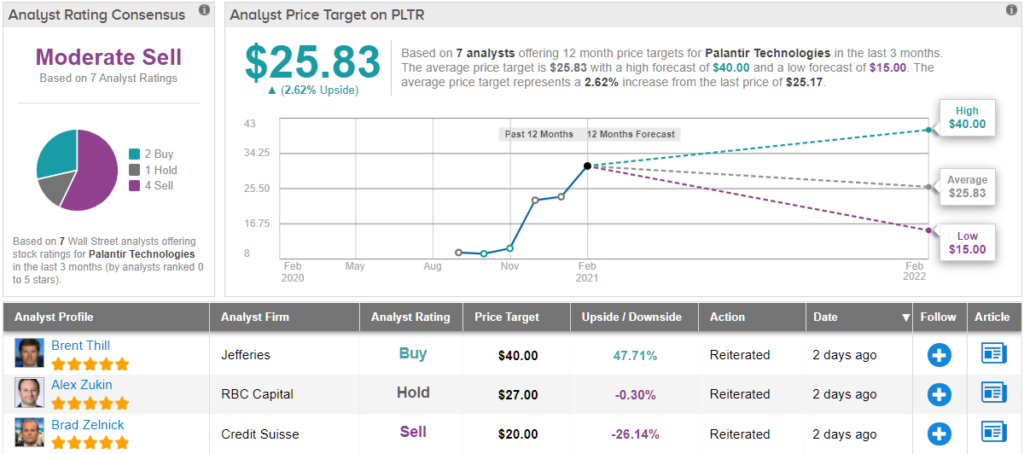

Palantir’s lofty valuation is the reason why Hedberg sticks to a Sector Perform (i.e. Hold) rating. However, the analyst boosted his price target to $27 (from $15), which implies a 7% upside from current levels. (To watch Hedberg’s track record, click here)

Overall, the majority on the Street remain Palantir skeptics. The stock has a Moderate Sell consensus rating, based on 2 Buys, 1 Hold and 4 Sells. The analysts expect the share price to stay rang-bound in the coming months, given the average price target currently stands at $25.83. (See PLTR stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.