After the bell rings on Tuesday (March 29), Micron (MU) will step up to deliver its latest quarterly report. Mirroring the broader markets’ volatile start to the year, the stock has had a rough ride in 2022, having shaved 15% off its valuation so far.

However, a stock’s poor performance does not necessarily correlate with a company’s fortunes, and heading into the print, Rosenblatt analyst Hans Mosesmann expects the computer memory giant to bring its A-game again.

“We see the February quarter (F2Q) being driven by strength across the board, including in data center, mobile, PC, and auto, as well as better than expected bit shipment and pricing trends for both DRAM and NAND,” the 5-star analyst opined.

For the quarter, Mosesmann expects revenue and adj. EPS to both come in above the consensus estimate of $7.52 billion and $1.97, respectively.

Looking ahead to the May quarter (F3Q), the analyst also anticipates Micron will guide above the Street’s forecast of revenue growth around high single-digits sequentially and adj. EPS of $2.27.

The analyst counts “continued global DRAM tightness, a stronger than expected NAND environment, and overall ASP tailwinds,” as reasons to be confident. Both for DRAM and NAND, Mosesmann thinks the company saw “better than expected pricing.” DRAM shipments getting hit by the ongoing non-memory component shortages is the “wildcard” to keep an eye on.

On the whole, Mosesmann believes supply shortages will remain an issue throughout the year. This, coupled with demand from cloud and smartphone customers, bodes well for the company in CY2022. In fact, given the current supply/demand dynamics for DRAM and NAND, Mosesmann expects Micron to deliver “record revenues and solid profitability in FY2022.”

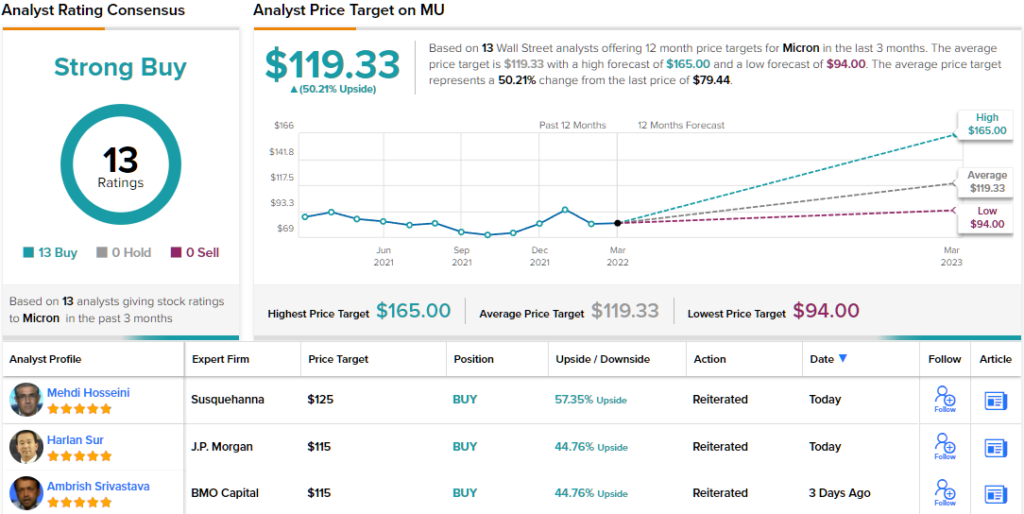

To this end, Mosesmann rates MU shares a Buy, backed by a $165 price target. This suggests room for outsized share appreciation of 107% in the year ahead. (To watch Mosesmann’s track record, click here)

Overall, there are 13 analyst reviews on record for MU, and all of them are positive, naturally culminating in a Strong Buy consensus rating. While the $119.33 average price target is not quite as bullish as Mosesmann’s objective, the figure still implies robust gains of 53% over the one-year timeframe. (See Micron stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.