Nokia (NOK) was one of the names caught up in the retail-driven January short squeeze mania. However, like most short squeezes, the boom was short-lived and the stock came tumbling back down to pre-squeeze levels.

Yet, Northland analyst Tim Savageaux points out that a lot else has changed at the company, which deserve investor attention.

At its recent Analyst Day, Nokia disclosed “196 5G commercial agreements and 55 live networks vs 63 and 18 respectively, at the time of our launch, 20 new RAN customers and increased share at another 22,” the 5-star analyst said. “Progress on deployment of RF and baseband Reefshark chipsets has been better than expected as well ending CY20 at 43% of 5G systems with a target of 70% this year.”

The company also announced a 5G C-Band deployment deal with AT&T, and said it plans to reduce the headcount by as much as another 10,000, in what the company is calling part of its “reset.”

Moreover, there has been a new emphasis on a “best of breed competitiveness vs reliance on end to end,” which Savageaux believes is “positive.” So is a focus on “differentiated core IC technology across all aspects of the Mobile and Network Infrastructure businesses.” These span from Mobile (Reefshark) to Optical (PSE-V), from Routing (FP40) to Fixed Access (Quillion).”

Therefore, when looking at Nokia’s wide-ranging portfolio, Savageaux sees potential for synergies and believes the company is well positioned to compete.

“With the shares trading under 1X revs and the sum of parts analysis still compelling,” the analyst summed up, “We think it’s likely that the shares are at higher levels a year from now even absent strategic catalysts.”

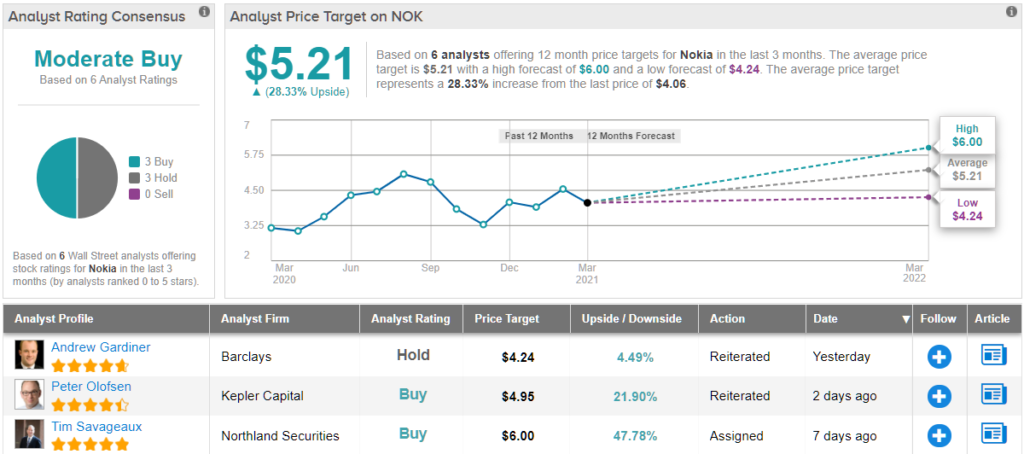

Accordingly, Savageaux rates NOK an Outperform (i.e. Buy) along with a $6 price target. Investors stand to pocket ~48% gain should the analyst’s thesis play out. (To watch Savageaux’s track record, click here)

The rest of the Street also believes shares are about to push higher. Going by the $5.21 average price target, the forecast is for ~28% gains on the one-year time horizon. Rating wise, the analysts are split; with 3 Buys and Holds, each, the stock qualifies with a Moderate Buy consensus rating. (See NOK stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.