Can any superlatives be added to the increasingly long list of ones already used to describe Novavax’ (NVAX) progress in 2020? Words such as stupendous, incredible, and amazing can by now hardly do justice by to the meteoric- there’s another one – rise of the vaccine specialist. The evidence: Novavax’ share price has increased by 3,370% year-to-date.

Apart from the early promise shown by its COVID-19 vaccine candidate, NVX-CoV2373, Novavax’ surge has been built on accelerating momentum. Eventually though, the vaccine player will have to back up the share gains, government grants and analysts’ ratings with positive trial results.

NVAX’ latest surge (Friday’s 17% uptick) came following another price target raise from a long time NVAX bull.

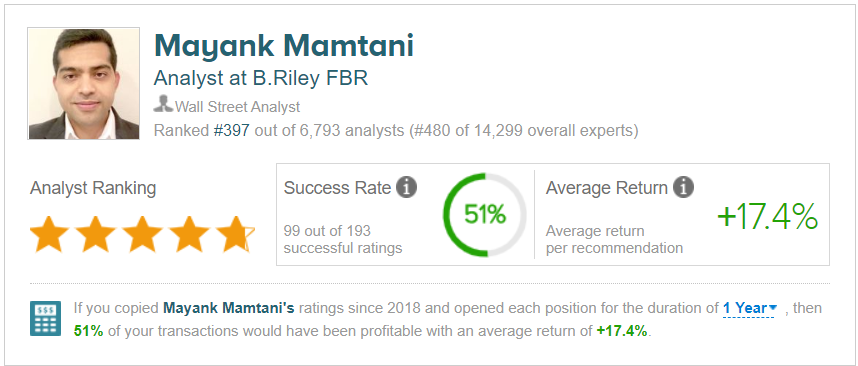

B Riley FBR analyst Mayank Mamtani raised his Novavax price target from $106 to $155, while reiterating a Buy rating on the stock. (To watch Mamtani’s track record, click here)

Mamtani believes the biotech is most likely to “emerge as strongest among peers,” and explains why he believes Novavax’ has the upper hand:

“We believe MRNA’s recent Ph. I 45-subject NEJM-published data sets a low bar for NVAX to meet/exceed, including with the low dose, 5 μg + 50 μg Matrix-M, prime/booster regimen… Prior successful experiences with NVAX’s adjuvanted nanoparticle protein platform, notably in terms of eliciting broad antibody (B cell) and cell-mediated (T cell) response, reflects highly de-risked nature of clinical development with the incremental benefit of applying trial execution learnings from relatively more advanced Ph. III programs, notably from MRNA and AZ.”

So, Mamtani argues Novavax lagging behind its peers might be a good thing. While Moderna, Oxford Uni/AstraZeneca and Chinese company Sinovac’s programs have already advanced or are advancing to phase 3, NVX-CoV2373 is currently in a Phase 1 trial with a data readout expected by the end of the month.

Additionally, the prior success Mamtani argues stands in Novavax’ favor relates to another drug in its vaccine pipeline.

Influenza candidate NanoFlu includes the same proprietary Matrix-M adjuvant as NVX-CoV2373 and in a Phase 3 trial proved it was “safe, scalable, and key to eliciting responses in elderly.”

Mamtani believes “this bodes favorably for ‘2373 to demonstrate a differentiated profile, relative to mRNA-1273 with the prioritized 100 μg dose level associated with high rates of solicited adverse events, local (pain) and systemic (fever, fatigue, chills, headache).”

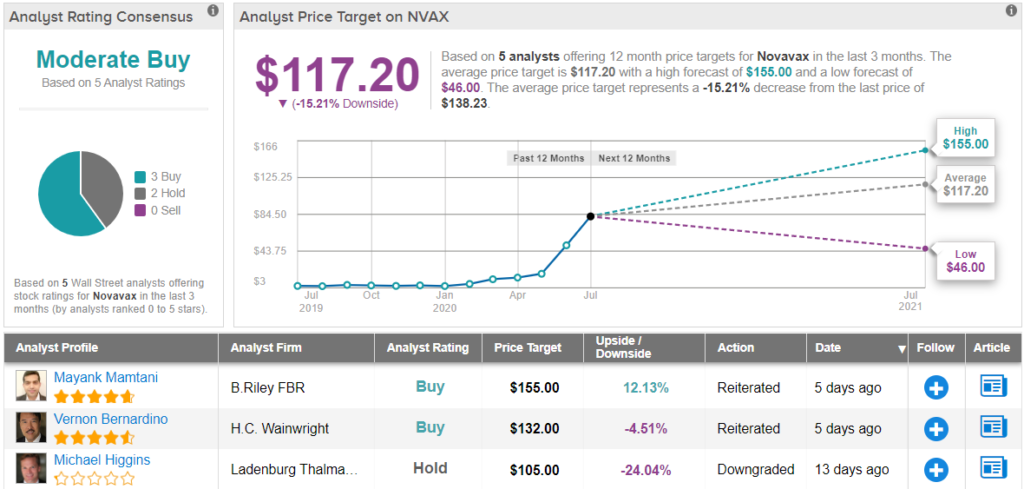

All in all, Novavax has a Moderate Buy consensus rating based on 3 Buys and 2 Holds. However, with an average price target of $117.2, the analysts expect shares to decline by 15%, implying most think Novavax has surged enough for now. (See Novavax stock analysis on TipRanks)

To find good ideas for healthcare stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.