Can you feel the ground moving beneath your feet? Shares of Ocugen (OCGN) skyrocketed over 800% in the past three trading sessions after the biopharmaceutical company disclosed it had signed a binding letter of intent (LOI) with India based Bharat Biotech to co-develop a COVID-19 vaccine for the U.S. market.

Bharat’s offering COVAXIN, a whole-viron inactivated COVID-19 vaccine candidate, has already shown promise in Phase 1 and 2 clinical trials in India and the enrollment of 26,000 subjects for the Phase 3 study is currently underway.

The agreement stipulates Ocugen will hold the vaccine’s U.S. rights, and the remaining details are expected to be finalized over the coming weeks.

Considering Bharat’s reputation for world-class R&D and manufacturing capabilities in vaccines and bio-therapeutics, H.C. Wainwright analyst Swayampakula Ramakanth thinks the company is a “suitable partner.”

Ramakanth believes the “broad immunity targeting different components of the virus could potentially provide better protection against emerging mutant viruses, such as the one currently circulating in the UK.” With this in mind, in the Phase 1 study, COVAXIN has shown robust antibody responses against spike (S1) protein, receptor-binding domain (RBD) and the nucleocapsid (N) protein of SARS-CoV-2.

“More importantly,” the 5-star analyst added, “COVAXIN also induces comparable levels of neutralizing antibodies to those in human convalescent serum,” which, the analyst believes,” bodes well for the success of the ongoing Phase 3 trial in India.”

Over the next few weeks, Ocugen is expected to meet with the FDA to discuss how to advance COVAXIN’s development.

However, due to the fact the details of the definitive agreement have yet to be finalized, in addition to the current lack of “insight into the U.S. regulatory pathway or commercial strategy,” Ramakanth stays on the sidelines for now.

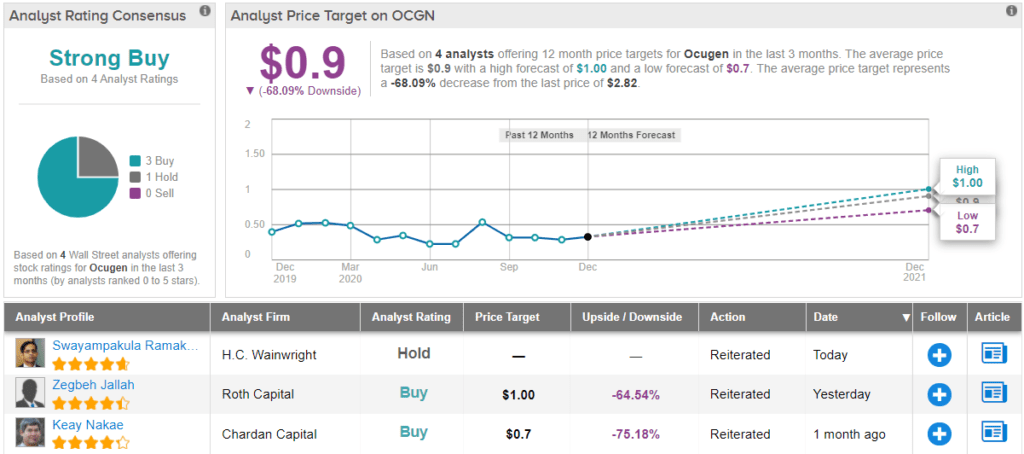

Accordingly, the analyst rates OCGN a Neutral (i.e. Hold) without suggesting a price target. (To watch Ramakanth’s track record, click here)

In contrast, all 3 other analysts who have recently posted an Ocugen review rate the stock a Buy. However, the Strong Buy consensus rating is backed with a $0.9 price target, which implies downside of 68% from current levels. This is most likely a result of the stock’s meteoric rise and analysts’ inability to turnaround new price targets so quickly. (See OCGN stock analysis on TipRanks)

To find good ideas for coronavirus stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.